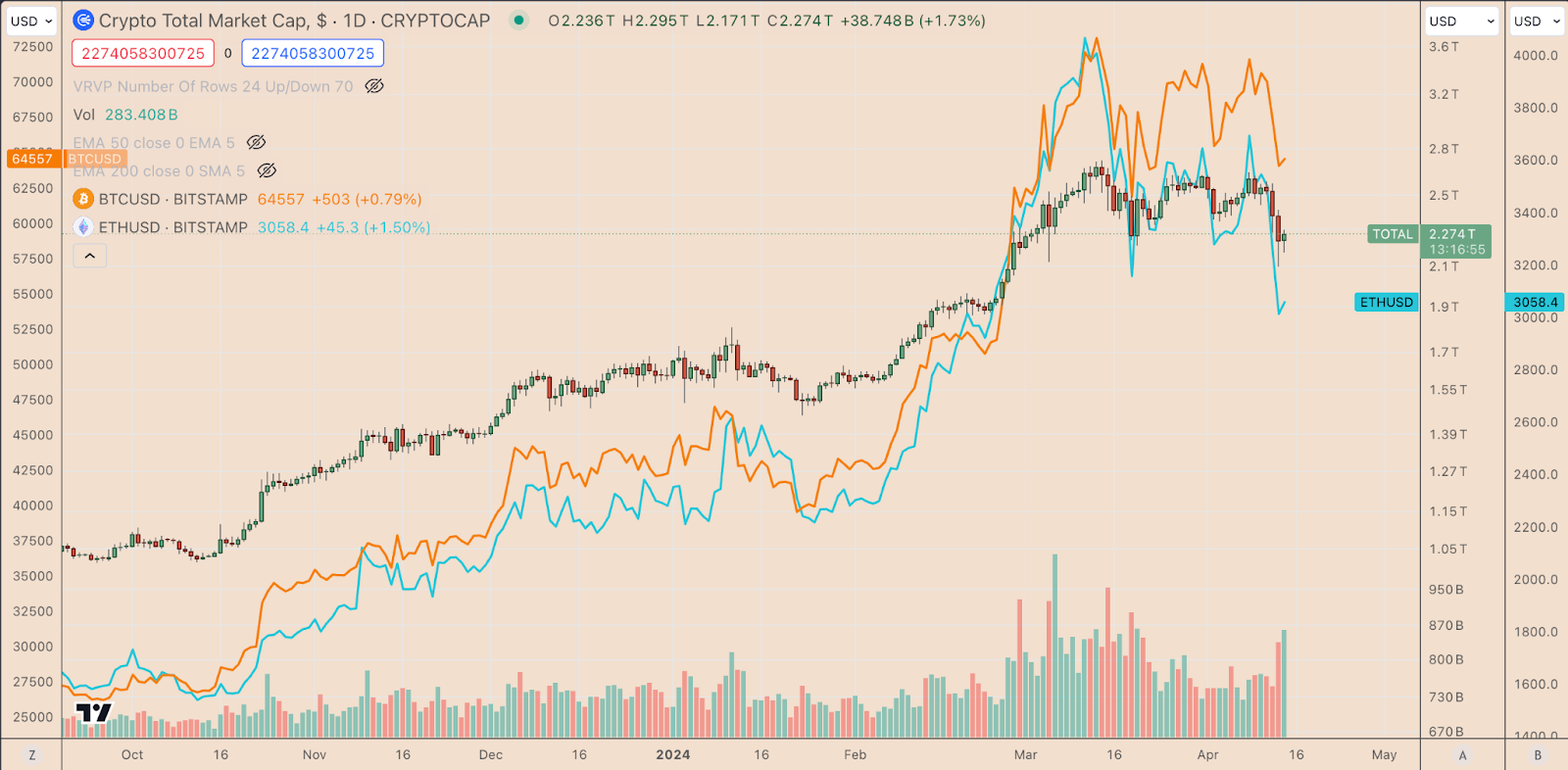

Bitcoin (BTC) fell below $65,000 on April 12th, a sharp drop from its peak of $71,000 earlier that same day, as a selling frenzy swept through the crypto and stock markets, causing some altcoins to plummet more than 15% in mere minutes.

Ethereum, the second-largest cryptocurrency by market capitalization, fell by 12% to $3,100, then managed to claw back some losses, closing down 8% at $3,244.

Related: Bitcoin ETF Boom Continues Ahead of Halving Anniversary

This downturn reflected a broader sell-off across all asset classes amid increased global economic uncertainty and geopolitical risks.

Bitcoin led the decline on April 14th, dropping by 7.5% over the last 24 hours to around $62,160. Meanwhile, Ethereum, the runner-up, suffered a 10.6% slide, trading at about $2,900 over the same period.

Altcoins Fall

Meanwhile, BNB and Solana (SOL) took a nosedive of almost 14% before clawing back some losses. Both tokens were down around 12%, trading at $593 and $153 respectively.

Smaller cryptocurrencies faced an even sharper decline: tokens like Cardano (ADA), Avalanche (AVAX), and Bitcoin Cash (BCH) saw losses ranging from 15% to 20%.

Moreover, cryptocurrency markets experienced liquidations totaling around $2.5 billion since April 12th, including approximately $964 million in liquidations in just the past 24 hours. Notably, long liquidations far surpassed short liquidations.

The prevalence of long liquidations suggests that the crypto market had been overestimated from the bullish side, fueled primarily by growing euphoria around Bitcoin ETF inflows and the 2024 Bitcoin halving.

Traders who borrowed capital to open larger positions in anticipation of market growth fell into a trap when the market suddenly nosedived due to the Iran-Israel conflict, leading to mass liquidations of long positions. This compounded the crypto market slump.

Why Did the Crypto Market Dive?

The recent 24-hour crypto market plunge is part of a broader correction that began on April 12th. This period coincided with heightened tensions between Iran and Israel following Iran’s launch of drones and missiles in response to an Israeli strike in Syria.

Risk-taking traders exercised extreme caution in the hours before and after the attack, pulling capital out of riskier markets like cryptocurrency and seeking refuge in safer havens such as the US dollar. Consequently, the US dollar, which measures the dollar strength against a basket of major foreign currencies, supported by 0.79% since April 12th.

Traditional stock markets also took a hit as investors feared escalating Middle Eastern conflicts after warnings from US officials about potential aggressive actions by Iran against Israel.

More Info:

- Ethereum’s Delayed Bull Run Largely Depends on ETF Approval

- What Does Spot Bitcoin ETF Mean for Investors?

This uncertainty pushed investors towards safer assets, leading to a rise in treasury bonds and the US dollar. Meanwhile, the S&P 500 and Nasdaq 100 indices fell by roughly 1.7%. Gold prices briefly soared to over $2,400, and oil prices rose by 1%.

As global markets navigate economic indicators and geopolitical tensions, the crypto sector remains particularly sensitive to such events, gearing up for possible further fluctuations as tax season approaches and unfolds.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.