ETH price forecast

- The largest community-driven altcoin;

- Besides being digital money, Ethereum has smart contracts you can program;

- Liquidity Staking Coins are groundbreaking, but they shouldn’t break rules (outshining the master);

- After crypto winter, brace up for Ethereum ETFs;

- Institutional investors are coming for ETH;

- Upcoming events like the next ETH Monaco Conference;

- Ethereum bullish forecast eyeing hot $5K next 3 years;

- Ethereum’s bearish forecast looking down on $1K in next 3 years.

Overview of Ethereum

We don’t need any central authority, Mom and Dad!’ But instead of staying out late and blasting music, we can revolutionise the way we handle transactions and digital agreements.

That statement up there is Ethereum. __Community-run, decentralized and distributed Ethereum. You’ll owe it to this buddy for deploying your smart contracts, playing around with programmable smart contracts and making payments in ETH.

Read more: Ethereum’s Impending Doom? Liquid Staking Tokens to Conquer the Crypto World

Technically, Ethereum connects millions of interconnected computers through a set of rules. These rules are called the Ethereum Protocol. Hence, the Ethereum ecosystem serves as a foundation for enabling decentralized finance, digital assets and communities.

So that developers can build and grow their own decentralized applications on the platform. Thereby allowing anyone with an internet device to participate in DAO governance, interact with smart contracts, submit cross-border remittances and so much more.

Today, Ethereum is the 2nd largest cryptocurrency by price and market capitalization. According to CoinMarketCap, the cryptocurrency has a market cap of $220 billion and represents roughly 20% of the blockchain market share. See Ethereum Market Cap below:

In this forecast, we are going to evaluate Ethereum’s historical performance, existing fundamentals, current industry trends, upcoming events in the ecosystem, expert opinions and predictions. You’ll acquaint yourself with knowledge about some of the external factors affecting the price of Ethereum, particularly use cases, community strength, developer ecosystem and so on.

Historical Performance analysis

An Introduction to Ethereum historical price trends in the early days of Crypto

Vitallik Buterin and Garvin Wood launched Ethereum in 2015 with an opening price of $0.74. Coinbase listed the cryptocurrency a year later at a price of $7. 2017 saw the crypto market enter a bull year, where Bitcoin tested its first ATH of $20K. Ethereum, usually trading in sync with BTC, surged by nearly 70% and tested the first $1600.

2021 and 2022

Ethereum reached the height of its second bull rally in November 2021 after testing $4,815. 2021 proved to be excellent for crypto. Bitcoin tested an ATH of $70K, majority of the altcoins followed suit. The Ethereum ecosystem grew by considerable strides. Thereby, enabling the blockchain to hit a market cap of $55 billion for the first time.

In 2022, Ethereum dipped from its all-time levels during that year’s second half. It was not Ethereum alone that crashed. The general cryptocurrency market underwent a bloodbath that saw Bitcoin plummet from its ATH to levels below $16,000. Other altcoins like Solana, Chainlink, Uniswap, and Polkadot also shed massive value from their market caps. In that year, Ethereum retested 2018’s high between $800 – $1000. Some of the contributing factors to the 2022 plunge include Terra Luna’s collapse and the FTX contagion.

2023 heading into 2024

2023 is an above-average year for Ethereum. The markets are recovering from billions of losses encountered in the previous year. However, the majority of the cryptocurrencies have managed to recover nearly half their all-time highs. Including Ethereum which is trading around the $1,900 support level. The cryptocurrency market has posted significant improvements compared to previous years. Despite tight regulations slowing down progress, strides such as a crypto-ETF are valuable milestones. We will talk about this in detail in a later section.

Fundamental Analysis

We derived our fundamental analysis for Ethereum on the basis of four attributes:

- Utility and use case

- Network activity

- Team and developer community

- Competition

- Roadmap and visions

Fundamental analysis involves the process of determining whether an asset is undervalued or underrated. Same as you’d say a certain actor is underrated and go ahead to give reasons. Well, let us look at three of these attributes.

Utility

Ethereum is a digital smart contracts blockchain platform. ETHER, the platform’s native currency powers all transactions that take place on the blockchain. Developers can also build and deploy decentralized apps and layer 2 blockchains on top of Ethereum. For example, Polygon is a layer 2 blockchain protocol that helps extend Ethereum’s scalability scope. According to its official website, the technology has applications beyond digital cash.

“Ethereum is home to global payments, digital money and applications. The community has already built a thriving digital economy, disruptive methods for earning online, and so much more. It’s open to everyone, wherever you are in the world – with only an internet connection.’’

Network activity

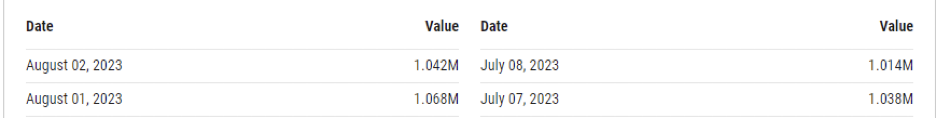

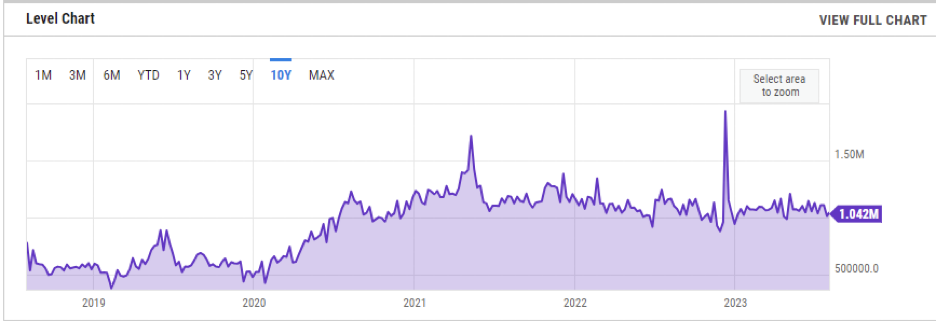

Ethereum records an average of 1 million transactions per day. For example, the first two days of August 2023 recorded 1.038 million and 1.014 million transactions, respectively. See the image below and the 10-year chart for Ethereum’s daily transactions:

Ethereum transactions per day denote the overal number of transactions happening on the Ethereum Network on any given day. This number increases as interest and optimism around Ether grows.

Roadmap and vision

One of the biggest goals for Ethereum is to become more scalability and support over 1000 transactions per second. In addition, the blockchain intends to achieve high throughput without increasing its carbon footprint. The blockchain has already made significant progress in making this possible, especially through the MERGE.

The merge took place on September 15 when Ethereum’s execution layer merged with the blockchain’s proof-of-stake (POS) consensus, beacon chain. As a result, they would no longer be a need for high energy to confirm transactions.

Market and Industry Trends

Liquidity Staking Tokens (LST)

There is a heightening fear of Liquidity Staking Tokens replacing Ethereum’s native currency, Ether. Presently, LSTs have a market value of $17 billion and have already recorded significant strides as the DEFI standard. A cryptocurrency like Polygon is already position #12 by market rank yet it’s a protocol built on top of Ethereum. A possibility exists in the near future for toppling ETH from its throne and ushering in an era of Liquidity Staking Tokens.

Ethereum ETFs

Ethereum ETFs are a new way of providing more exposure to investors who want to invest in the second-largest cryptocurrencies. After SEC approved Blackrock’s ETF filing, institutions like Bitwise, Ether Strategy, Roundhill, ProShares Short Ether Strategy, GrayScale and VanEck followed suit with their filings for an Ethereum ETF. Check this space for any updates concerning Ethereum ETFs, as this is a 2023 Q3 developing story. All the mentioned filings have not yet received a response from SEC.

Upcoming Events and News

Ethereum holds major events across the world every month. The majority of the people who attend these events are looking for the latest updates from industry leaders, building their network in the crypto industry, staying ahead of market trends, developing new skills and gaining insights about new employment opportunities in the industry. Upcoming events over the next few months include:

- Eth Munich

- Eth Toronto

- Eth Korea

- Eth Accra

- Ethereum Singapore

Here are some upcoming meetups as well from the Ethereum official website:

These events and community meetups are vital for building more community engagement, bringing developers together and connecting industry leaders, investors and users. The ripple (Not XRP) effect is an overall positive sentiment around Ethereum.

Expert Opinions and Ethereum Price Predictions

In evaluating the price predictions for Ethereum, we checked over our friends at Digital Coin Net, Wallet Investor and GOV.com to compare their forecasts. Note the analysts behind these predictions implemented a combination of technical indicators, evaluation of crypto market trends, various cryptocurrency predictions, expert opinions, fundamental analysis, market sentiment, complex algorithms and data analysis tools to evaluate Ethereum’s historical price trends and provide the following ETH price forecast.

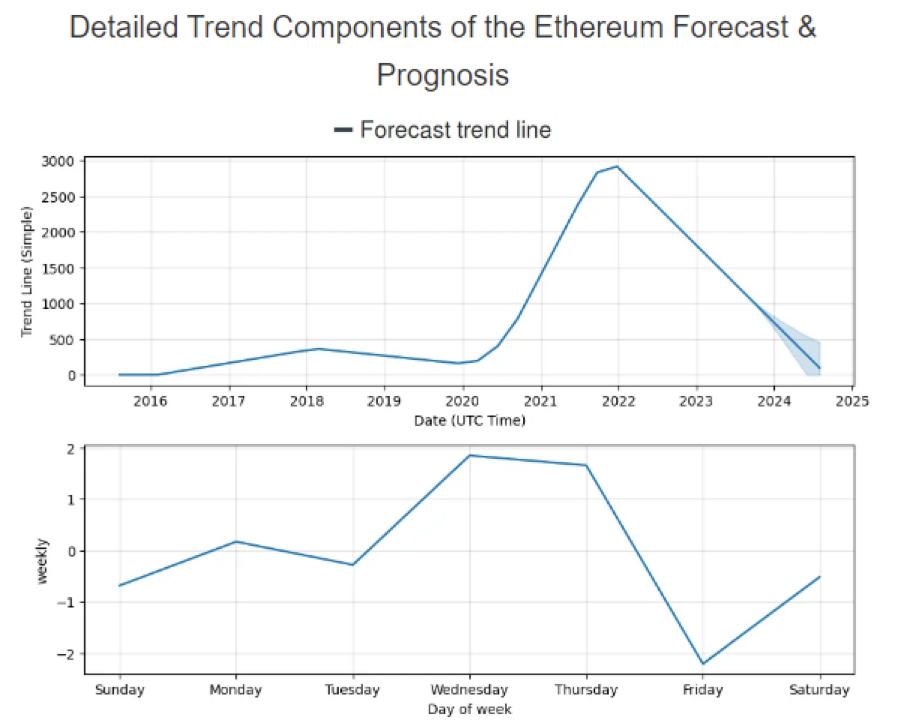

1. Wallet Investor

Wallet Investor had a rather bullish target for Ethereum in the short term. However, for the long-term forecast, the price analysis service recorded a rather bearish prediction. According to Wallet Investor, ETH will drop below $1000 by 2025.

Below is Wallet Investor’s forecast line:

2. DigitalCoinNet

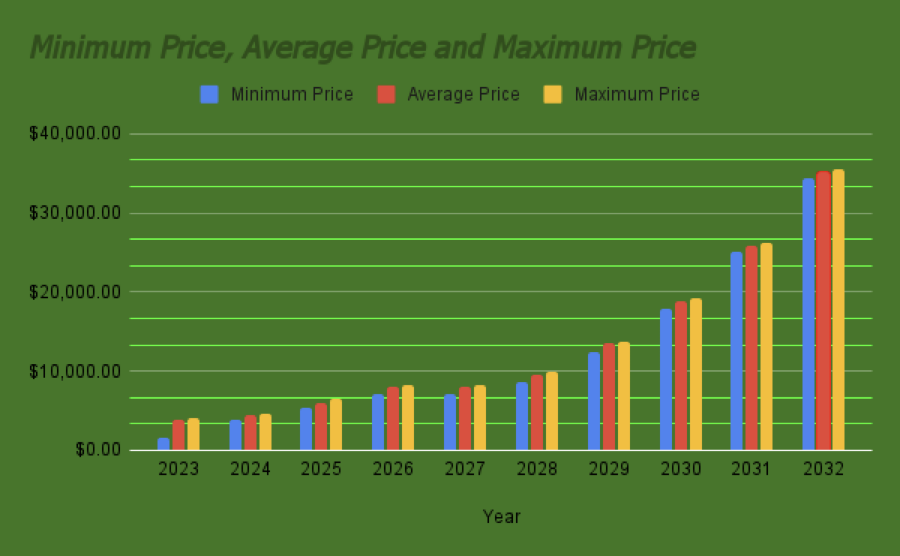

We analyzed 2024 -2032 Ethereum prediction data from Digital Coin Net and visualized it through the graphical charts shown below:

As you can see, Digital Coin Net holds a bullish short-term price forecast and long-term price forecast for Ethereum. By 2026, long-term price projection analysts believe the price will test the $5,000 mark.

3. Gov Capital

According to Gov Capital’s intelligent prediction algorithms, Ethereum will surge by 122% and hit $4176 in 2026. An evaluation on the prediction site indicates an investment of $100 today would yield $222 in August, next year. With minimal crypto market risks.

Conclusion: Ethereum forecast crypto market analysis

After crunching data bites and consulting within our crypto prediction circles, we’ve concluded Ethereum is getting less attention. It’s not like Vitallik was out for attention or something, but our evaluation of his invention showed a high chance of stealing the show. You are wondering from who? Bitcoin. Time to roll out the crypto-red carpet!

As we end, it is important you find the knack to determine who missed or did not miss the mark in their price prediction for Ethereum.

Wallet Investor shows a bullish short-term outlook but predicts a bearish long-term trend with ETHEREUM valuation potentially dropping below $1000 by 2025, DigitalCoinNet holds a more optimistic view, forecasting Ethereum to reach $5,000 by 2026. Meanwhile, Gov Capital’s intelligent prediction algorithms suggest a surge to $4176 by 2026.

Diving into the world of investments is like salsa dancing with a kangaroo__ – exciting but potentially wild! This is not to say you can dip your toes. Take these steps before investing in Ethereum. (Or any other crypto). First, count what you have and then what you can lose without throwing tantrums!_ Going around telling everyone crypto is a scam. I know a guy who bought Terra (LUNA) at $10 and HODLED. When the price reached $70, he went to his bedroom and sent another 80% of his life savings. LUNA plunged below $1, and so was his life savings. We all know what happened! First, they came for his mortgage, then they took his car and then they came for his house. I didn’t speak because I wasn’t a careless Bitcoiner. 🚀

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.