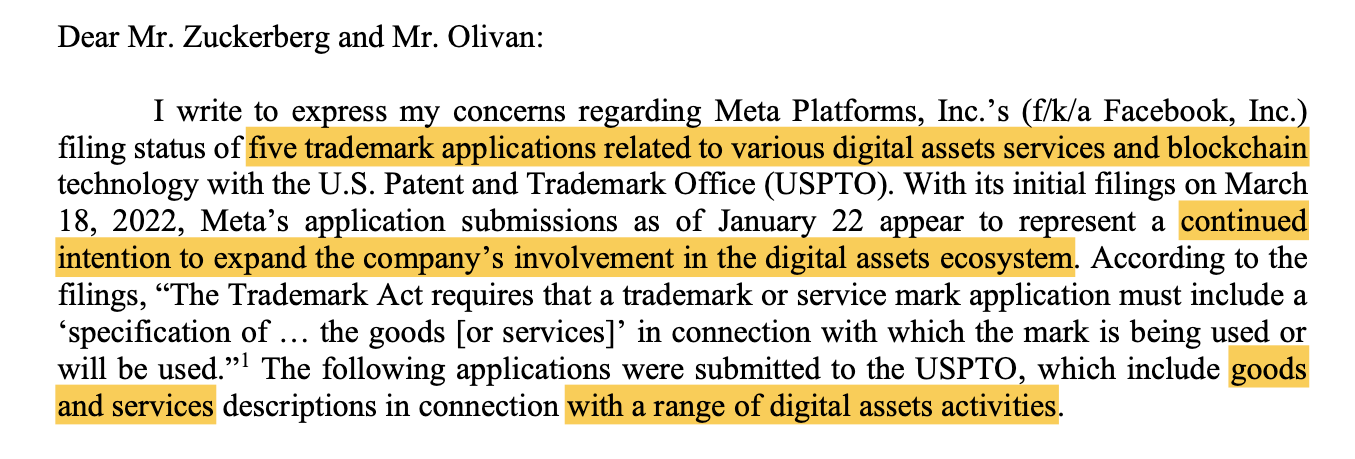

The United States House Financial Services Committee is pushing Meta to reveal any blockchain or cryptocurrency plans they might have. There are still five crypto and blockchain-related trademark fillings since 2022.

Trademark fillings are like the passes for various services in the world of crypto trading and “blockchain assets” – covering everything from exchanges, payments, and transfers to wallets and all the hardware and software that comes with them.

Maxine Waters, a high-ranking committee member, pointed out that the filings show Meta is working on digital assets. Despite, the company telling the Democratic Financial Services Committee on Oct. 12, 2023, “that Meta does not have ongoing digital asset work.”

The Official Letter to Meta

In a letter dated January 22, Maxine Waters wrote to Meta’s founder and CEO, Mark Zuckerberg, and the Chief Operating Officer, Javier Olivan. She said that those trademark applications from March 18, 2022, “appear to represent an ongoing intent to expand the company’s participation in the digital asset ecosystem.”

A US Congresswoman wants to know about Meta’s Mark Zuckerberg plans and his five trademark applications filed with the USPTO.

She also asked about Meta’s stablecoin research, asking if they’re planning a partnership with stablecoin projects. And, of course, Waters wants to know whether the company plans to implement distributed ledger technology (DLT), and how that tech will work with crypto functions in its metaverse.

Meta’s Previous Cryptocurrency Failures

Let’s take a walk through Meta’s memory lane with cryptocurrency misadventures. Back in 2019, they developed a plan to birth the digital wallet Novi (formerly Calibra) by 2020. That plan fell through without the new rescheduled release date.

And then there’s the tragic history of Diem (formerly Libra), Meta’s dream of a stablecoin. In mid-2019, they had to drop the Diem due to legislative pressure. Fast-forward to January 2022, and Meta ended up unloading Diem for $200 million to the now-defunct Silvergate Bank. Hope this bad investment didn’t start a series of misfortunes for the bank.

The Meta Deadline Dilemma

In addition to the official letter from US lawmakers, Meta received a Notice of Allowance (NOA) for each application – confirming that their trademark filings align with the registration requirements. Now, the company has six months to decide whether it will use the trademark sign, or request a six-month extension to submit its application.

The first NOA message was sent into their inbox on August 15, 2023, and now they’ve got until February 15 to craft a reply. NOA’s last message was sent on January 16th, giving Meta an extended window to respond until July 16.

Maxine Waters also wants to know Meta’s plan for responding to the NOAs. Is Meta planning to pursue any Web3, cryptocurrency, or digital wallet projects, or maybe even launch a crypto payments platform? As of now, there have been no official comments from Meta regarding the responses.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.