Hi crypto gang! Ready to find out what’s been happening in the world of crypto? This week is abuzz with activity and intrigue: from Sweden’s stringent measures targeting crypto mining companies to Binance’s anticipated return to the Indian market, and the exposure of fraud within the Omni Network token, to the remarkable ascent of Magic Eden in the NFT marketplace scenes. Let’s begin.

Sweden to Squeeze $90 Million from Mining Companies

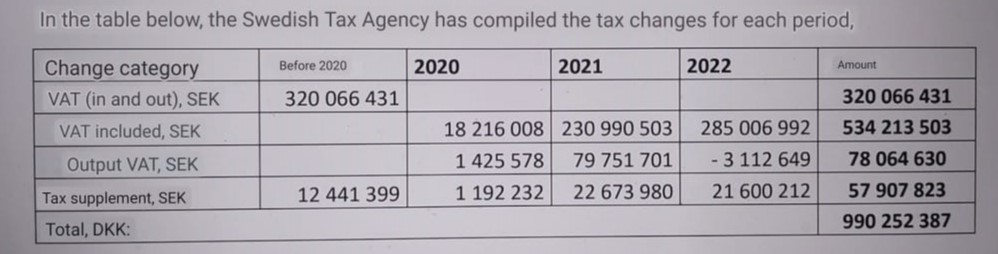

Swedish cryptocurrency miners are facing a huge tax bill of more than $90 million following a government investigation that revealed the misappropriation of funds over four years.

The Swedish Tax Agency Skatteverket delved into the operations of 21 cryptocurrency mining companies from 2020 to 2023. The investigation revealed that 18 crypto firms had furnished “misleading or incomplete” information to obtain tax breaks.

According to the agency, some crypto outfits spun misleading business descriptions to value-added tax (VAT) on taxable transactions. Others got crafty with sidestepping import taxes on mining equipment or income tax on their mineral plunder.

A rough translation of the Tax Agency’s statement went like this:

“This approach leads to tax vanishing from the country in the form of improper input VAT payments, uncollected output VAT, and unaccounted-for crypto assets.”

Crypto mining companies are now obliged to cough up a total exceeding 990 million Swedish kronor ($90 million) to the tax authorities. This includes unpaid collective VAT amounting to $85.4 million and additional tax levies of around $5.3 million.

Binance’s Indian Revival

The cryptocurrency exchange Binance is set up for a comeback in India after a four-month ban, paying a $2 million fine for not playing by the rules. Just to jog your memory, Binance and nine other foreign crypto exchanges got the boot from India for not abiding by local AML (Anti-Money Laundering) rules.

The Financial Intelligence Unit (FIU) of India’s Ministry of Finance cut off access to nine URLs and mobile apps of foreign crypto exchanges, including Binance, in early January due to non-compliance with the country’s anti-money laundering law.

Reportedly, before the ban earlier this year, Binance accounted for over 90% of cryptocurrency trading volume in India.

Binance will be the second foreign exchange after KuCoin to mark its return to the country following the financial regulator of India locking out crypto exchanges over compliance issues.

Indian users flocked to foreign crypto exchanges like Binance to dodge taxes, prompting the government to ban unregistered foreign exchanges.

Now, having got the paperwork sorted with the Indian regulators, foreign crypto exchanges like Binance must play by the same rules and provisions as Indian exchanges.

A person familiar with the matter said, “Unfortunately, it took Binance more than two years to realize that there’s no room for negotiations, and no global power can demand special treatment, especially at the cost of exposing the country’s financial system to vulnerabilities,” as reported by ET.

While KuCoin and Binance chose to get registered entities in India, OKX, another prominent crypto exchange among the nine banned ones, shut down operations altogether citing regulatory burden.

Omni Network Token Fraud Ends in a Zero

The ERC-20 token OMNI from the Omni Network fell by over 55% nearly 18 hours after its launch, shedding more than half its market cap. Meanwhile, a fake token with the same name just got “rug pulled,” plummeting by 100%. The developers of the counterfeit OMNI token, using the same ticker, pulled off a scam worth $398,000.

PeckShield, a blockchain security firm, reported in an April 18 update that the fake token crashed by 100% after a smart contract deployment dumped over 1.7 quadrillion tokens for 132 Wrapped Ether (WETH).

OMNI Token Distribution

In the distribution, early testers, builders, and community participants received 50% — 1.5 million OMNI — from the latest giveaway, amounting to approximately $36.2 million. Eligibility was determined based on a snapshot taken on April 3.

The remaining tokens were divided up among EigenLayer restakers and several non-fungible token (NFT) projects, including Pudgy Penguins and others.

On April 15, Omni Network disclosed that 9.27 million OMNI tokens — 9.27% of the total supply — were earmarked for public launch tokens, used for “launch pools and liquidity.”

The largest portion of OMNI — 29.5 million tokens, accounting for 29.5% of the total supply — will be allocated for “ecosystem development” and initially disbursed at the discretion of the blockchain-supporting company, Omni Foundation.

Nearly a quarter of all OMNI tokens — 23.3 million — were designated for investors and consultants.

Magic Eden Surpasses Blur to Become Top NFT Marketplace in March

Magic Eden outpaced Blur as the leading NFT marketplace in March. Its ascent was partly fueled by its new Diamond rewards program and ongoing partnership with Yuga Labs — just when the NFT studio cut ties with platforms not supporting creator fees.

As it stated in CoinGecko’s report for the first quarter of 2024, published on April 17, NFT trading volume in March surged by 194.4% to $756.5 million, while Blur saw a modest increase to $530.4 million.

March marked the first month since OKX capitalized on the Bitcoin ordinals craze in December last year that Blur lost its status as the top NFT trading platform by volume. Prior to this, Blur led in trading volumes for 10 consecutive months after overtaking OpenSea in February 2023.

However, OKX has since lost a significant share of Bitcoin NFT trading volume to companies like Magic Eden and UniSat, resulting in a 73.3% drop in its trading volume since December to $180 million.

Despite this, OKX achieved third place in NFT trading volume during the first quarter of 2024, joined by Solana-based Tensor and OpenSea to complete the top five rankings.

Royalty Disputes

Lately, ensuring proper royalties has become a serious bone of contention between NFT marketplaces and studios.

OpenSea, once the reigning NFT marketplace, shut down its royalty control tool last August. CEO Devin Finzer admitted the tool didn’t quite hit the mark he hoped for, noting that competitors like Blur, Dew, and LooksRare were getting the upper hand by integrating the Seaport protocol to circumvent OpenSea’s blacklist and thereby dodge creator fees.

But earlier this month, OpenSea partially backtracked on this stance, extending support for the ERC-721C programmable revenue standard. This move aims to strike a balance between ensuring creators get their due and staying competitive in the cutthroat world of NFT trading.

In short, the crypto and NFT world presents both opportunities and challenges for participants and regulators alike. Sweden’s tax measures and Binance’s comeback in India show that this space isn’t for the faint-hearted. The Omni Network token scam? Well, that’s a reminder to always double-check before investing in digital assets! As for royalty disputes, let’s hope they get sorted out because fair play is key in the NFT universe. Stay updated with us in this dynamic crypto world!