Cryptocurrency: the decentralized, digital frontier where traders are likened to swashbuckling pirates and HODLers are the heroes of this new financial age. But beware, crypto enthusiasts, as every treasure map has its traps. Enter the labyrinth of cryptocurrency taxes, filled with regulations, IRS guidelines, and a lexicon that could make even a crypto-whale feel like a fish out of water. Hold tight, dear reader, as we embark on this twisting journey where we get into the nitty gritty of the ever so confusing crypto tax maze.

Crypto tax lingo: Tax Confusion Unraveled

Before diving any deeper let’s first tackle some of the cryptocurrency tax terminology, where the lingo can seem as confusing as trying to pronounce “Satoshi Nakamoto” after a few too many espressos. But don’t worry, we’re going to break down these terms in a way that’s a little less boring than Gary Gensler at a party on a Saturday night:

- Cryptocurrency: Digital or virtual money. Think of it as money with a PhD in computer science. Can be used to buy real stuff without cash, banks or credit cards or just to show off to your friends.

- Taxes: That thing you owe the government, even in the mysterious realm of cryptocurrency. Remember, Uncle Sam wants to keep tabs on your virtual coins too.

- Capital Gains: Made a profit from your crypto? Bravo! But you’ll have to share a piece with the tax authorities. It’s like tipping your waiter, but less voluntary.

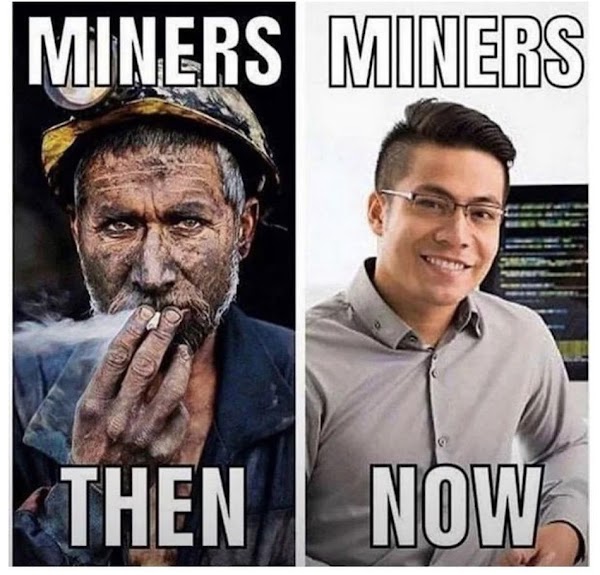

- Income Tax: Earning cryptocurrencies through mining or other means is considered income and taxed accordingly.

- IRS Guidelines: The playbook from the Internal Revenue Service on how to handle all things tax-related with cryptocurrencies. Imagine the rules of a board game, but less fun and more, well, taxing.

- Cryptocurrency Transactions: Buying, selling, trading, or even spending crypto. It’s like swiping your credit card, but with more bragging rights.

- Taxable Events: Situations that make the taxman raise an eyebrow. Selling crypto or buying a yacht with Bitcoin – these could be your invite to the not-so-fun tax party.

- Tax Planning: This is the art of organizing your finances to minimize how much you owe at tax time. It’s like building a financial fortress to protect your treasure, except the dragons you’re fighting off are tax forms.

- Cryptocurrency Tax Software: A superhero for your taxes that automates all the tricky calculations and makes sure you’re in line with all those aforementioned IRS guidelines. A must-have sidekick for any modern crypto trader.

- Record-Keeping: Keeping track of all your crypto transactions. Imagine a diary, but instead of your deepest thoughts and dreams, it’s full of boring numbers and tax codes.

- Tax Forms: The paperwork needed to report your cryptocurrency transactions to the government. They’re like school tests, but instead of grades, you get tax bills (or refunds if you’re lucky).

- Tax Compliance: Playing nice with tax rules. Think of it as following the dress code at a fancy club but with more at stake.

- Tax Treatment: How the government views and handles the taxation of cryptocurrencies. It’s like going to a spa, but instead of massages and manicures, you get tax codes and regulations.

- Gift Taxes: Gifting cryptocurrencies can trigger gift taxes. Unless it is valued less than $16.000 at the time of giving.

Do people have to pay taxes on cryptocurrency?

In most cases: yes, cryptocurrencies in general are not immune to the taxman. In the United States and many other countries, cryptocurrencies are ironically not treated as currencies, but as property for tax purposes, creating various tax obligations. Whether you’ve struck crypto gold by mining or traded your way to a fortune, the tax authorities want a piece of that digital pie. This means the IRS will be at your door for various crypto-related activities such as buying, selling, trading, or even earning cryptocurrencies.

Taxing Times in Cryptoland: How Different Countries Approach Crypto Taxation

Let’s take a whirlwind tour of the crypto tax landscape, a terrain as diverse and dynamic as the digital currencies it governs. As the crypto market matures, regulators worldwide are scrambling to keep up, creating tax regulations as multifaceted as a blockchain.

Read more: Crypto Slang 101: The Ultimate Guide

The General Buzz

Globally, there’s a significant buzz around crypto, and the tax folks are taking notes. Governments are recognizing the benefits of blockchain technology, and the tax rules are evolving, trying to catch up with the crypto comet.

Europe’s Embrace

Europe is hugging blockchain like a long-lost friend, actively promoting its use in various sectors. They’ve got a comprehensive approach to regulating cryptocurrencies. Europe’s treating crypto like the cool new gadget and giving it the respect it deserves.

Asia’s Approach

South Korea is stepping into the crypto-tax spotlight, planning a 20% crypto earnings tax. They’re playing hard to get, delaying it until 2025. But oh boy, the questions on regulation are popping up like pop-up ads on a shady website.

The American Way

In the U.S., crypto is treated as either a superstar asset or a fancy piece of property. Short-term gains are looking at taxes from 10% to 37%, while long-term gets a break from 0% to 20%. The IRS is watching your crypto moves like a hawk watching a mouse.

Germany’s Game

Germany has chosen an interesting approach, classifying cryptocurrencies as assets, and offering extensive guides on crypto taxation. Unless the profit is under €600, Hold it for a year, and it’s tax-free. It’s like holding your breath, but for 365 days, and then – tax relief!

Got staked crypto? It’s taxed unless held for over 10 years. But don’t think it’s all easy sailing; income tax still applies if you’re paid in crypto or mining it. While the approach has its perks, it’s not an all-encompassing tax haven for every crypto enthusiast.

Switzerland’s Sweet Spot

Switzerland is playing the sugar daddy, offering tax exemptions for various crypto activities. They’ve rolled out the crypto red carpet, and the digital currencies are dancing.

The United Kingdom’s Twist

Hold the phone! The UK’s throwing a twist, with crypto profits to be filed separately starting from 2025. They’ve added a little British flair to the crypto tax tea.

Singapore’s Crypto Base

Another example is Singapore, where some crypto exchanges like Phemex, KuCoin and many other crypto oriented companies have set up base. It might seem like a crypto utopia for individual investors, but don’t let those dollar signs (or Bitcoin symbols) in your eyes blind you to the fine print.

Yes, there’s no capital gains tax on your trading profits and buying a latte with Litecoin is treated like a barter deal. But if you’re a business accepting or dealing in crypto, the taxman’s still knocking on your digital door with a bill. Individual investors, party on; businesses, brace yourselves. Singapore’s sunny, but its tax shade doesn’t cover everyone.

Mining Income Mayhem

Income from mining or staking is like the wild card of crypto taxation. In the U.S., it’s taxed like you’re running a business. In Canada, it’s treated as ordinary income. But in Singapore, it’s a capital gain. It’s a worldwide tax party, and everyone’s dancing to a different beat.

So, there you have it. Whether it’s Germany’s geeky guides, South Korea’s teasing tax, the U.S.’s vigilant IRS, or Switzerland’s sweet deals, crypto taxation is a world tour you don’t want to miss. It’s fun, it’s chaotic, and it’s as unpredictable as the regulations themselves.

Cryptocurrency vs. stocks

In the rapidly evolving world of investments, two asset classes that have gained prominence are stocks and cryptocurrencies. Both present unique opportunities, but understanding their differences, especially when it comes to taxation, is crucial for informed investing.

Stocks are traditional investments that represent ownership in a company, categorized into common and preferred types. While common stockholders can vote in shareholder meetings and receive dividends, preferred stockholders have priority in dividends and liquidation but cannot vote. Investing options include direct purchases, mutual funds, or exchange-traded funds (ETFs).

Cryptocurrencies, on the other hand, are digital or virtual currencies protected by cryptography. Unlike physical fiat currency, cryptocurrencies exist digitally unless converted. Investment in cryptocurrencies requires an account on a cryptocurrency exchange platform and proper research to select the right one. The tokens can be stored in digital wallets, including cold (hardware) wallets for extra security. It is possible to exchange crypto with others directly without a middleman, on a DEX for example. For the bravehearts among us there’s also ways to exchange crypto to fiat currency directly through peer to peer services, but these come with great risk.

Difference Between Stocks and Cryptocurrency:

Here’s a quick rundown on the main differences:

Type of Assets: Stocks stand as tangible assets symbolizing a stake in a company’s ownership, while cryptocurrencies primarily serve as digital tokens representing a portion of the whole virtual currency. Intriguingly, some cryptocurrencies take things a step further by allowing a form of company control. Through Decentralized Autonomous Organizations (DAOs), token holders can wield their influence by voting on the governance of a blockchain or protocol, turning digital currency into a dynamic tool for communal decision-making.

Entrance to the Market: Investing in stocks is relatively harder, while cryptocurrencies allow easier entry.

Regulation: Stocks are strongly regulated, while cryptocurrency regulation is in its infancy, making it lightly regulated.

Risk Factor: Stocks inherently have limited risk, whereas cryptocurrencies are highly volatile.

Future Outlook: Stocks in general have a stable future, At least compared to crypto, where the future is highly unpredictable.

Investment Strategy: Stocks favor long-term holding for the best returns, while cryptocurrencies often suggest a quick exit at a favorable price. In the fast-paced world of crypto, a day’s movement can equate to a week in the stock market.

Crypto Taxation vs Stocks Taxation:

Capital Gains: Both are subject to capital gains tax, but cryptocurrencies offer more frequent tax loss harvesting benefits since the wash sale rule doesn’t apply.

Tax Rates: Cryptocurrencies tax rates are dynamic and depend on jurisdiction, whereas stocks are taxed at varied rates depending on the holding period and jurisdiction.

The bottom line is that both crypto and stocks have their place in a diversified investment portfolio, but a keen understanding of the differences in their nature, regulation, risks, and especially taxation is essential for prudent investment decisions. While stocks remain a tried-and-true investment avenue, cryptocurrencies offer a new frontier with a different set of risks and rewards, including unique tax implications that need to be fully understood. Whether it’s the timeless appeal of stocks or the trendy allure of crypto, the choice ultimately aligns with individual appetites, capital, and goals.

Exchanging crypto for property

Trading crypto for property? Oh yes, the future is now. You might not have your jetpack yet, but apparently you can snag a house with your hard-earned Bitcoin. Enter Xerof, regulated in Switzerland, where the chocolate is smooth, and the exchanges are smoother. They claim to be “amongst the most trusted exchanges,” and why not? It’s a country known for its bank accounts and cuckoo clocks.

Now, whether exchanging your digital doubloons for a home sounds like responsible adulting or just a wild weekend in Vegas, that’s up to you. But given the wild west vibe of regulatory fields, it might be wise to hold off on trading your Ether for an estate. After all, why rush into a real estate romp when you can just HODL and watch those house prices dance to the crypto cha-cha? Remember, patience is a virtue, especially when it’s a virtue that keeps you out of a bureaucratic maze!

Do’s and Don’ts in a World of Crypto Taxes

Whether you’re a crypto newbie or a blockchain veteran, let’s face it, deciphering the crypto-tax conundrum can feel like navigating an endless labyrinth, minus the cool mythological creatures (unless you count Dogecoin). But fear not, brave adventurers, as we distill down the essence of this taxing journey into a neat, digestible list of Do’s and Don’ts.

Do’s

- Dive into due diligence: Tax rules vary by location, so make sure you know the laws in your territory. When in doubt, ask yourself: “What would Vitalik do?”

- Declare your digital darlings: Remember, the taxman has a keen interest in your crypto activities. Hiding your gains might seem tempting, but it’s about as smart as investing all your savings in the latest memecoin.

- Diligently document: Keep a record of your crypto transactions as meticulously as a miner keeping tabs on his dynamite. You’ll need it when tax time rolls around.

- Defend with software: Utilize cryptocurrency tax software. It’s the superhero we need but probably don’t deserve. It makes crypto tax calculations look like kindergarten math.

Don’ts

- Don’t dismiss your digital deeds: If you mine, trade, sell, or even spend your crypto, it’s probably a taxable event. Pretending otherwise is like trying to convince a Bitcoin maximalist that altcoins matter.

- Don’t dodge taxes: The crypto world may feel like a digital Wild West, but it’s no place for outlaws. Tax evasion may seem thrilling until you realize the consequences are as real as a blockchain verification.

- Don’t delay: Timely filing and paying of taxes can save you from penalties. Procrastination might work for your laundry, but it won’t fly with the IRS.

- Don’t deem it a game: Crypto may have its fun moments, but treating your tax obligations lightly is like playing Russian roulette with your financial future. Be serious. Be smart.

In the end, while crypto taxes may seem as volatile as the value of your favorite altcoin during a market dip, remember: armed with the right amount of knowledge, you can navigate the labyrinth with ease.

Read More:

- Can Memecoins Make You Laugh All the Way to the Bank?

- Coins and Tokens: What’s the Difference?

- Trends and Performance of Major Cryptocurrencies

Stay smart, stay informed, and most importantly, don’t lose your cool in the crypto-tax maze. After all, the world of crypto is a wild ride – don’t let taxes be the bump that throws you off course. Happy HODLing, fellow adventurers!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.