Bitcoin (BTC) tiptoed back towards $44,000 early Thursday, paring back some losses caused by the sudden drop of US stocks on Wednesday. The S&P 500 index bid farewell with a 1.42% dip, sending shockwaves through riskier assets like bitcoins.

However, traders’ optimism about Bitcoin remains robust before an anticipated approval for Exchange-Traded Funds (ETFs) in the US, a move that could bolster demand. Plus, there’s the halving event scheduled for April 2024, historically known as the pre-party to crypto bull runs. Bitcoin has a history of blossoming post-halving, which automatically reduces the flow of new coins in the market. Traders are probably banking on this event.

Related: Betting on Bitcoin: Bloomberg Analysts Raise the Stakes on ETF Approval

Ride to $160,000!

CryptoQuant boldly declared in a report released on Wednesday by CoinDesk that Bitcoin prices will soar to at least $50,000 in the short term. Their words carry weight, considering this firm is the Sherlock Holmes of crypto analysis, offering on-chain market smarts and data analytics to Wall Street’s finest and institutional bigwigs.

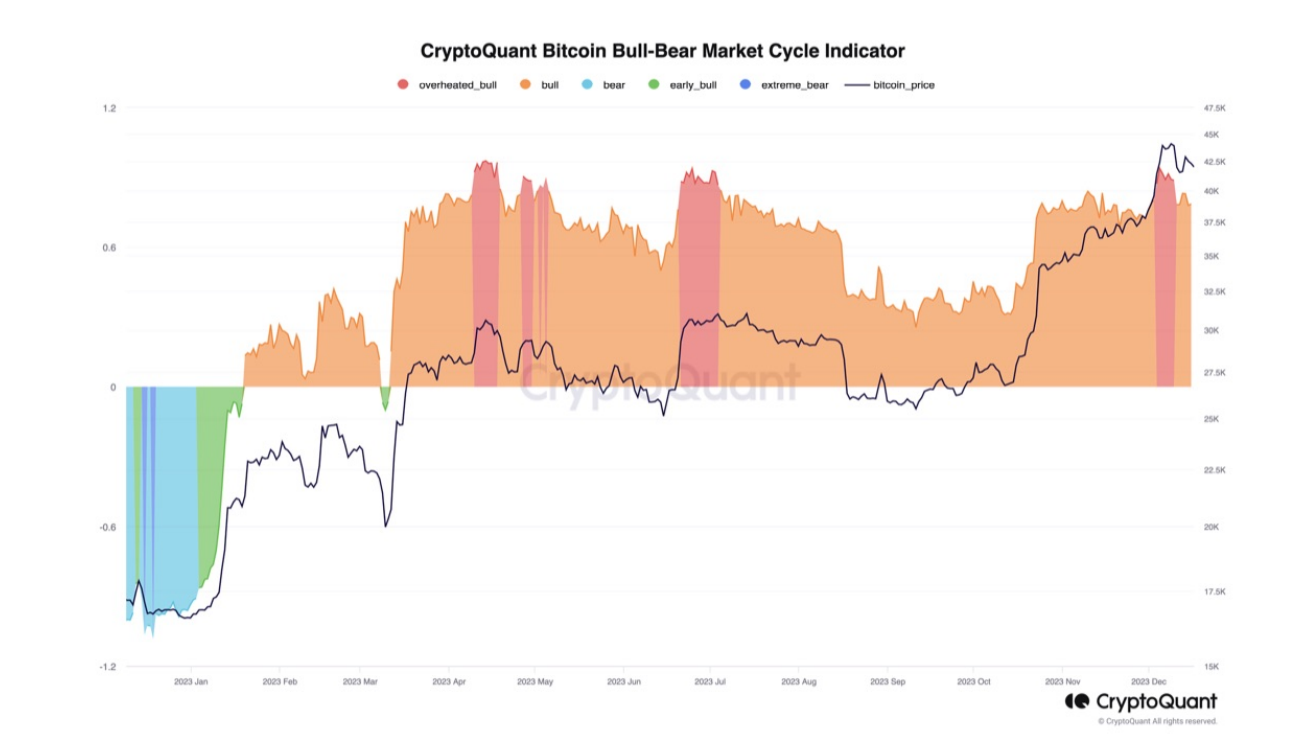

Among the reasons for their confidence, apart from the halving and ETF approval, analysts point fingers at the market valuation cycle, network activity, the macroeconomic perspective, and growing stablecoin liquidity. Whatever all this might mean, it sounds convincing.

With a bunch of catalysts and historical behavior, BTC might just catapult to $160,000 in the widely expected bull market, set to kick off in 2024 according to CryptoQuant analysts.

Internal network evaluation and network metrics are flashing signals that Bitcoin is still riding the bull wave and could hit $54,000 in the mid-term, maybe even skyrocketing to $160,000 as the peak of this cycle, they proclaimed.

The hype surrounding the impending Bitcoin ETFs just won’t quit. Over seven heavyweight players in the traditional financial circus, like BlackRock, are having chats with the U.S. Securities and Exchange Commission (SEC) about Bitcoin spot ETFs. These negotiations keep going, suggesting things might just be moving positively.

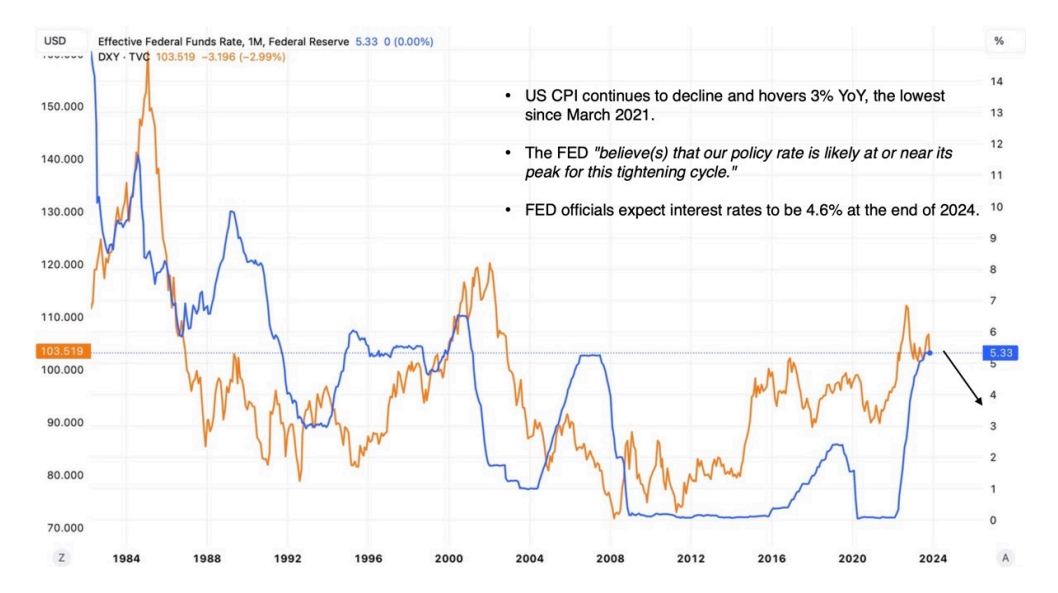

Traders are also crossing their fingers for a scenario where the U.S. Federal Reserve lowers interest rates in 2024. With inflation on a downward slide, lower rates historically encouraged betting big on riskier assets like tech stocks and cryptocurrencies.

But don’t relax too soon, prices might still fall sharply in a pool of unrealized gains, states CryptoQuant in their report. Analysts cautioned that there are some price correction risks, considering that short-term Bitcoin holders enjoy significant unrealized gains, historically preceding price corrections.

Finally

The recent dance around $44,000 was a mere warm-up, a response to the shaking of the US stock market. Yet, amidst this volatility, traders are donning their rose-tinted glasses, eyeing the potential ETF approval and the looming halving event in April 2024 as catalysts for Bitcoin’s surge.

CryptoQuant analysts added positivity with their proclamation of a $50,000 short-term target while hinting at a much grander perspective. The echoes of $54,000 are in the air, and whispers of $160,000 loom large. The stage is set for 2024, a year predicted to be the carnival for Bitcoin bulls.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.