In the realm of DeFi, Solana is witnessing an unprecedented surge: this year, its decentralized exchanges (DEX) are recording colossal trading volumes and liquidity metrics.

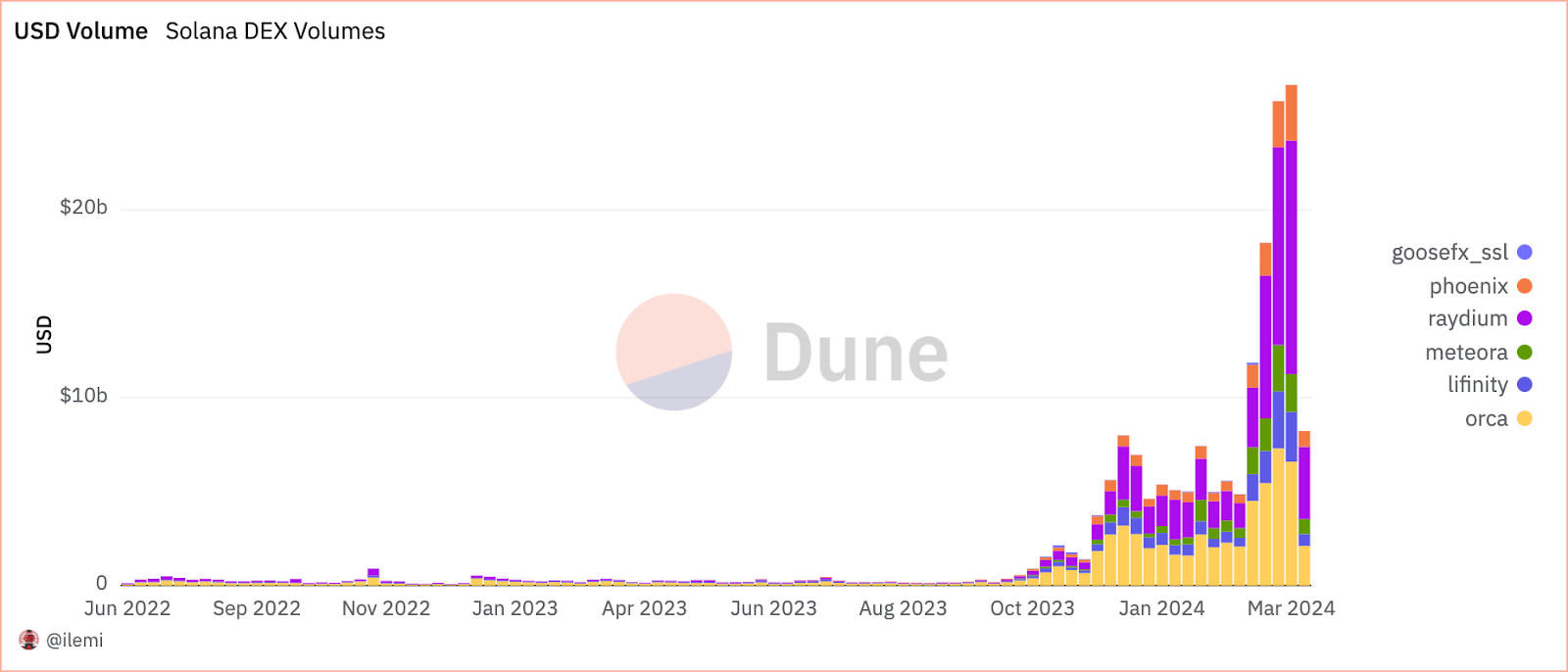

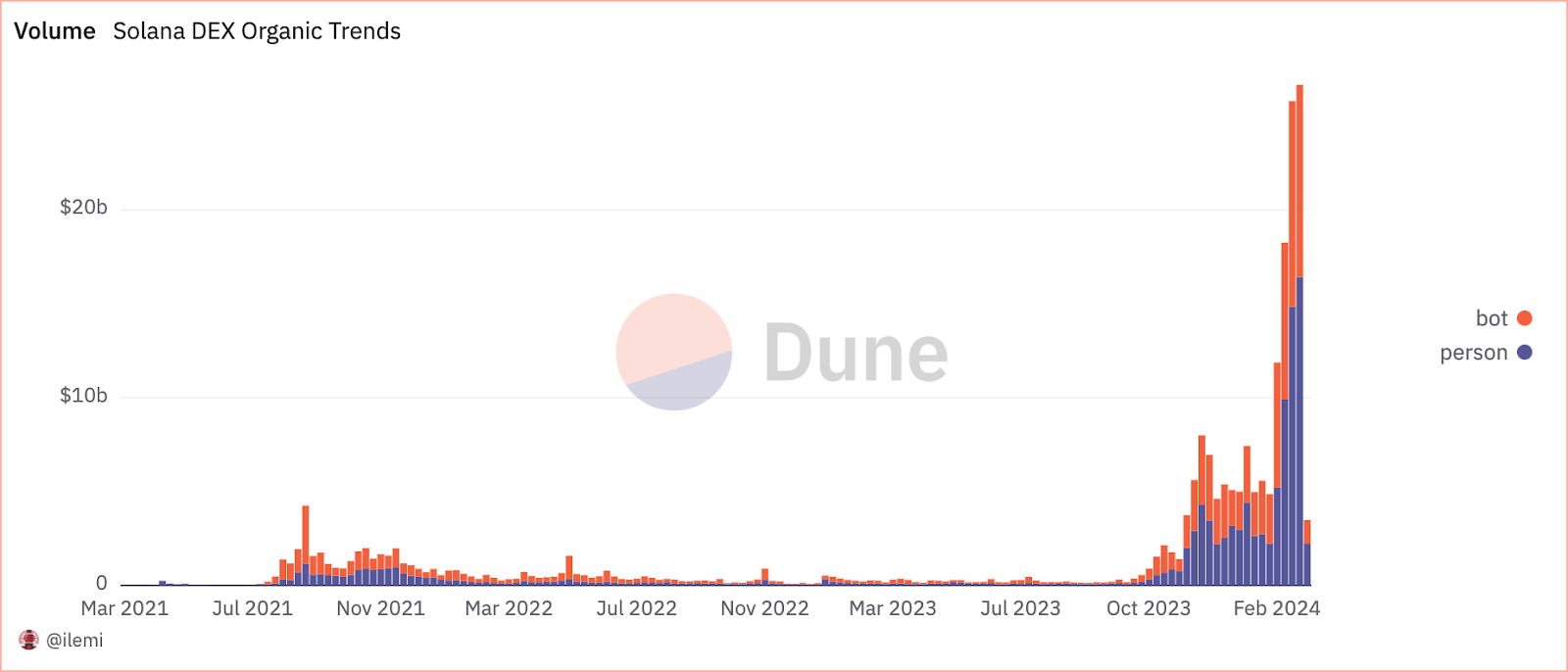

From the stellar surge in DEX volume, hitting a staggering $26.7 billion in March, to the sudden influx of traders dealing in organic produce, all signs point to a thriving ecosystem. This revelation underscores the intricate dynamics at play within the Solana DeFi ecosystem.

Related: Dog Days of Crypto: Solana Memecoin Turns $226K into $1.69M in 5 Days

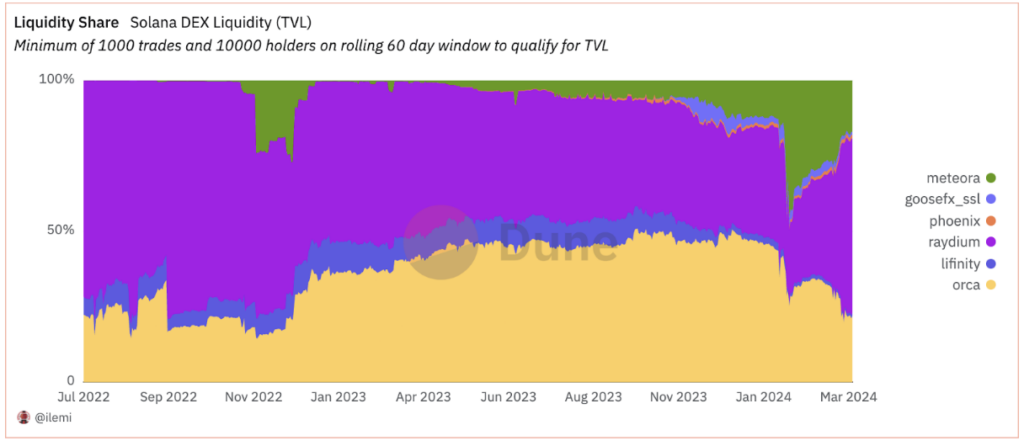

The Solana DEX ecosystem is undeniably massive. As per the data provided by Dune Analytics, the total count of traders within the network slightly surpasses the 5.8 million mark. Liquidity, measured by the total value locked in decentralized exchanges, hit $1.2 billion on March 25th.

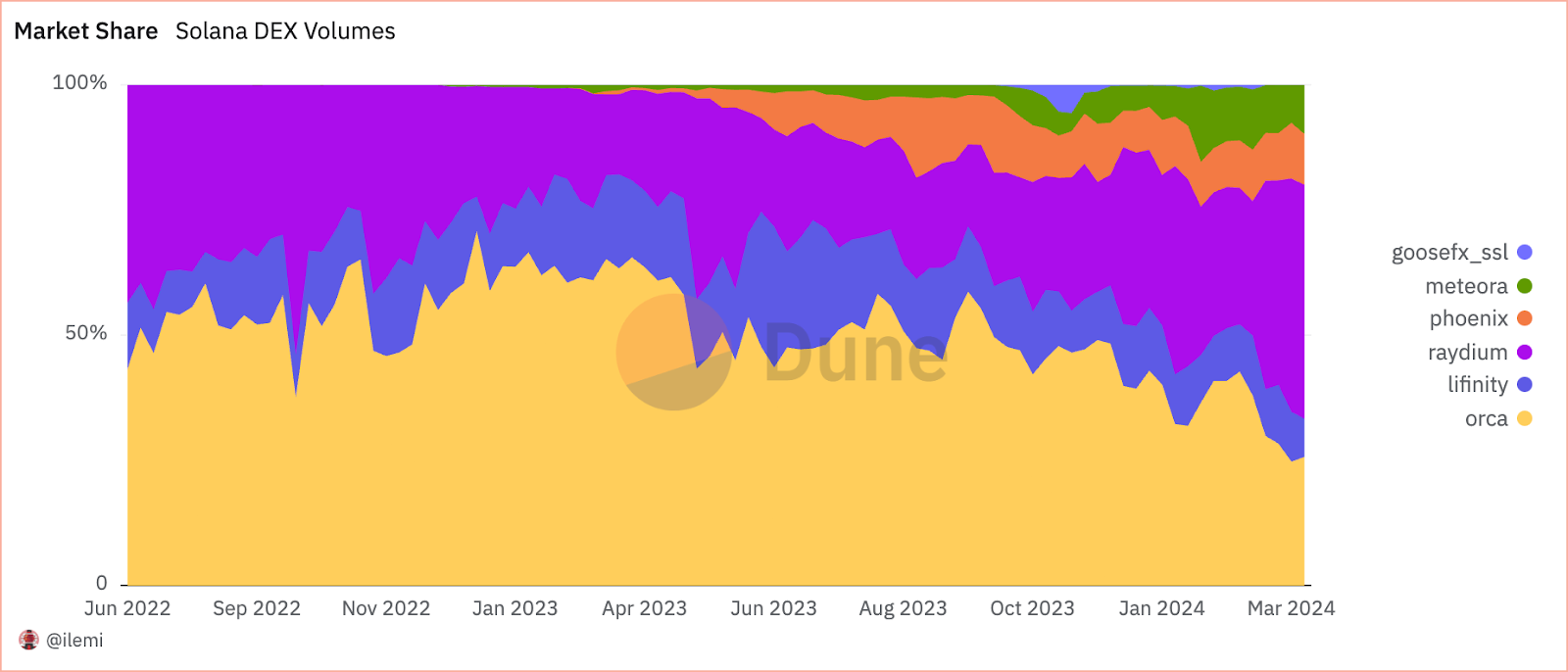

Solana’s having quite the year. There has been a notable increase in trading volume on decentralized exchanges within the network. A surge in DEX volume usually signals growing organic activity and interest in blockchain networks. Analyzing the distribution of these volumes and liquidity across Solana protocols helps us understand which parts of its ecosystem are thriving and where the bulk of the activity is happening.

Raydium is rocking the charts in volume and liquidity

Orca dominated the DEX for most of 2024, recording in daily trading volumes ranging from 2 to 4 billion dollars. However, its reign worsened towards the end of February when Raydium became the primary DEX for Solana traders, hitting a whopping $12.4 billion volume on March 18th. Despite a significant drop in volume by March 25th, Raydium still snagged the lion’s share, further solidifying its position as the DEX champ.

On March 25th, Raydium held 46.7% of the total DEX volume, with Orca trailing behind at 25.7%. Phoenix and Meteora lagged behind with 10.2% and 9.7% respectively.

When it comes to liquidity, Raydium keeps its crown. As of March 25th, Raydium was holding tokens worth $694.9 million, making up 58.6% of the total liquidity on Solana’s DEX. Orca’s liquidity clocked in at $205.7 million, or 21.1% of the shares, while Meteora claimed just over $201 million, or 17%.

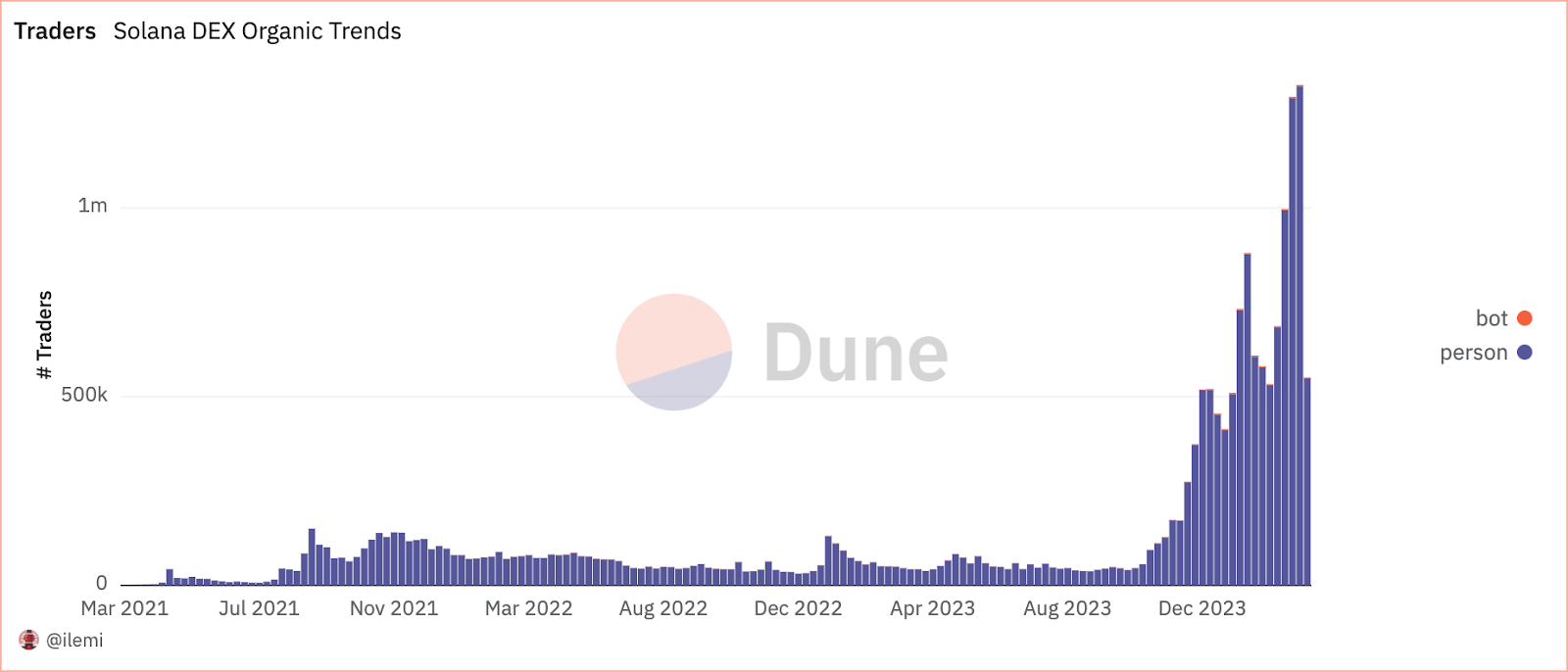

The Influx of Traders has Pumped Up

The number of organic traders in the network has surged from around 453,000 at the beginning of the year to a record-breaking 1 million on March 18th, with only about 3,000 “traders” identified as bots.

However, despite the relatively small number of bots, they’ve managed to amass a significant volume on Solana’s decentralized exchanges. As of March 18th, out of the $26.7 billion on DEX, bots accounted for $10.2 billion. Even though the volume from bots dropped by $1.2 billion on March 25th, it still made up a third of the total volume recorded that day. This has been a consistent trend throughout the year: bot volume consistently accounted for 30% to 40% of daily DEX volumes.

The surge in volume and liquidity on Solana’s DEX confirms that the network is on the rise. Information from Dune indicates a rise in interest and engagement in the DEX market, with Raydium emerging as the dominant DEX platform. The significant role of bots in boosting trading volume doesn’t diminish the evident organic growth of the network.

These developments could bode well for Solana. The network’s ability to attract such a high level of engagement and liquidity has put it at the forefront of DeFi. However, maintaining such a high level of engagement becomes increasingly challenging.

More Info on Solana:

- How Did ‘Star Wars’ Stormtrooper Land into Solana NFT Game MixMob?

- Dog Days of Crypto: Solana Memecoin Turns $226K into $1.69M in 5 Days

Let’s suppose the network and its protocols manage to sustain performance and continue offering their innovative propositions — airdrops and high-yield returns. In that case, it’s reasonable to anticipate Solana establishing itself as a leading force in DeFi.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.