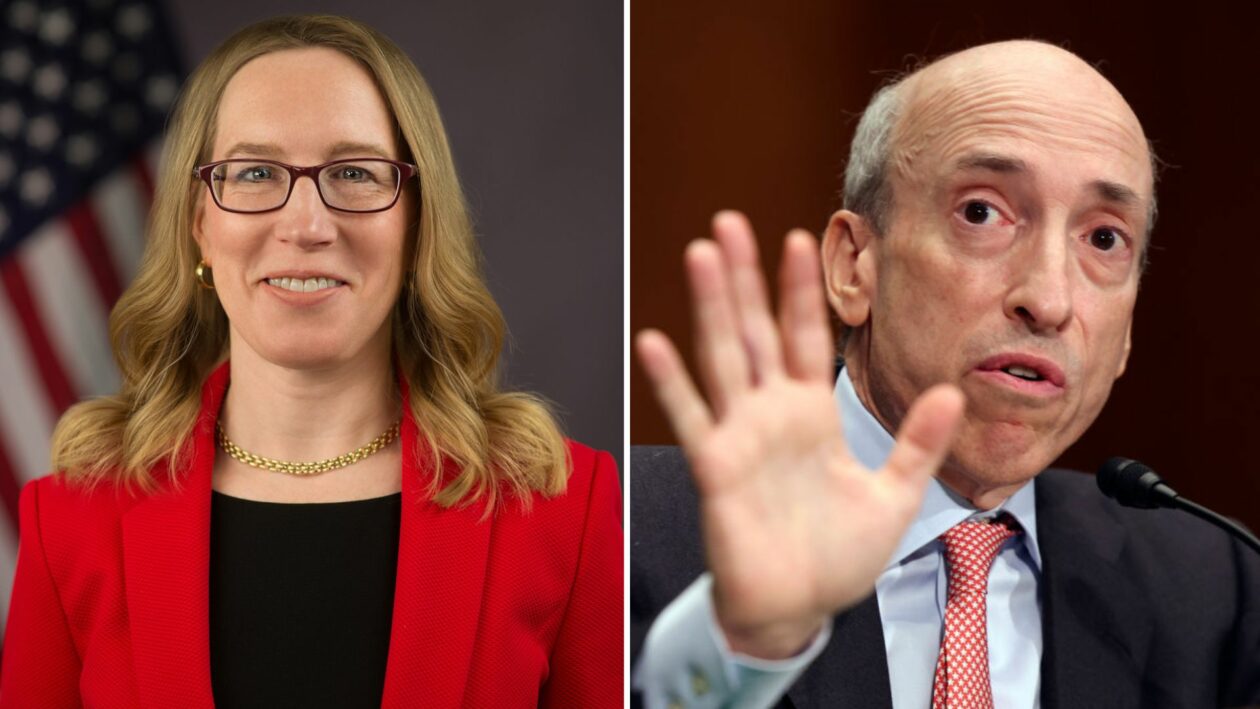

In the ever-shifting landscape of cryptocurrency regulation, a political chess match is underway, and the next move could bring surprising results. Former SEC official John Reed Stark has spun a speculative scenario involving a Republican resurgence in the 2024 U.S. elections, potentially turning the tables on crypto enforcement. Could this mean that SEC Chair Gary Gensler, the current crypto sheriff in town, might see his throne taken over by none other than the crypto-friendly Commissioner Hester “Crypto Mom” Peirce?

Read more: Power Drama at the SEC, Bank of China’s Crypto Leap, Bitcoin Football, and CPI Volatility

Political Ping-Pong: A Crypto Twist in the Making

In a Twitter prophecy on August 13th, John Reed Stark, once the chief of the SEC Office of Internet Enforcement, painted a picture that could only be concocted in the world of politics. He suggested that if a Republican President assumes the throne in 2024, the pendulum of crypto regulation could swing dramatically. This hypothetical shift might include tapping the crypto-advocate Commissioner Hester Peirce to replace Gary Gensler, the current head of the SEC. It’s an amusing prospect, considering how swiftly crypto fortunes can change.

The Contenders: Trump, De Santis, and Scott

As the political stage sets for this intriguing play, a lineup of Republican contenders vies for the lead role. The charismatic former President Donald Trump takes center stage, followed at a distance by the Florida Governor Ron De Santis and the South Carolina Senator Tim Scott. The irony here lies in the fact that the outcome of the crypto plot could be determined by the choice of one of these figures who, not so long ago, might have struggled to pronounce “blockchain.”

Crypto Mom to the Rescue?

If the curtain indeed rises on a Republican-led act, Stark’s crystal ball suggests that Commissioner Hester Peirce could dawn the “Crypto Mom” cape and step into the role of SEC chair. The irony? Peirce is known for her dissension against the very crypto regulations Gensler champions. Stark humorously imagines a scenario where most of the SEC’s crypto-related actions grind to a halt under the guidance of the once-dissident commissioner. It’s a plot twist even Shakespeare would envy.

From Harmonious Hums to Discordant Notes: The Crypto Divide

Stark reminisces about a time when crypto was a harmonious melody hummed by politicians from both sides of the aisle. The days of Trump, Clinton, and Waters joining in a chorus against the “dangerous and horrific plague” of crypto now seem like a quaint refrain. The irony amplifies as Stark highlights the modern-day cacophony, with De Santis promising to protect Bitcoin while Senator Elizabeth Warren rallies an “anti-crypto army.”

A Republican Requiem for Friendly Crypto?

While the political tug-of-war continues, Stark humorously suggests that until a Republican sets up shop in the Oval Office, the SEC’s stance on crypto might remain akin to a skeptical parent staring at a teenager’s latest fad. Predicting that the regulator would likely keep its guard up, Stark envisions a rejection of spot Bitcoin ETFs, all with a dash of “compelling” rationale.

Spot Bitcoin ETFs: Too Good to Be True?

To underscore his point, Stark adds a touch of sardonic flavor by citing an Aug. 8 Better Markets SEC Comment letter. This letter outlines how spot Bitcoin markets can be akin to a house of cards, with artificially inflated trading volumes, a few puppeteers pulling the strings, and a dependence on select entities. It’s as if the crypto world couldn’t resist adding a dash of intrigue even to its most serious documents.

Read More:

- Chairman Gensler’s Resignation Rumors Debunked by SEC PR Team

- The Sec vs Ethereum rodeo; security edition

- Betting on Bitcoin: Bloomberg Analysts Raise the Stakes on ETF Approval

Predicting the next move is like forecasting the weather in a tornado. The scenario painted by John Reed Stark is both a hilarious satire and a glimpse into the tantalizing uncertainty that swirls around crypto. As politicians jockey for power and crypto enthusiasts clutch their tokens, we can only wait and watch as this political crypto soap opera unfolds.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.