Pantera Capital, one of the biggest players in digital asset management, is aiming to reel in over $1 billion for a new fund that will offer investors access to the full spectrum of blockchain assets. Pantera Fund V will be the company’s second all-purpose fund, dabbling in seed capital, early-stage tokens, liquid tokens, and other assets.

Related: Fortune Favors the Gamer: Andreessen Horowitz’s $30 Million for Gaming Startups

Last year, fund managers faced a sticky situation trying to attract new capital. If successful, this fund would be the largest raised since the sector collapsed amidst a series of scandals and bankruptcies in 2022.

For qualified investors, the fund’s minimum investment size clocks in at $1 million, with the first closing scheduled for April 1, 2025. According to documents, limited liability partners will need to pay at least $25 million.

Pantera’s fund size is expected to match its last one, which pulled in about $1.25 billion two years back, as per someone in the know who was not authorized to speak publicly. Leading the charge at Pantera is Dan Morehead, a seasoned Bitcoin investor who was an executive at Julian Robertson’s Tiger Management earlier in his career.

Pantera Capital Rounds Up Funds for a SOL Token Buyout

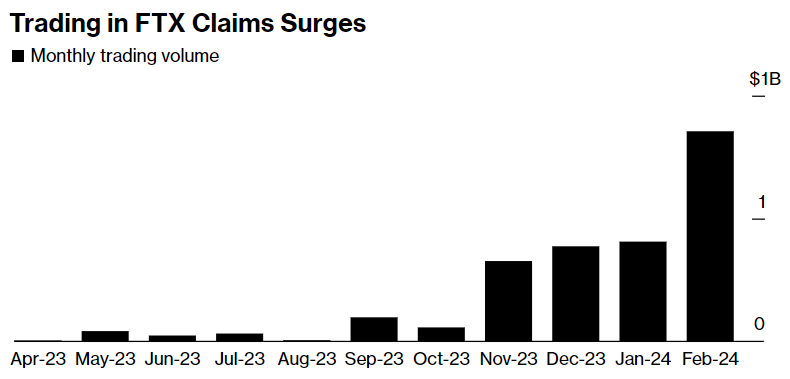

Earlier this year, Pantera raised some financing to purchase SOL tokens at a steep discount from the bankrupt crypto exchange FTX.

Pantera is on the prowl for funds for the Pantera Solana Fund, which has the “opportunity” to snap up SOL tokens worth up to $250 million from FTX’s stash, according to marketing materials from February, sent out to potential investors. In exchange for the option to purchase SOL at 39% below the average 30-day price or at $59.95 a pop, investors must agree to a transition period lasting up to four years.

The compromise for investors, each of whom must put up a minimum of $25 million to play, is that SOL tokens will initially be locked up and doled out gradually over four years. As per the materials, Pantera plans to charge a management fee of 0.75% along with a 10% performance cut.

According to a source familiar with the sale, Pantera Capital was among the winners in yet another batch of SOL tokens sold at a discount, auctioned off by administrators overseeing the bankruptcy of the former crypto exchange FTX. Per an anonymous source, around 2,000 SOL tokens were offloaded this week, as sale information wasn’t disclosed.

Earlier this month, FTX Estate offloaded roughly two-thirds of its Solana token reserves for $2.6 billion in a mega-discount deal, with players like Pantera and Galaxy Digital jumping in on the action. The 41 million SOL tokens being sold by FTX Estate are locked up following a pre-arranged transition period, meaning they’re off-limits for trading on the market. They’ll gradually hit the market over four years.

More Info:

- Changing the Future of AI and Social Interaction – The Big Interview With Reface Co-CEO Anton Volovyk

- Solana’s Struggles: Demand Surges and Network Overload

- Solana Telegram Trading Bot Quits the Game after Exploit Drained $523K

According to two people familiar with the sale’s progression, the tokens were sold at a higher price than the roughly $60 price fetched at the previous auction. They anticipate more auctions to come. Moves like Pantera’s offer allow FTX liquidators led by John J. Ray III to unload SOL and free up funds for creditors without putting immediate pressure on the token’s price.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.