It’s been almost a month and a half since spot exchange-traded funds based on the first cryptocurrency were approved. And what do we see? ETFs are slowly moving the cryptosphere towards mass adoption! Let’s get to the bottom of it all!

Related: What Does Spot Bitcoin ETF Mean for Investors?

US Market Rules Now

Picture this: Europe doesn’t rule anymore! Trading Bitcoin on American cryptocurrency exchanges has become easier than on the largest exchanges on the European continent (which are often not allowed to operate in the United States). All of this can be explained by the influence of new national exchange-traded funds on the crypto world, which they are slowly moving into.

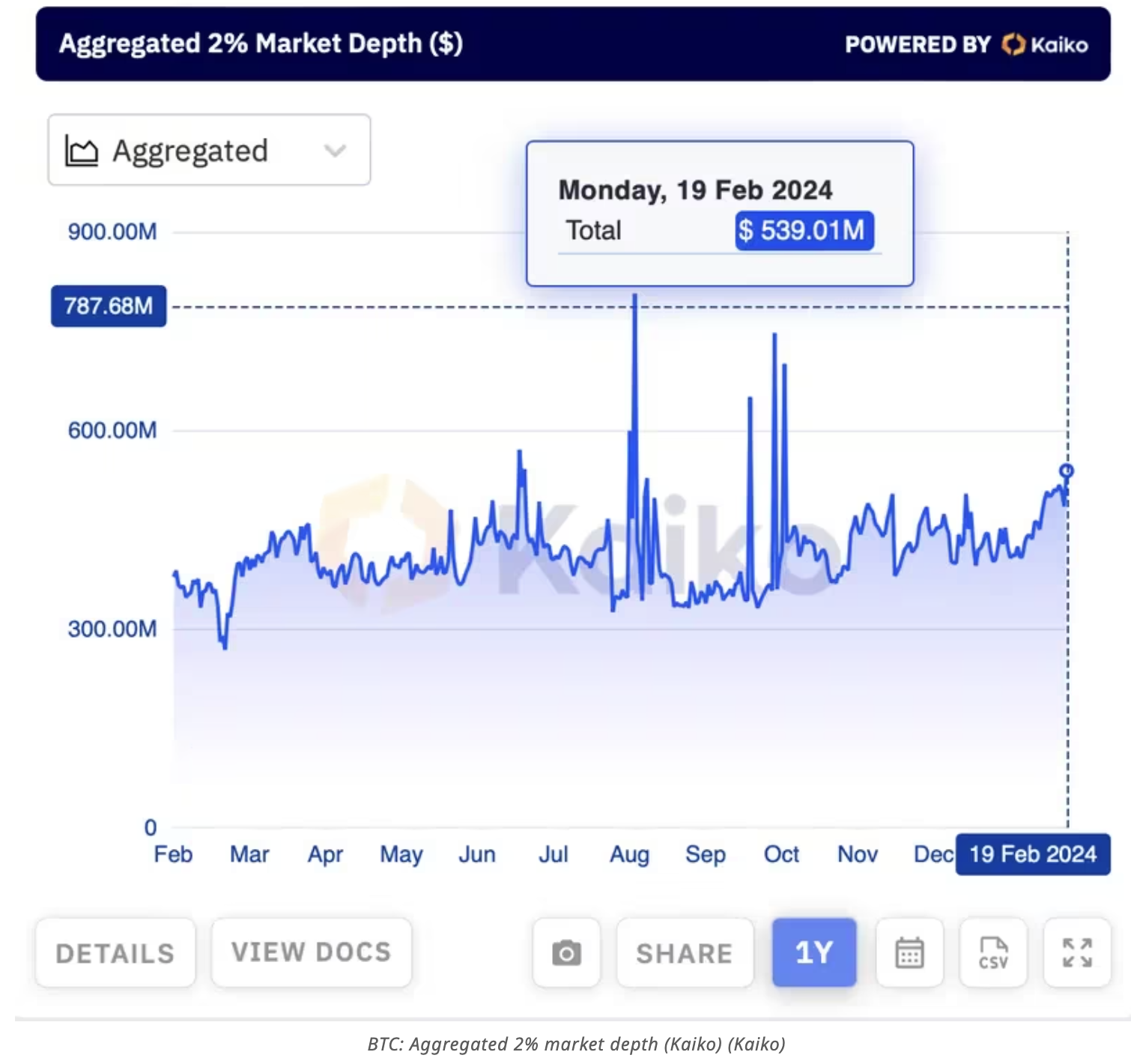

And we have gotten to the point where, compared to the previous year, American trading platforms now account for almost half of the buy and sell orders within 2% of the average Bitcoin price this year. This is all just since the adoption of ETFs!

Oh, these…

According to BitMEX Research, last week the total value of spot exchange-traded Bitcoin funds in the U.S. increased by $2.3 billion. iShares Bitcoin ETF from BlackRock (well, who else) provided the bulk of the inflow.

Bitcoin Is New Gold

André Dragosch, head of research at ETC Group, drew attention to the growing divergence between flows related to crypto funds and gold.

“This could be the first sign that Bitcoin is taking away the crown of the main savings instrument from gold,” he noted. Thus, new ETF flows are increasingly important to Bitcoin’s overall performance.

Dragosch expects the trend to continue in the long term and “Bitcoin will eventually undermine gold’s position as the primary means of savings.”

However, he stressed that the current capitalization of gold ETPs is about three times the aggregate of similar cryptocurrency-based products.

What’s in the Outcome?

What do we get out of this? There is actually more positive here, after all. First of all, Better liquidity due to more buy and sell orders within 2% of the average price.

This leads to the next advantage – the absence of excessive price fluctuations and smaller slippage, i.e. the difference between the prices at which transactions are quoted and executed.

Plus, (my favorite part) BlackRock Inc. and Fidelity Investments raised a net $5 billion from investors. While everyone was looking away from these products, such investments contributed to the doubling of the Bitcoin price over the past 12 months.

Although there are disadvantages. Again, for Europe. We now live in US time! “Bitcoin’s positive price momentum was most pronounced during US trading as market participants take advantage of increased liquidity,” especially in the hour before the US market closes at 4 pm, said Matthew Siegel, head of digital asset research at VanEck.

Read More on Bitcoin:

- Fake Bitcoin ETF Tweet Triggers SEC and Twitter Investigations

- Bitcoin Has Gained Legality Within Honduras

- Spot Bitcoin ETFs Debut with $4.6 Billion Trading Volume, But Zero Inflows

However, the world of cryptocurrencies is still very volatile, yet the price of BTC (not gold) is growing because of ETF approval, mass adoption, and surely upcoming halving. Those who sold everything for $40,000 better not think about it! And you, still wishing you had bought at $25,000 for 1 BTC in September?

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.