If you want to crush your trading game and stack those profits like a boss, you need a trade journal in your arsenal. It’s like the secret weapon that all the top dogs in the industry swear by. A trade journal is clutch for planning and executing trades like a pro, and it’s about to become your new best friend. So buckle up and get ready to dive into the wild world of trade journals and unlock their full potential in the crazy realm of finance.

Related: Crack the Code: CCI Secrets for Crypto Traders

Understanding a Trading Journal

A trading journal is a personal trading document that contains all of a trader’s activities, including strategies and risk assessment. If done correctly, keeping a trade journal is extremely effective for traders tracking their trades. Additionally, it ensures traders can optimize their trades and make decisive moves, which gives them total control over trading data and performance.

The Role of Trading Journals in Industry Communication

Trading journals play a significant role in productive industry communication, particularly those dealing with trading activities and financial markets. Here are some of the roles trade journals play in industry communication.

Knowledge Sharing

Trade journals act as a repository for knowledge and experience. Teams and organizations can use trade journals to share collective wisdom and insights, fostering a collaborative and learning environment.

Analysis and Documentation

Since documenting past trades helps to analyze patterns and strategies, trade journals provide a structured platform to document market insights. Traders aside, portfolio managers and analysts can use it as a tool for career advancement to document, identify patterns, and refine moves for future trades using a trade journal.

Mentorship

Trading journals play an important role in industry communication because they provide an invaluable tool for training newcomers and mentoring junior traders. Experienced traders can also use it as an information exchange tool, effectively passing down critical strategies and ideas to other traders.

How to Create a Trade Journal

To create a trading journal, one must first customize it in different formats to fit their trading needs. It’s all about planning and documenting. That said, here is how you can create a trading journal to analyze, evaluate, gather market intelligence, and execute trading calls.

Choosing a platform

First, choose the right platform suitable for your needs. There are options like Excel, Google Sheets, and other specialized software, depending on your requirements and preferences. For other advanced features like real-time insights and analytics, specialized software like TradesVIZ, Trademetric, and TradeZella will help organize your trading journey.

Journal Customization

Once you have chosen a platform, customize it with crucial data, charts, and notes that fit your trading goals and style. The journal may include tracking price changes, visual performances, analyzing trades, and integrating metrics to improve risk management and decision-making. Also remember to add notes focused on each trade, such as trading pairs, entry and exit points, trade volume, and loss or gain.

Steady Update and Review

To make sure that the data contained in the trading journal is accurate, it’s important to always review and update accordingly. Keeping track of trade data will make your performance analysis easier. It will also create room for adjustments to your trading strategy to increase success.

Range of Topics Covered by Trading Journal

Here are some important elements pertaining to trades that the trading journal covers:.

- A date trade was initiated.

- Date of trade exit

- Net gain

- Total capital

- Direction of trade: long or short

- Trade remarks

- Profit and loss were sustained.

- Recovered capital

- Signal for the trade entry point

- A trading instrument used to deliver a trade

Types of Trading Journals

Basically, there are three types of trade journals. Each one plays similar roles but comes in different forms; the key is to work with the one that works best for you. The types of trade journals include the following:

- Notebook: You can simply record trade details on a new page or divide pages into different columns.

- Spreadsheet: By making use of a spreadsheet like Excel or Google Sheets, you can keep track of your trades. Unlike notebooks, where you manually create columns, these tools automate the process. Spreadsheets have ready-made columns where you can enter your entry points, outcomes, multimedia contents, and texts.

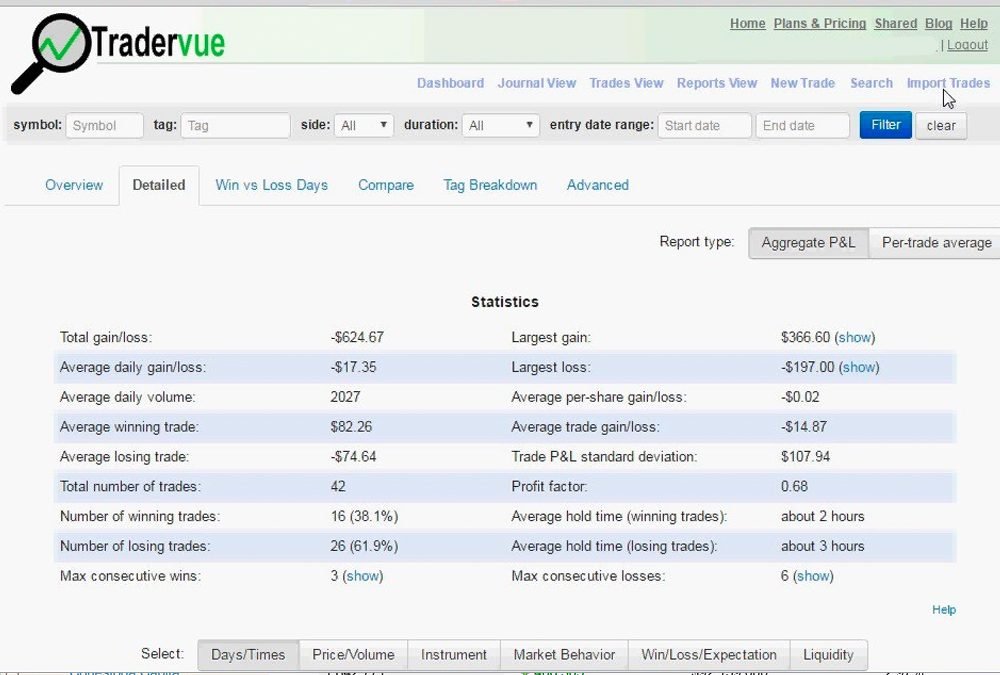

- Specialized app: Choosing trading journal software with more advanced features is also advisable. Journal software like TraderVue and EdgeWonk makes it easy to analyze and record trades. The financial industry has experienced a change in the delivery and consumption of trade journal contents due to digital transformation.

Why Do You Need a Trading Journal?

A trading journal allows traders to review executed trades, track trades, and enhance their previous trading strategies. Let’s take a look at the reasons why trading journals are necessary.

- Record Strengths and Shortcomings: A trading journal will help you keep an account of your errors to correct and reinforce better trading strategies and decisions. Recording your shortcomings and strengths will help you optimize your trading decisions and adjust certain strategies. Furthermore, you can use the recorded information to identify your shortcomings and rectify them.

- Building Strategic Frameworks: Precisely keeping records of trades, calculations, and moves will help to take notes and build a framework for strategies. The strategic framework can help you determine your trade success and avoid making unpredictable moves.

- Building a Growth Plan: You can set goals to get better results by measuring the critical aspects of your trades. Every trader’s goal is to increase the success rate while reducing risk and shortcomings.

- Emotions Management: Becoming a trader means there’s a lot of work to be done in managing your psychological state. This is because different market situations will elicit different emotions. With a trading journal, you will be able to organize your thoughts and understand the different emotional triggers behind each trade.

- Progress Tracking: Another reason for a trading journal is its innovation in recording and tracking progress. You can see how much you have improved in decision-making, risk management techniques, and market analysis.

Best Practices For Using a Trading Journal

After understanding how to create a trading journal, you also need to understand the best practices to maximize its usefulness. Some best practices include keeping records, conducting performance reviews, and learning from both successes and mistakes. Check out the best practices for using a trading journal for professional development.

Performance Reviews

Conduct performance reviews according to your preferences for optimal use of your trading journal. This gives you the chance to identify patterns and trends like the ones listed below:

- Trends reversals

- Chart patterns

- Candlestick patterns

- Consolidation phases

- Continuation patterns

Aside from performance reviews, other best practices for using a trading journal include recording and gaining knowledge from achievements and setbacks.

A Path to Continuous Improvement

Keeping a trade journal is like having a secret weapon that’ll take your trading game to the next level and have you rolling in the dough. By figuring out what works for you and what doesn’t, you can create a trading style that’s as unique as your fingerprint and tailored to your needs, especially when it comes to specialized fields.

More Info:

So, don’t sleep on this powerful tool! With the right setup, you can become a trading ninja in your specialized fields while observing long and short squeezes. It doesn’t matter if you’re a stonk samurai, a forex fighter, or a crypto crusader; a trade journal is your secret sauce to dominate the market like a whale!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.