Welcome to HODL.FM. A publication in Web3 that hates spam and respects actionable insights.

In this daily crypto news article, Exodus Movement happens to be our player of the match after receiving approval from the SEC to list a tokenized common stock on the stock exchange.

Software development enterprise Exodus Movement announced to have received a greenlight from the U.S. Securities and Exchange Commission to list its stock on the New York Stock Exchange (NYSE).

Related: Awakening the Bitcoin Time Capsules: Dormant Wallets Return

Tokenization on the Algorand Blockchain

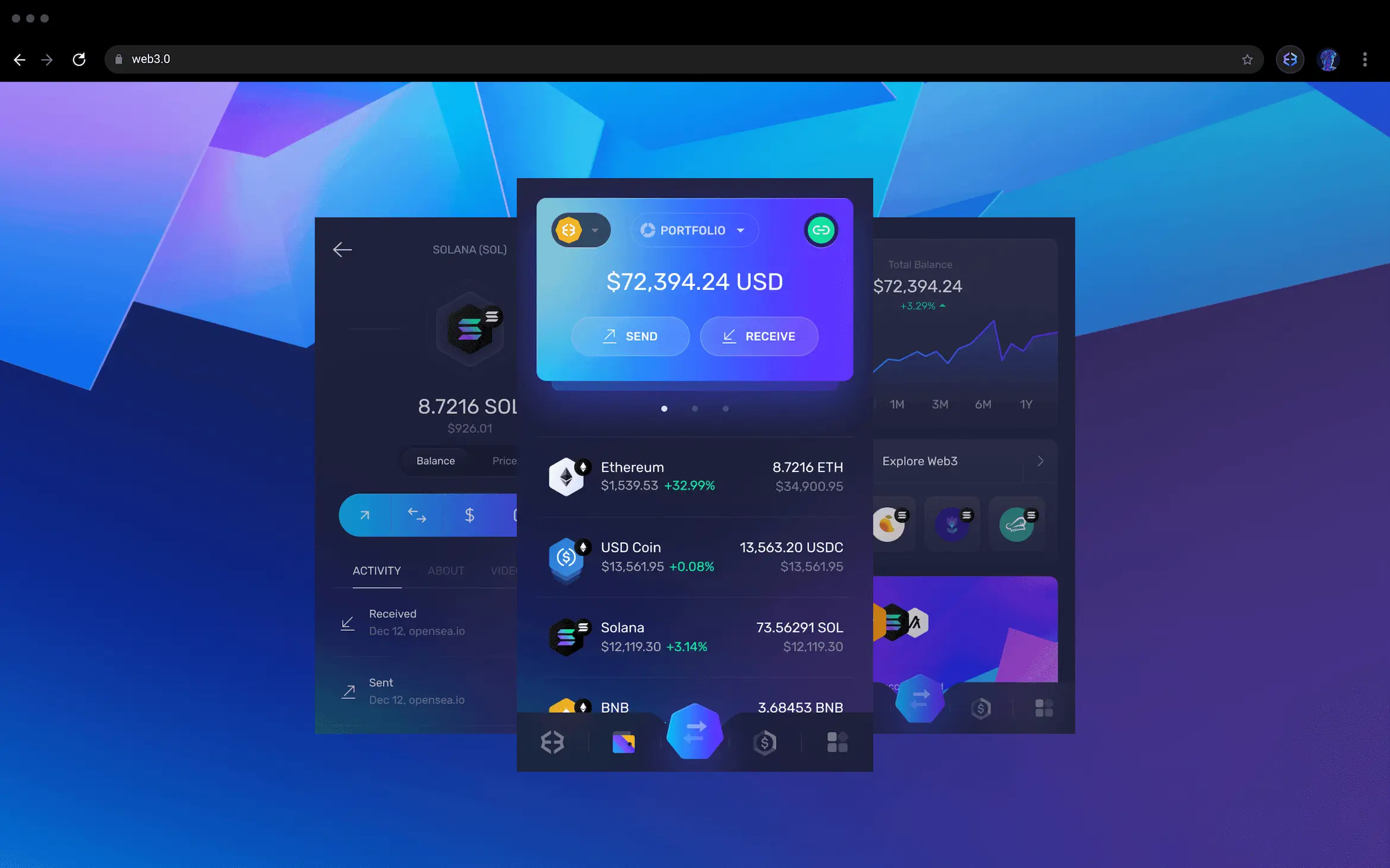

The software company that also operates the Exodus Wallet said the best thing about its common stock is that it is tokenized on the Algorand blockchain, which makes it not only unique but also the only U.S. company to have tokenized common stock listed on the NYSE.

Approval from the SEC means Exodus Movement will provide its Class A common stock shares to investors as per compliance requirements set out by the Securities Act, and therefore allow the company to raise funds from the public by following regulations.

What’s really cool about this is that our common stock is tokenized on the Algorand (ALGO) blockchain, and so we’re the only company in the United States that has our common stock tokenized on the blockchain. That’s true today, and that will be true on Thursday as well.

Exodus CEO and co-founder JP Richardson

The journey of Exodus in the publicly traded company arena started in 2021 after listing its stock on tZero. Meanwhile, the company would kick off the sale of its common stock on 8th April of the same year, and raise $60 million by 13th April. The record sale which took place within 5 days to emerge successful was lauded as the largest compliant public offering for a crypto-related venture. According to the company’s roadmap, tokenizing the $60 million worth of shares on the blockchain will take upto 9 months.

More: Top Blockchain Projects of 2024

How to Find the EXOD Common Stock

As per its recent announcement, the EXOD stock will be available on OTCQX until 8th May 2024 and start trading on NYSE American on 9th May 2024. JP Richardson, the CEO and co-founder of Exodus said tokenizing the stock would simplify and enhance investment. According to the executive, the tokenized EXOD stock is as simple as trading a cryptocurrency which underscores its phenomenal impact when it comes to user experience. Furthermore, he reiterated that the stock would open the door for corporate governance through direct voting via the blockchain.

This announcement comes at the height of an intense crackdown against cryptocurrencies entities by the United States Securities and Exchanges Commission. Nonetheless, Richardson emphasized that they have a positive future outlook about publicly tradeable crypto assets. He said its a new era of tokenizing traditional stocks on the blockchain.

Final Thoughts

The news comes ahead of traditional payments platform Revolut announced Revolut X on 7th May, a trading platform that aims to rival cryptocurrency exchanges by providing a convenient and reliable portal for users who prefer intuitive UX, minimal fees and convenience.

Major developments like the ones mentioned above represent a renewed sense of focus on cryptocurrencies among traditional finance players at the peak of increasing retail investment in the space, thanks to Bitcoin’s exchange traded products that kicked off this year’s bull market.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.