We’re back to dish out the juiciest highlights of last week! While you were busy tracking Bitcoin’s moves, the world had its own share of fun. We threw a grand party celebrating Bitcoin’s halving, Spain got fed up with tax-dodging crypto-hiders overseas and laid down the law, and Coinbase’s stocks took flight (thanks, competitor!). Finally, a new analytical forecast for the main cryptocurrency`s price warmed our hearts on these chilly first winter days. Grab your cocoa and join our digest: all the good stuff’s packed in there!

Happy Birthday, Bitcoin Halving!

It feels like just yesterday we were all gathered around, toasting the first Bitcoin halving on November 28, 2012. We were swapping funny stories and thinking that exchanging 10,000 bitcoins for a pizza was the deal of the century. And here we are, suddenly standing at the doorstep of its 11th anniversary. Hard to imagine, right?

Why does Bitcoin have this magical touch where halving things suddenly turns profitable?

Of course, it’s important to note that it’s only profitable for some. Miners go above and beyond, diving into their pockets, purchasing expensive equipment, upgrading computing power, only to receive half the reward every four years. Well, the world isn’t fair, but considering that the price of Bitcoin increases with each halving, they’re not that disappointed after all.

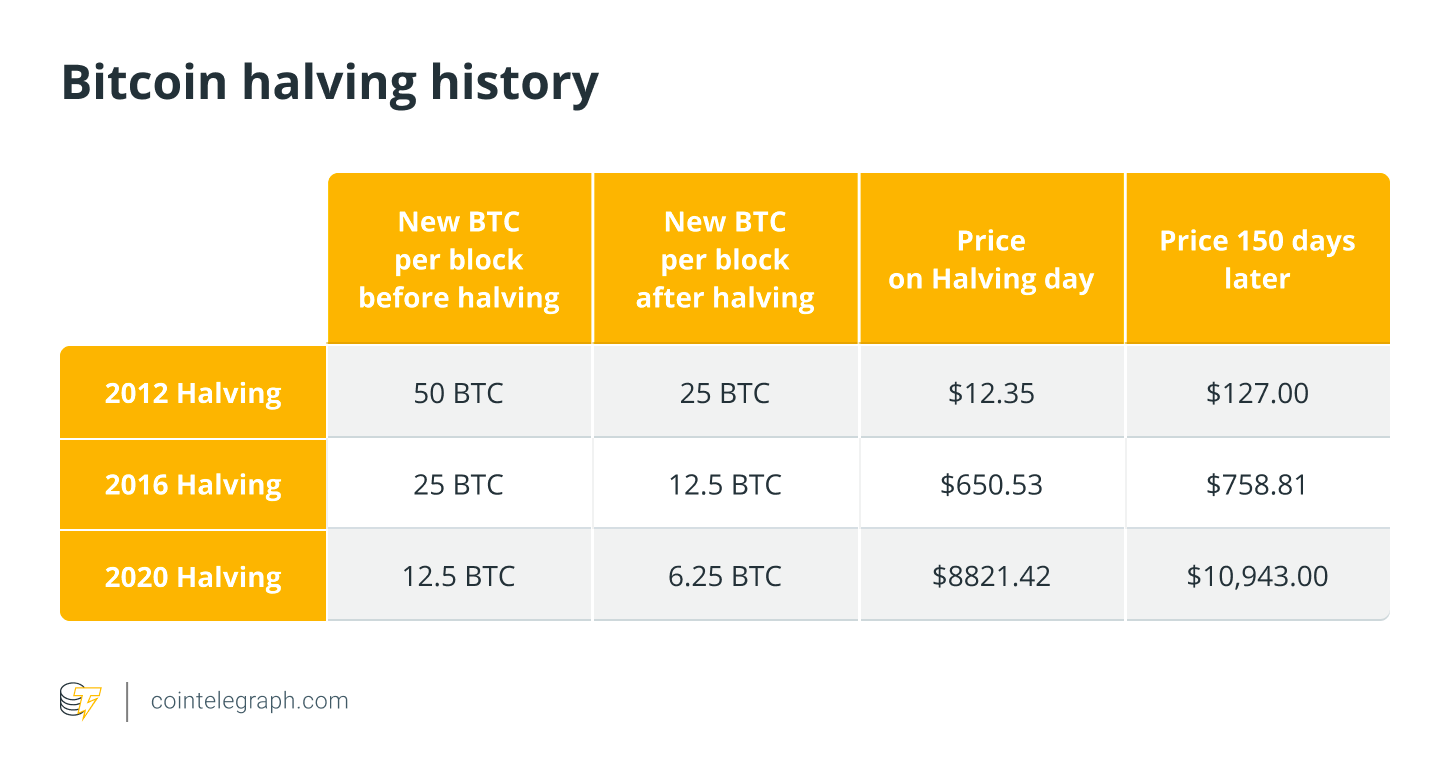

As Bitcoin undergoes halving, effectively halving the issuance of new coins, this event historically impacts prices. A year after the first halving, Bitcoin surged to nearly $1,000. The second halving prompted a staggering 350% increase in the following year. Post the third halving, BTC skyrocketed to its historic high, hitting almost $69,000.

What lies ahead after the fourth, and certainly not the last, Bitcoin halving?

The upcoming halving of Bitcoin is scheduled for April 2024. Although predicting its precise impact on prices remains unclear, many Bitcoin enthusiasts are particularly bullish about the price in the coming year. Expectations are high, especially with the anticipation that U.S. securities regulators might finally give the green light to a Bitcoin exchange-traded fund.

Spain has its hands around the crypto holders’ necks

In a quest to keep a closer eye on crypto coins and boost tax honesty, the Spanish Tax Agency (AEAT), or Agencia Tributaria, has set some pretty strict rules. Residents with crypto stashes on foreign platforms need to spill the beans by April 1, 2024, according to the AEAT. But don’t sweat it unless your crypto treasure chest surpasses 50,000 euros (or 55,000 US dollars) on non-Spanish platforms.

TrippleA’s report spills Spanish crypto fans: roughly 1.1 million folks are part of the crypto club, making up around 2.5% of the population by 2022. A good chunk of these hodlers keeps their digital assets on platforms outside Spain’s borders. The mandate’s goal? Make sure these crypto-savvy individuals cough up their fair share of taxes on those sweet crypto gains.

Agencia Tributaria, is getting tougher on rounding up taxes from crypto holders. But hey, despite these tighter rules, the Spaniards continue to avoid tax liability in every possible way (who doesn’t, eh?). In April 2023, they fired off 328,000 warning letters to those who conveniently forgot to pay their crypto taxes for 2022. That’s a whopping 40% surge from the 150,000 warnings in 2022 and a staggering leap from the mere 15,000 notices sent out in 2021.

The long-term consequences are anticipated to be constructive for Spain’s cryptocurrency sphere. By tightening tax rules and waving the transparency flag, the government is playing the legitimacy card. The result? A smoother ride for crypto businesses and a siren call for more investors to hop on the crypto spanishcoaster.

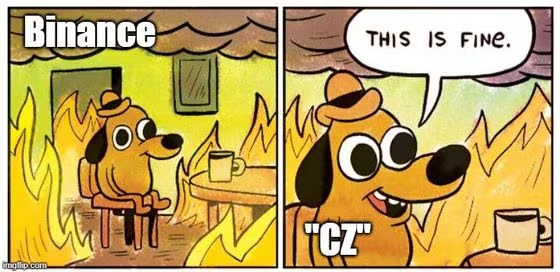

Coinbase took flight while Binance took a tumble

During Coinbase’s fantastic ascent, this renowned cryptocurrency exchange platform witnessed a significant stock surge. On Monday, November 27, 2023, its shares skyrocketed to an 18-month peak at $119.77, while others might be feeling a bit binance’d out!

What were the reasons behind this, you ask?

- The first and most obvious reason (yes, you caught the Easter egg in the title) is, of course, the recent revelations swirling around Binance. Binance and its founder CZ admitted guilt in money laundering, violating US sanctions, and running an unlicensed money transfer business. CZ’s five-year ban on operating the exchange and a whopping $4.3 billion fine didn’t exactly jazz up the reputation of Coinbase’s main rival.

- Secondly, the green light given by the U.S. Securities and Exchange Commission (SEC) regarding a slew of Bitcoin exchange-traded funds (ETFs) sparked increased interest in Bitcoin and other cryptocurrencies. This ultimately benefits Coinbase.

Other key points to note:

- Coinbase’s stock has soared by an impressive 77.4% in the last month.

- Year-to-date, Coinbase’s stock has surged by a remarkable 250.2%, according to TradingView.

- Presently, Coinbase commands a market capitalization of approximately $30.58 billion.

Analysts are cheerfully donning their rose-tinted glasses, foreseeing a continuation of this positive trend in Coinbase’s stock prices in the foreseeable future.

The “One Look” technical analysis indicator predicts Bitcoin’s price at $48K

And here we are, saving the best for last. Of course, we couldn’t resist wrapping things up with another dose of positivity regarding Bitcoin’s price.

The Ichimoku Cloud, which translates from Japanese to “one look,” is a technical analysis indicator. It uses five lines to sniff out an asset’s trend, momentum and even peeks into its future support and resistance. It’s helping traders spot trends, potential turnarounds, and the perfect moments to hit that buy or sell button.

The future of Bitcoin is looking promising – forecasts are pointing towards a potential surge to nearly $50,000, especially after the noise caused by the approval of the first Bitcoin ETF in the United States (yes, the whole price hype is once again converging on ETFs).

CryptoCon analyst highlights the Ichimoku Cloud indicator, which is apparently yelling about Bitcoin’s upward trajectory. Recent analysis, published in X (hopefully, no need to explain what that is), predicts a minimum rise for Bitcoin to hit $43,000, with a potential ceiling around $48,000.

Per CryptoCon, the indicator’s optimistic vibe suggests that Bitcoin’s rally isn’t ready to call it quits just yet. Moreover, he is boldly declaring:

The most conservative level here is 43.2k, but the true top of the red cloud could be labeled as high as 48k.

ETF`s contribution

Although the specifics about which ETFs will get the green light remain unclear, the anticipation of a potential ETF market debut is casting its shadow on Bitcoin’s potential growth trajectory. The expected Ichimoku Cloud forecast of hitting $48,000 seems to align with the potential ETF approval date, slated for early January. Quite the promising coincidence, don’t you think?

To sum up

As we look back at these events, it’s evident that the Bitcoin halving birthday party brought nostalgia, while Spain’s tax maneuvers added gravity. Meanwhile, Coinbase’s stellar rise amid Binance’s tumble made headlines, and the bright prospects for Bitcoin’s value supported our spirits.

Hope you didn’t spill your cocoa on your laptop while diving into these news bites. Come back next week for more equally thrilling tales!