ETFs are Unstoppable. Spot Bitcoin ETFs recorded the largest inflows in a day, enabling them to touch an all-time high in market share of daily trading volumes.

Related: Spot Bitcoin ETFs Debut with $4.6 Billion Trading Volume, But Zero Inflows

Spot Bitcoin ETF net inflows hit $1B+ yesterday

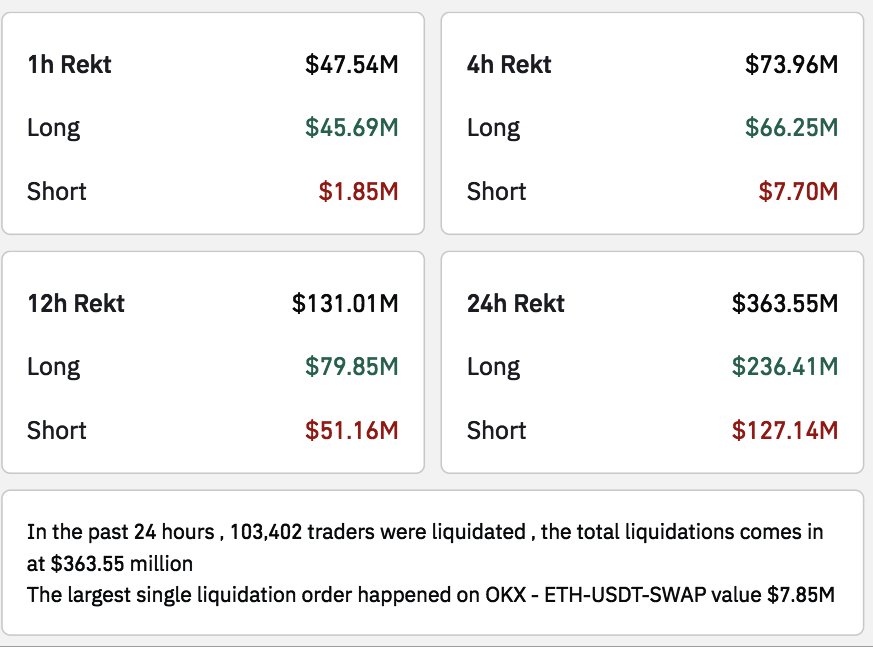

On 13 March 2024, BTC continued its climb to a historic ATH of $73,637. This liquidated $100 million worth of overleveraged trades, prolly by FUDs who think every music is a sad song.

But the biggest milestone was recording $1,045,000,000 inflows to spot Bitcoin ETFs within a single day. This represents a staggering 14,706 BTC inflow.

iBIT from Blackrock continued to shine the spotlight with a record inflow of $849 million, which brought the assets under management to a total of $15.4 billion. Yes, you heard it right, Blackrock kind of bought $849,000,000 worth of BTC when the price was at $70,000. If that’s not bullish enough to draw your attention, let’s see how much BTC the iShares Bitcoin ETF fund has.

At press time, the fund holds 215,000 BTC – a whale of whales, right? No – wait until halving day and perhaps past it to surely see who the world’s largest whales are.

Total Bitcoin ETF Inflows

Since January 11, 2024- when the Securities and Exchanges Commission approved the first ETF, net Bitcoin ETF inflows have accumulated to $11.1 billion.

Have you ever had that one friend who’s always the life of the party? For those of us who spend our days chasing the crypto bag behind trading charts, that friend is spots. For the total inflows :

- Spot Bitcoin ETFs are scooping 90% of the total trading volumes, while

- Bitcoin Futures ETFs have only 10% of the market.

Bitcoin Market Dominance is UP

Market dominance is like a popularity contest, it hints to us HODL bros how much of the market is vouching for Bitcoin. You won’t believe it! Bitcoin dominance has improved by 7.49% over the last 6 months.

One year ago, the coin’s dominance was floating around 40 – 49% until it hit a super high of 52% in June 2023. It did surprise many but what surprises even more is how the ETFs and the recent ATH have left everyone NOT talking about the current market dominance of 54%.

Well, according to some analysts, the largest coin in the world might continue flexing its dominance, unlike your BAYC NFT holdings, which have been going lower and lower.

What it Really Means to HODL

Elsewhere on the bitcoinverse, a comment on Bitcoin Magazine made us rethink what it really means to acquire Bitcoin and to HODL Bitcoin.

For Michael Saylor, the endgame is to accumulate as many Bitcoins until the one with the highest amount becomes the winner.

But for a guy like @romoolo (on X), who has been Bitcoining since 2010, accumulating Bitcoin is not about filling the largest bag. It’s more about HODLING the little you have, for as long as you can.

And then there was an entire comment section filled with contraries like , the more you accumulate the more you win and ; the more of us _ instead of one person_ gets Bitcoin, the more we use the network and the more everyone wins.

More on Bitcoin ETF:

- Will the Spot Bitcoin ETF Finally See the Light of Day?

- Fake Bitcoin ETF Tweet Triggers SEC and Twitter Investigations

We kept scrolling until we learned we ‘HODL bros’ come in different shapes and intellect. The only three things that bring us together is our shared love for the ecosystem, and how beautiful and handsome we all are.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.