Well, here we are, at the end of yet another crypto year. Traditionally, it’s time for a recap, but we’re not backing down from our traditions and releasing a New Year’s Digest! This time around, no boring news with charts and fancy terms. Just a couple of stories to entertain you, maybe get a little angry, and perhaps a touch of envy. Let’s dive in and stir up some fun!

Related:

The SEC Collects Fines From Cryptocurrency Companies

The crypto investment issuer, BarnBridge, and its founders agreed to cough up $1.7 million to settle accusations from the Securities and Exchange Commission (SEC) that they offered illegal crypto securities to U.S. investors.

While the SEC often goes after crypto companies for alleged safety rule-breaking, these actions stand out as the first targeting a crypto startup that structured itself as a “decentralized autonomous organization” or DAO. During this, the DAO held a public vote on how to respond.

The Ethereum-based crypto project is shutting down its structured crypto investment product named SMART Yield, which BarnBridge likened to “high-rated debt instruments.” Financial regulators mentioned that SMART Yield failed to register as an investment company despite collecting $509 million from crypto investors, including those from the USA.

When it came to BarnBridge, anyone holding its BOND token had a say in operations. Financial startups masquerading as DAOs don’t always register themselves as companies. Even less often do these organizations consider their products as securities that need SEC registration.

That might pose a problem if their goods are open to American investors, as was the case with BarnBridge. According to the SEC, BarnBridge didn’t take any steps to prevent American investors from buying its SMART Yield product.

According to securities lawyer Drew Hinkes’ tweets, the SEC’s allegations against SMART Yield raise questions about its broader stance on DeFi structures like pools, lending, rates, and stablecoin yields. But the outcome doesn’t dish out any radical answers.

The SEC accused Troy Murray and Tyler Ward, co-founders of BarnBridge, of breaking registration requirements and other violations. Both agreed to dish out individual civil fines of $125,000. BarnBridge DAO itself settled with the SEC by ponying up $1,457,000. In both instances, they played the classic “Neither Confirm Nor Deny” game with the allegations.

Soldout with the Worst Smartphone of the Year – Solana Saga

After months of mediocre sales, Solana Saga phones started disappearing from shelves last week. The smartphone snagged an award from a renowned YouTube blogger as the worst phone of the year. Why would people rush to buy a terrible phone, you ask? Well, here’s the scoop.

Buyers discovered that its crypto-perks were more valuable than the phone itself. It’s amusing that the smartphone comes with access to a giveaway of 30 million BONK, a Solana meme coin. Just a few months back, this stash of BONK was worth around $11, but last week, thanks to a staggering surge, it hit $865, surpassing the Saga phone’s $599 price tag.

Overall, Saga owners who claimed every giveaway or free perk tied to the phone received tokens totaling over $3,000. According to The Block, one of the devices sold for $5,000 on eBay. Not a bad profit margin, huh?

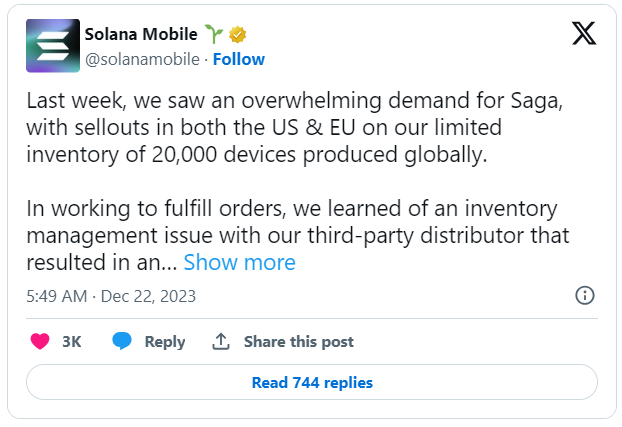

And now, according to Solana Labs, some smartphones sold last week simply never existed. Solana Labs claimed that the mishap was due to a third-party distributor, whose name remains a mystery. All affected customers have been notified of the issue, and in the coming days, they’ll get their money back, the company assured.

A few days later, the phone received the “Bust of the Year” award for 2023 smartphones from tech reviewer and YouTube sensation Marques “MKBHD” Brownlee. Solana Labs tried to turn a potential blunder into a cheeky viral moment. The company even asked Brownlee to bring the “Bust of the Year” award to their office, and the Solana 3.land project created an NFT collection titled “Saga: Bust of the Year,” inspired by this award.

We applaud those who can laugh at themselves, but we don’t applaud an irresponsible approach to business. Solana Saga is definitely getting crossed off our New Year wish list.

X-Payments may Simply Make having a Bank Account Unnecessary

Elon Musk said that X will most likely introduce payment features by mid-2024. Looks like Musk is rooting for traditional currency, claiming that money acts as a “database for resource allocation” and serves this purpose adequately until governments excessively meddle with the system.

We’re as surprised as you that it’s not about his favorite cryptocurrency, or at least Bitcoin. What’s more, Musk claimed, “I don’t spend a lot of time thinking about cryptocurrency – hardly any at all.” It’s a bit hard to believe after his fondness for meme coins and Tesla’s Bitcoin buy.

In recent months, X snagged licenses in several U.S. states, granting it the power to do peer-to-peer payments and other money transfers akin to PayPal. The company scored its latest license in Pennsylvania in mid-December, bumping up its total licenses to a lucky 13.

Musk announced that X plans to offer various financial features, including investing in securities and the ability to manage users’ “entire financial life.” Based on earlier estimates, X’s financial functions will be available by the end of 2024.

It’s quite a stretch to imagine a social network replacing a bank account, and how we will pay for purchases in stores using tweets. But when it comes to Elon Musk, you want to believe in all his, sometimes crazy, ventures. Who knows, maybe one day we’ll be swiping our Twitter feed for groceries.

Bitcoin Miners have Truly Become the Gold Diggers

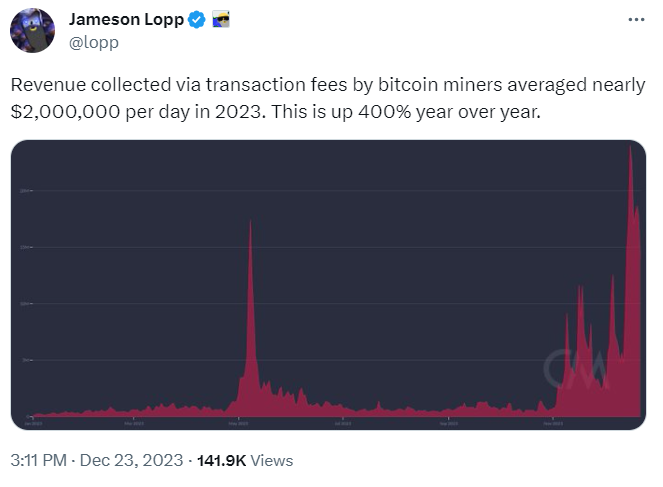

Apart from the fortunate Bitcoin holders who saw their profits soar towards the end of the year, the real jackpot winners turned out to be the miners. This month, the combined daily income of miners from block rewards and transaction fees hit an annual high of $64 million, nearly 400% more than last year.

Since the start of December, the daily mining income hasn’t dropped below $33.85 million, signaling a hefty profit for miners in the fourth quarter of 2023. On average, according to Coinmetrics, miners were raking in a cool $2 million a day in transaction fees alone for the year 2023.

The grand earned for the year – a whopping $10 billion in income, making it a total revenue of $57 billion amassed over the last 15 years. Talk about a digital treasure chest!

Hash rate and mining complexity

But don’t think they’re just scooping up Bitcoins with a shovel. In 2023, there was a sharp surge in Bitcoin network’s mining hash rate. According to Coin Metric’s report on the mining network’s status in the fourth quarter of 2023, the hash rate jumped from 250 Exahashes per second (EH/s) at the start of the year to 480 EH/s. Coinwarz data shows this hike in hash rate led to a 26% increase in Bitcoin mining difficulty over the last three months.

This means the current equipment is no longer as efficient, and miners receive fewer profits. It’s like trying to mine gold with a spoon. Plus, the upcoming event could double the trouble by halving the rewards from the current 6.25 down to 3.125.

However, the halving of Bitcoin could eventually put the brakes on the rapidly increasing mining difficulty. Plus, the surging hash rate shows an enhancement in network security, which might swiftly steer BTC prices toward bullish territory.

And now we’re rounding up the year with exciting news. But ahead of us lies an even more thrilling crypto future. While you’re enjoying the New Year’s feast, we’ll be keeping an eye on the hottest news for you and surely be back with another digest next year!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.