Get ready for the upcoming halving event — it’s about to shake up the daily supply of BTC, cutting miners’ rewards in half. The shock of halving makes Bitcoin even more scarce and acts as a deflationary measure, bolstering its appeal as a savings instrument.

Bitcoin investors will be delighted with the anticipated price surge post-halving, but miners must adapt or exit the business as they contend for reduced BTC rewards. Ultimately, it’s the miners who take the hardest hit from the halving.

Bitcoin Halving Hype Hits Peak

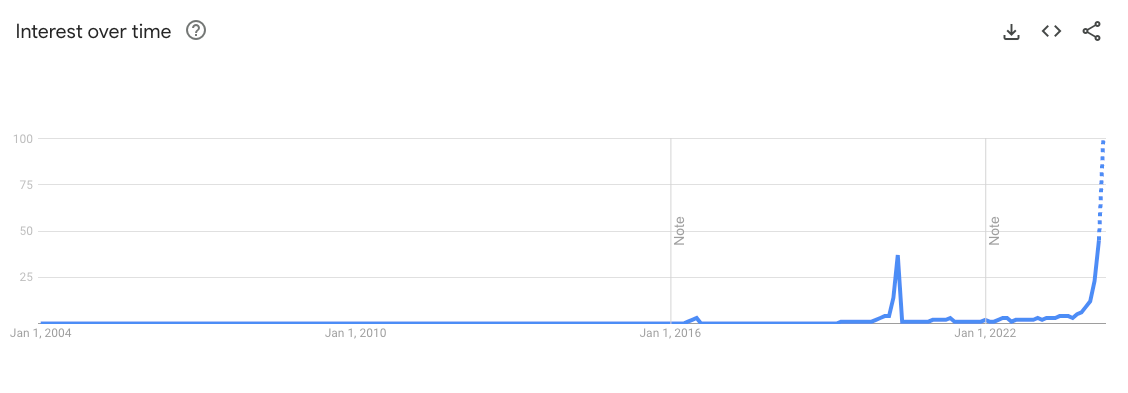

The level of interest in Bitcoin halving on Google has soared to an all-time high, with projected data showing it more than doubling the figures from the last halving in 2020.

According to Google Trends, search interest in the term “bitcoin halving” has already reached a score of 45, with Google predicting it will hit 100 by the end of this month, signaling “peak popularity” for this term.

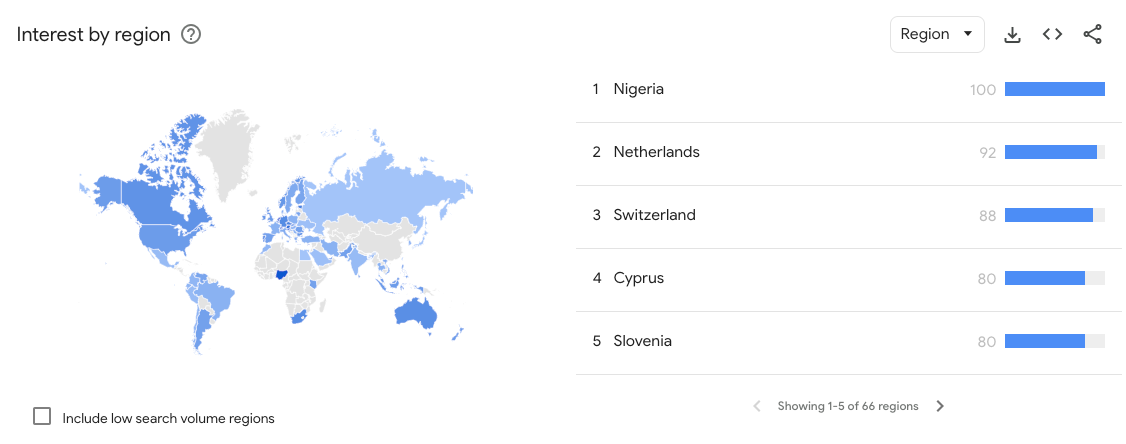

Google Trends data reveals that the highest interest in Bitcoin halving is observed in Nigeria, the Netherlands, Switzerland, and Cyprus.

The record-breaking interest in the halving event shouldn’t come as a surprise following Bitcoin’s impressive performance over the past few months.

Market commentators are pointing to historical price patterns of Bitcoin, speculating that Bitcoin could see significant growth in the months following the halving.

Relevant news:

The Love-Hate Relationship Between Miners and Halvings

Next Evolution for Bitcoin is Runes, Debuts Same Day as Halving

Miners Dilemma: Adapt or Die

As indicated by the countdown timer, the Bitcoin halving is currently scheduled for 4:00 a.m. UTC on April 20th. Halving Bitcoin is a programmed process in the Bitcoin protocol that reduces the amount of BTC that can be mined per block by 50% every 210,000 blocks, which happens roughly every four years. In just a few days, mining rewards per block will drop from 6.25 BTC to 3.125 BTC.

With each halving, mining Bitcoin becomes more difficult as larger mining rigs are needed, and the mining difficulty increases.

BTC miners are constantly optimizing their operations because they’re playing the long game, dependent on the market price of the Bitcoins they receive for mining blocks, based on how efficient their mining rigs are. Since block rewards aren’t increasing, miners have to gear up for survival in a volatile market.

Miners will be on the hunt for more cost-effective energy sources and carefully tweaking their mining gear. This could lead to significant changes in how the Bitcoin mining industry functions, which is relevant to every Bitcoin holder out there.

The price of Bitcoin is closely tied to miners’ profitability. Suppose the price of Bitcoin doesn’t increase sufficiently to compensate for the reduction in block rewards. In that case,If the price of Bitcoin doesn’t increase sufficiently to compensate for the reduction in block rewards, those older miners from three to five years ago will no longer be economically viable.

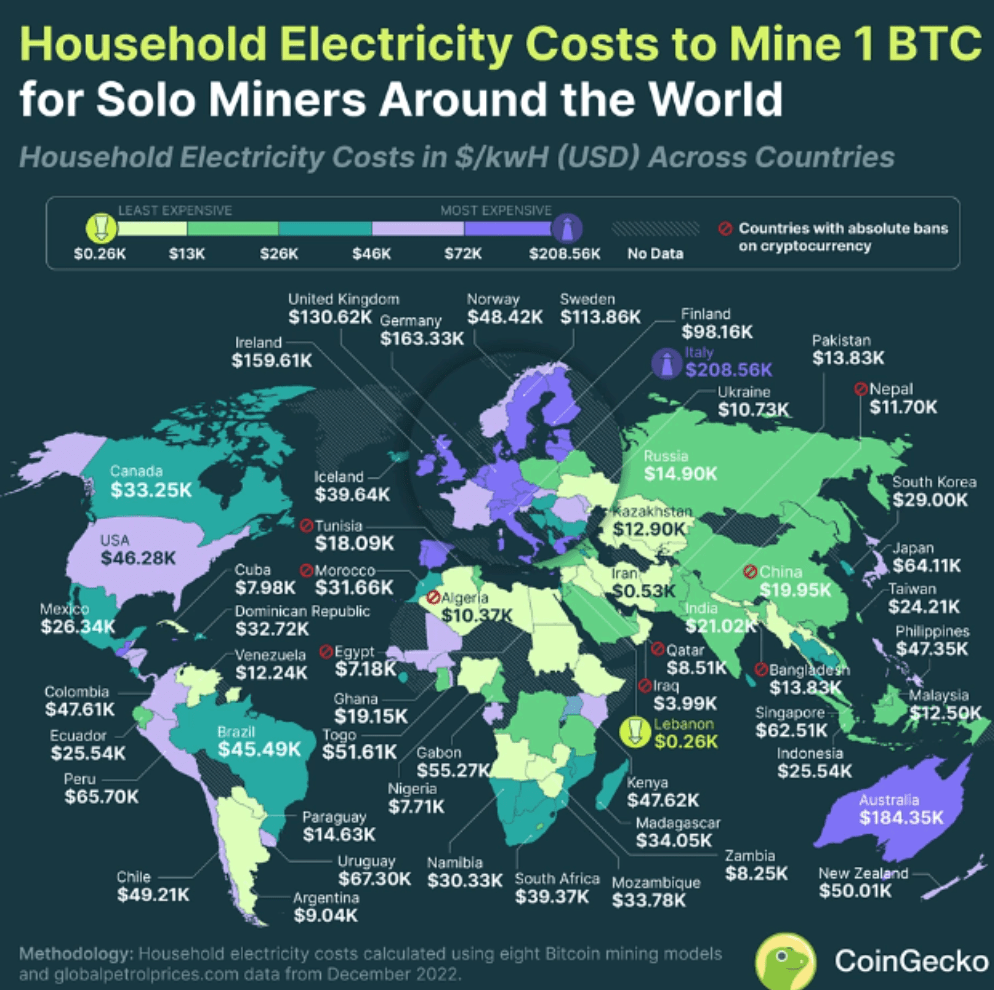

Plus, electricity costs are one of the most important factors for miners, though having a legal and safe regulatory environment is also crucial. Thanks to a friendly regulatory setup, the US remains one of the top spots for mining, despite having higher energy costs compared to other countries.

Mining worldwide’s spread largely hinges on electricity costs to operate mining rigs. The cost of mining 1 BTC can vary significantly depending on where the miner is located. Take Italy, for example – one Bitcoin there is roughly equivalent to the price tag of a brand-new luxury car.

Countries or regions with lower purchasing power could see the halving event as a golden opportunity, with older-generation mining rigs flooding the market. Halving is like a chance for new regions to strike gold; keep an eye on the Middle East, Africa, and Latin America. Countries like Paraguay and Venezuela are poised to grab attention sooner or later due to their low electricity prices. Tether even threw $500 million into Bitcoin mining operations in Paraguay, showing off their potential.

Ultimately, the halving will be a liquidity shock for miners and the market. Bitcoin’s programmed nature ensures predictable behavior, allowing savvy miners to survive. Think of the halving as a purge of inefficient miners, which should ultimately upgrade the Bitcoin mining infrastructure.