Let’s talk about Bitcoin ETFs finally obtaining the SEC’s nod and what it means for the crypto market.

Bitcoin ETFs Changing the Crypto Game

Finally, that day has come! After years of waiting, the US Securities and Exchange Commission (SEC) gave a green light to the first batch of spot Bitcoin exchange-traded funds (ETFs).

This is a great occasion to celebrate.

In total, 11 ETFs have been approved, including the Grayscale Bitcoin Trust (GBTC), which dumped its older status as a crypto investment fund. Keep this ticker in mind, as we’ll revisit it later.

Other providers include Bitwise, VanEck, Fidelity, and BlackRock. Yes, the largest asset manager with $10 trillion AUM is also in the game.

Finally, Bitcoin has a sense of legitimacy on Wall Street, and it doesn’t have to blush in the company of traditional institutions.

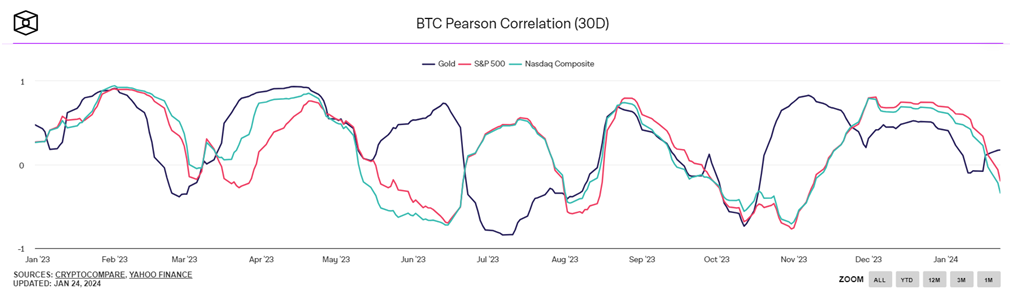

These cryptocurrency ETFs have the potential to change the game in the crypto space, bringing in new capital from traditional whales. Guys in suits with deep pockets can get exposure to BTC to diversify their portfolios. Why not? Crypto assets still show the lowest correlation to traditional markets:

And it’s not only about whales. Retail investors will likely play a visible role as well, benefiting from a more convenient cryptocurrency trading approach.

For many, opening positions with their brokerage platform is much easier than dealing with a crypto exchange, having a digital wallet, keeping the seed phrase safely, buying stablecoins to exit positions, etc.

The rising popularity of ETFs is expected to bring more speculative forces, although it may actually stabilize prices and improve price discovery due to a broader pool of investors and greater liquidity. A Moody’s analyst reportedly said:

In the medium to long term, we see it as a positive development that will increase the price discovery and the stability of bitcoin. And it will probably increase the allocation of some institutional investors to this asset class.

Bitcoin Market Reaction

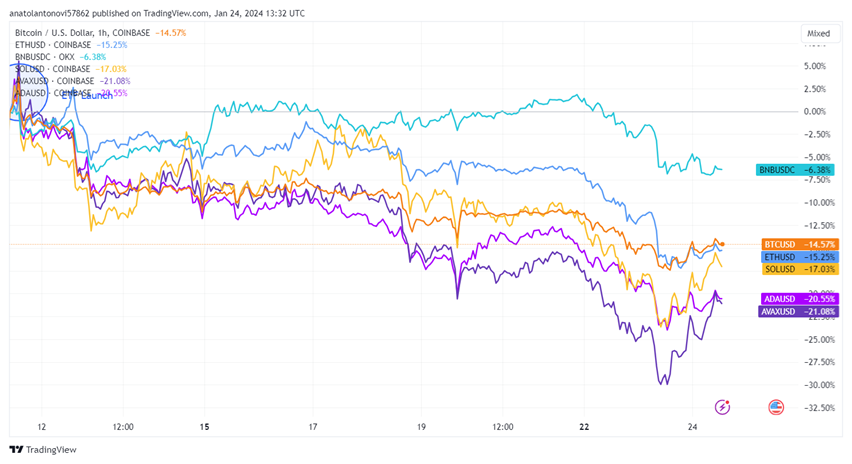

About two weeks after the ETFs went live, Bitcoin is defying bullish expectations.

Market dynamics are currently dominated by bears, with the king of crypto losing about 15%.

How come?

Well, to begin with, you should know that the cryptocurrency market has priced in the SEC approval months ago. In fact, that was the main driving factor pushing the BTC price from about $26,000 in mid-October to over $45,000 at the beginning of 2024.

While unexpected for many, a correction like this makes sense. But I must acknowledge – it’s quite dramatic indeed.

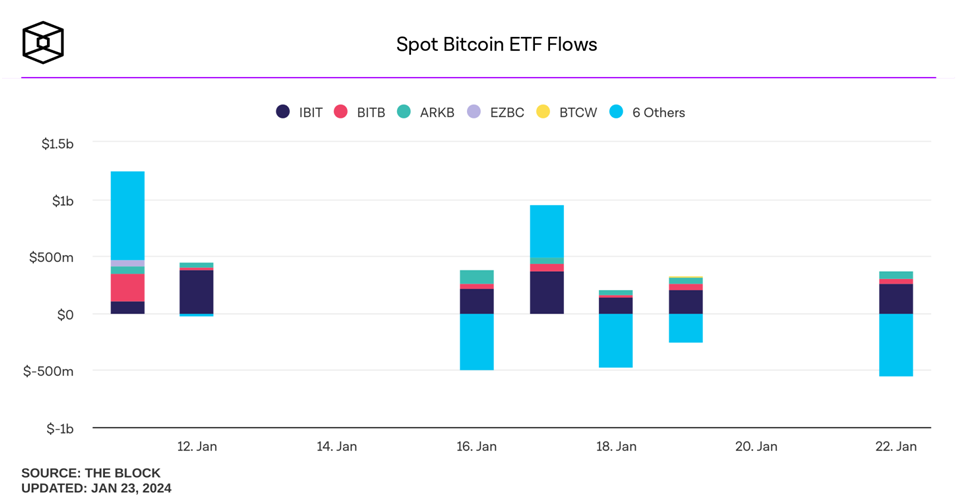

The correction came after market participants realized that the ETFs don’t pull in as much capital as anticipated. The net inflow is at nearly $4 billion after about two weeks.

Even worse, we’re still waiting for new money – so far, what’s considered as new inflows is actually capital moving from Grayscale (GBTC) to other ETFs.

As Grayscale Investments CEO Michael Sonnenshein assures us that most of his competitors won’t survive because he is cool and he wouldn’t reduce the eye-bleeding 1.5% fee anyway, over $2 billion worth of crypto has already left GBTC, triggering growling bears.

Still, we shouldn’t worry about this correction – the impact of ETFs isn’t showing up overnight. We’ll explore the long-term scenarios below, so keep reading.

Altcoins in the Mix

It’s not a secret that altcoins are following the price of Bitcoin, showing a high level of correlation except when an altcoin season is confirmed. Therefore, the Bitcoin ETFs’ performance will have an impact on altcoins, too.

If Bitcoin bleeds, everyone else suffers.

The high correlation will likely maintain in the coming years as well, with Bitcoin still accounting for 50% of the market share and acting as the first violin of the crypto orchestra.

Regulatory Factors

While the SEC finally approved the first Bitcoin ETFs, that doesn’t mean it suddenly turned more crypto-friendly.

The US crypto regulatory decisions are important because other jurisdictions follow them. Today, all eyes are on the US – this is where the largest institutional investors reside.

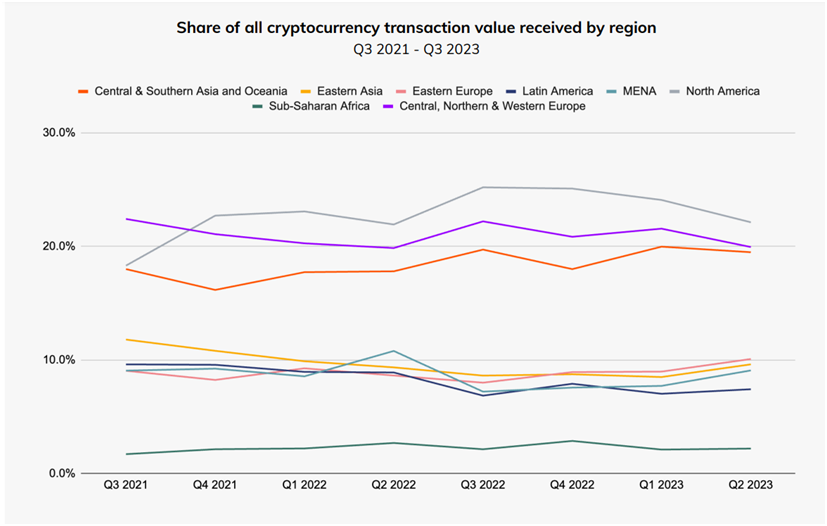

(In the chart above, you can replace North America with the US – it accounts for over 90% of the continental market anyway)

While Europe is more progressive and crypto-friendly (the EU is the first major jurisdiction to adopt a comprehensible crypto regulatory framework), the US is a bit trickier.

Yes, Bitcoin is accepted and treated as a commodity; the SEC approved the first ETFs, but there are many regulatory uncertainties, especially regarding altcoins and crypto service operators.

It’s true: the FTX collapse scared the hell out of everyone, but that doesn’t mean US watchdogs should hinder innovation.

Here, Binance US CEO Norman Reed criticizes the SEC due to the ongoing court battle, but this is not only about Binance – the entire crypto market is waiting for more love from the SEC.

Market Risks and Opportunities

This is an interesting time to be a crypto investor. Despite the high volatility and the risks involved, Bitcoin can be a great safe haven amid the current geopolitical crisis and the post-COVID macroeconomic rollercoaster with the Fed taking center stage.

Bearish case

While crypto enthusiasts have high expectations of Bitcoin following the ETF approval, the price ascension may be delayed until Binance and the SEC reach a final outcome and the world makes sure Binance has a healthy financial situation. Whether you like it or not, you’d better not want a collapse of the largest exchange.

Bullish case

The immediate reaction following the SEC’s EFT approval has been surprising, but market sentiment is still positive for the longer term.

Bitcoin has the potential to thrive due to fresh demand from traditional investors and the speculative power of the new ETF products.

Also, don’t forget that the next halving event is just around the corner. The reduced mining reward will cut BTC’s inflation rate, making it even scarcer. This is a strong bullish signal for the months to come.

The halving event and the Bitcoin ETFs are a powerful combo.

Related: What is the Bitcoin Halving and How Bitcoin’s Supply Is Limited

What Do the Experts Say?

The crypto market is relieved after the BTC ETF approval, with most experts sharing optimistic expectations.

SkyBridge Capital founder Anthony Scaramucci shared his expert opinion on the SEC’s decision:

“I think this is a really big breakthrough for Bitcoin as a digital asset, it’s a much broader story for digital property in general. I think Bitcoin will probably see its all-time high at the end of the year, and is likely to go through its all-time high by the end of the year.”

Scaramucci pointed to the first spot gold ETF approved in 2004. It took years, but the metal eventually surged following the event.

A similar outlook was shared by Twitter/X user Plan B – the guy who proposed the stock-to-flow (S2F) model.

Basically, the S2F model suggests that the BTC price increases as the coin gets scarcer after its halving events. The S2F chart screams for an immediate bull run to catch up with the metric.

Meanwhile, some analysts are concerned that the majority of BTC ETF issuers have picked US-based crypto exchange Coinbase as custodian, and that is a concentration of risk no one is talking about.

The Final Note

Bitcoin ETFs are live. Bitcoin is now on stock exchanges. This is big news, but it’s too early to see any results.

The majority of financial advisers in the US still avoid crypto. Michael Kitces, an influencer in financial planning, told NYT:

At best, it’s deemed too volatile. At worst, the advisers are skeptics about crypto and its viability altogether.

Nevertheless, Kitces says that a segment of advisers would allocate up to 2% of a client’s portfolio to Bitcoin ETFs.

My take is that Bitcoin ETFs are here, and this is a huge milestone. Maybe there is no rush of capital today, but the next bull run can trigger a FOMO that could take ETFs by storm. Let’s see where this takes us.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.