Patience, they say, is a virtue. And in the exhilarating realm of cryptocurrencies, where fortunes can soar and plummet with the blink of an eye, patience becomes more than just a virtue—it becomes a superpower.

In the wild and unpredictable world of cryptocurrencies this peculiar term has emerged that holds great significance for investors and enthusiasts alike. “HODL,” a misspelled version of “hold,” has become a rallying cry for those brave enough to weather the storm of market volatility. In this article, we will delve into the art of Hodling, exploring its meaning, benefits, and strategies that can help you earn and save in the realm of digital currencies.

What does HODL mean in the crypto world?

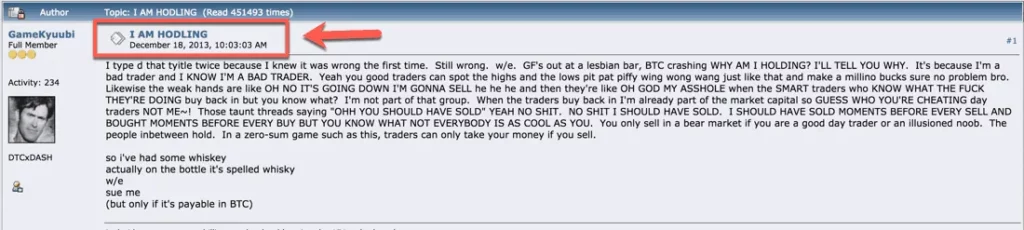

HODL, in the crypto community, stands for “hold on for dear life.” It originated from a humorous post on the Bitcointalk forum back in 2013 when a user, GameKyuubi, misspelled “hold” during a period of tumultuous price movements. Apparently, he was very excited due to the crazy level of volatility back then. Little did they know that their typo would birth a viral meme and a strategy that has stood the test of time.

Here is the original post, it is still live!

The legendary typo that started HODL

Characteristics of a True Hodler

This extraordinary individual has mastered the art of patience and understands that true wealth is built gradually, brick by digital brick. With a gleam of determination in their eyes, the HODLer grasps the profound significance of the elusive 21 million bitcoin limit, recognizing it as a sacred truth.

They remain unfazed by the whims of fleeting altcoins. The HODLer has their sights set on a grander mission – to paint the future in shades of vibrant green, turning it into a utopia of untold possibilities. With a steady hand and unwavering resolve, the HODLer is the torchbearer of the hodling revolution, illuminating a path towards a brighter and more prosperous tomorrow.

Long story short, a Hodler holds onto his/her tokens, no matter what.

What Is Hodling Strategy?

Hodling, at its core, involves purchasing a cryptocurrency and holding onto it for an extended period, regardless of market fluctuations. It is a strategy that encourages investors to resist the urge to sell during short-term volatility and wait for the value of their chosen digital asset to appreciate over time. Those who embody the hodling spirit are often referred to as having “diamond hands.”

Hodling as a Safe Strategy

In a world where financial institutions reign supreme, the crypto market operates in a decentralized manner, free from the oversight of a central authority. While this decentralization offers numerous advantages, it also contributes to the inherent volatility of cryptocurrencies. So, is hodling a safe strategy?

Though not without risks, hodling has proven to be a fruitful endeavor for many. By identifying cryptocurrencies with strong potential and supportive communities, investors can wait patiently for the value to soar before deciding whether to secure their profits or continue hodling. Hodling is particularly beneficial for beginners, as it eliminates the need for precise market timing.

Basically, by hodling, you are significantly lowering your chances of making silly mistakes, like going full FOMO, which we will cover later. It is a no-action strategy, and no action means no panic-related mistakes. Makes sense, right?

How to Hodl Crypto

To successfully hodl crypto, one must adhere to a few essential principles:

- Be prepared for volatility: Do we really need to say this? Cryptocurrency markets are notorious for their wild price swings. Embracing the rollercoaster ride and maintaining a long-term perspective is crucial for hodlers. If you expect anything to be possible, then nothing will surprise you!

- Long-term thinking: Hodling is not a get-rich-quick scheme. It requires patience and a belief in the potential of the chosen cryptocurrency to deliver substantial gains over an extended period. So, it is a good idea to invest in the tokens of promising projects with legit people behind them.

- Don’t day trade: Hodling and day trading are polar opposites. While day trading aims to profit from short-term market movements, hodling prioritizes long-term value appreciation. Remember, we are not Forex traders, we are not utilizing leverage when hodling, we are just HODLING.

- Stay involved in the crypto community: The best friend of a Hodler is always another Hodler. Remaining engaged with the crypto community through social media platforms, forums, and educational resources can provide valuable insights and help hodlers stay informed.

What to Do When Hodling Crypto Long Term For Profit

To ensure a profitable hodling experience, it’s crucial to consider the following tips that will help you navigate the volatile crypto landscape:

- Choose cryptocurrencies wisely: Easier said than done, isn’t it? Take the time to conduct thorough research before investing. Look for cryptocurrencies with solid projects, innovative technology, and active communities. A strong project with a dedicated community is more likely to withstand market fluctuations and have the potential for long-term growth. Remember, investing in cryptocurrencies is not a hasty sprint but a calculated marathon.

- Make use of a cold wallet: When it comes to securely storing your precious crypto assets, opt for a cold wallet. Unlike hot wallets that are connected to the internet, cold wallets keep your private keys offline, providing an extra layer of protection against potential hacks or security breaches. By using a cold wallet, you reduce the urge to constantly monitor your portfolio’s performance, allowing you to resist impulsive selling decisions during market downturns. Also, remember the golden rule: “Not your keys, not your coins!” Actually, print this and hang it over your bed. I have it.

- Don’t buy when prices are high and don’t sell when prices are low: It may sound like common sense, but emotions can easily cloud judgment when it comes to buying and selling crypto. Avoid the temptation to jump on the bandwagon during price rallies when FOMO (Fear of Missing Out) kicks in. Buying at the peak of a rally can often lead to disappointment if the price subsequently drops. Similarly, during market dips, it’s important to resist panic-selling and succumbing to the grip of FUD (Fear, Uncertainty, and Doubt). Instead, consider adopting strategies like dollar-cost averaging, where you invest a fixed amount at regular intervals, or taking advantage of bear markets to accumulate crypto at discounted prices. Remember, hodling is about playing the long game and resisting the lure of short-term price fluctuations.

Crypto Slang Terms

Just like the term Hodl, the vibrant crypto community has several other funny but important slang terms. Let’s explore a few of them:

- FOMO (Fear of Missing Out): The anxiety that arises when individuals fear they will miss out on potential gains and make impulsive investment decisions.

- FUD (Fear, Uncertainty, and Doubt): The spread of negative news or rumors with the intention of causing panic and driving down the price of a particular cryptocurrency.

- Diamond Hands: Refers to hodlers who possess unwavering conviction and refuse to sell their crypto even during challenging market conditions.

- Paper Hands: The opposite of diamond hands, paper hands refer to weak-handed investors who easily succumb to panic selling and are quick to exit their positions during market downturns.

- Mooning: When a cryptocurrency’s price experiences a significant and rapid upward movement, often resulting in substantial profits for hodlers. It’s a term used to describe the moment when a cryptocurrency reaches its all-time high.

- Apes: This term originated from the popular phrase “ape together strong” and refers to a community of crypto enthusiasts who band together to support a specific project or token, demonstrating solidarity and collective action.

- BTFD (Buy The F***ing Dip): A mantra often repeated in the crypto community, encouraging investors to seize the opportunity and buy when the prices of cryptocurrencies dip, with the expectation of future price rebounds.

- YOLO (You Only Live Once): This term, borrowed from popular culture, reflects a high-risk, high-reward mentality often associated with speculative investments in cryptocurrencies.

- Bag Holder: An investor who is left holding a significant amount of a particular cryptocurrency that has experienced a substantial decline in value, often resulting in financial losses.

- Rug Pull: A deceptive maneuver executed by the creators or influencers of a cryptocurrency project, where they suddenly exit the project, causing the value of the token to plummet and leaving investors with worthless holdings.

- Shill: To promote or endorse a particular cryptocurrency or project, often done by individuals who have a vested interest in seeing its price rise. Watch out for shillers making false promises though, it is more common than you think.

What is the HODL strategy?

The hodl strategy involves buying and holding cryptocurrencies for an extended period, disregarding short-term market fluctuations, with the expectation of long-term price appreciation.

Is HODL the best strategy?

The effectiveness of the hodl strategy depends on individual investment goals and risk tolerance. However, hodling is often recommended for beginners due to the challenges associated with timing the market. Die-hard crypto maniacs can also hodl though, it is not exclusive to beginners.

What is a HODL portfolio?

A hodl portfolio consists of cryptocurrencies that investors hold for an extended period, aiming to benefit from long-term price appreciation rather than short-term trading.

Is crypto holding profitable?

While holding cryptocurrencies can be profitable, it is essential to choose assets wisely and remain vigilant in the face of market volatility.

Conclusion

Hodling is (almost) an art form that requires patience, research, and a steadfast commitment to weather the storms of the crypto market. By embracing the principles of hodling and following the strategies outlined above, investors can position themselves for long-term success in the ever-evolving world of cryptocurrencies. So, hodl on tight, dear hodlers. May your diamond hands remain unwavering, your moonshots soar to astronomical heights, and your hodling prowess shine brighter!