Welcome to this week’s edition of the weekly digest! Binance’s record-breaking settlement, Gemini’s legal tussle, Grayscale’s ETF ambitions, HTX’s hot wallet troubles, we’ve packed this digest with stories from the crypto world. No time to wait, let’s dive in!

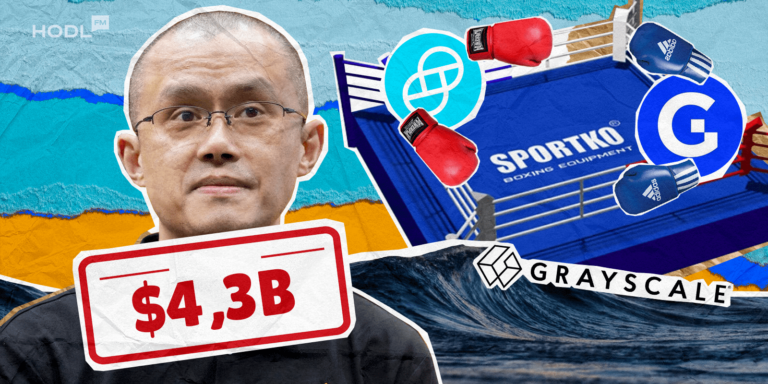

The Shockwave in the Crypto World: Binance’s $4.3 Billion Settlement

Have you felt that shockwave? Not an earthquake, not a meteor hitting the Earth. It’s Binance getting slapped by Uncle Sam.

Binance has agreed to pay a staggering $4.3 billion to settle criminal charges with the U.S. government. The settlement emerged as one of the largest penalties ever slapped on a corporate entity in the U.S.

Changpeng “CZ” Zhao, the founder and CEO of Binance, has pled guilty to charges in Seattle and accepted a personal fine of $50 million. Oh, he also stepped down from his position. That’s the end of an era for Binance, and the cryptosphere. The dude was the face of the largest crypto-related entity in the world.

But Binance was quick to fill the gap. Stepping into the shoes of the outgoing CEO is Richard Teng, a former Abu Dhabi regulator with a reputation for strict compliance. His background as Binance’s regional markets head and his regulatory experience are expected to bring a new level of stability and compliance focus to the exchange. Compliance is going to be ringing in our ears in the next couple of years, as it seems.

So, what was the reason for that ridiculously high penalty? Binance’s legal troubles stemmed from a lot of accusations: failing to implement an adequate anti-money laundering program, operating an unlicensed money-transmitting business, and violating U.S. sanctions law. Woah, they got away with just a couple of billion, didn’t they?

Post-settlement, Binance is mandated to appoint an independent compliance monitor for three years and report its efforts to the U.S. government. Zhao’s involvement in managing or operating Binance is prohibited during this period.

Well, this settlement once again shows the U.S. government’s determination to bring order to the crypto industry, in its own American way. Let’s all hope that this will be the turning point for the U.S. government to come to terms with crypto. It’s not a monster, Uncle Sam.

Genesis Sues Gemini for Recovering $689 Million

In other news, Genesis Global Capital has filed a lawsuit against Gemini Trust, a well-known cryptocurrency exchange. No end to lawsuits in crypto it seems. The lawsuit revolves around the recovery of a sum of over $689 million, which Genesis alleges was transferred to Gemini in a manner that unfairly disadvantaged other creditors.

The conflict between Genesis and Gemini is not new. It has been escalating since the collapse of FTX. The fallout from this collapse has led to a series of legal battles between these two entities.

Genesis filed for bankruptcy in January, which intensified the legal scuffle between the two companies. The situation was further complicated when Genesis sued its parent company, Digital Currency Group (DCG), for the repayment of loans exceeding $600 million. Gemini has also been actively involved in legal actions against Genesis, including a lawsuit over shares of the Grayscale Bitcoin Trust (GBTC) valued at approximately $1.6 billion.

Now, Genesis alleges that Gemini made significant withdrawals during a period of market instability, which was exacerbated by the collapse of Terraform Labs and the digital asset hedge fund Three Arrows Capital. These actions are claimed to have contributed to a “run on the bank” situation for Genesis. The lawsuit contends that these transfers were avoidable and potentially made with the knowledge of Genesis’s insolvency.

Genesis’s filing also suggests that Gemini demanded repayment of prior loans during a critical 90-day period to make matters even more complicated. Gemini has publicly denied these claims, labeling them as baseless and inflammatory. The company has expressed its intention to continue pursuing the legal process to address these allegations.

The fallout of the FTX collapse is still going on. As the case progresses, it will likely provide further insights into the operational practices and regulatory compliance of major players in the crypto industry. So, if you haven’t got the memo yet, prepare for regulations dear Hodler.

Grayscale’s Meeting with SEC to Explore the Path to a Bitcoin ETF

Grayscale, recently had a meeting with the U.S. Securities and Exchange Commission (SEC). The focus of this discussion was Grayscale’s proposal to transform its Grayscale Bitcoin Trust (GBTC) into a new type of investment product known as a spot Bitcoin exchange-traded fund (ETF).

Read also: Grayscale’s Landmark Victory Rescues Bitcoin from Dismal August

Translation to human: Grayscale’s Bitcoin Trust (GBTC) is currently a way for investors to get exposure to Bitcoin without actually buying Bitcoin directly. Instead, they buy shares of GBTC, which in turn owns Bitcoin. This method has been popular, but Grayscale aims to evolve it into something more accessible and widely recognized in the traditional financial markets: a spot Bitcoin ETF.

Now, back to the meeting. Grayscale executives and lawyers discussed with the SEC how they could change the rules to allow GBTC to be listed and traded as a spot Bitcoin ETF. This move would be a big step, as it would make investing in Bitcoin easier and more mainstream, just like buying stocks on the stock market.

If Grayscale succeeds in converting GBTC to a spot Bitcoin ETF, it could become a major player in this new market. Maybe a price hike in BTC could be on the horizon too. What do you think? Would you invest in BTC stocks?

HTX Exchange Suffers Significant Hot Wallet Hack

HTX, previously known as Huobi Global, experienced a horrific security breach resulting in a loss of $13.6 million, which later escalated to $30 million, like 13 million wasn’t enough.

Surprise surprise! Hot wallets are more vulnerable to hacks compared to cold wallets. In HTX’s case, hackers were able to access three of their hot wallets and steal various cryptocurrencies, including Ether (ETH), Tether (USDT), USD Coin (USDC), and Chainlink (LINK). They then transferred them to different Ethereum addresses.

But the conspiracy deepens. The incident is actually part of a larger exploit affecting the HECO Chain bridge, a technology that allows the transfer of assets between different blockchain networks. This bridge is a product of the collaboration between Tron and BitTorrent ecosystems, which lost a staggering $86.6 million due to what appears to be a security lapse involving a blockchain operator.

Justin Sun, the owner of HTX and founder of Tron and BitTorrent, quickly addressed the situation. He assured that HTX would fully compensate for the losses incurred in the hot wallet hack and that all other funds on the exchange were secure. However, he also announced the temporary suspension of deposits and withdrawals on the platform.

This is not the first time HTX has faced security issues. In September, the exchange was targeted in a similar hot wallet hack, leading to a loss of $8 million. This previous hack occurred shortly after HTX rebranded from Huobi Global. Despite these challenges, the exchange reportedly holds over $2 billion in combined user and corporate assets and continues to see significant trading volumes.

And that’s a wrap on another eventful week in crypto! Remember, Hodler, staying informed and vigilant is the key. Until next week, keep hodling on!