Bitcoin’s network hashing speed has soared to a record-breaking high of over 540 exahashes per second. Yet, the price per hash and profitability are plummeting again. Time to unravel the opposites at play here and figure out why this keeps happening!

Related: What is the Bitcoin Halving and How Bitcoin’s Supply Is Limited

The Christmas Day miracle in the Bitcoin world: the network’s computing power also known as mining – hashratehit a new all-time high. But this ended up putting more pressure on miners amidst declining profitability.

First things first, let’s crack into the concept of hashing in the Bitcoin network. Think of the Bitcoin network as a grand puzzle-solving competition where computers (aka miners) compete to solve complex mathematical problems. Hashing speed is like how fast these computers can crack these puzzles. The higher the hashing speed, the quicker these puzzles get solved. This speed matters because it impacts how secure and swift the Bitcoin network operates. When the hashrate is higher, it’s tougher for someone to hack the network or pull a fast one on the system.

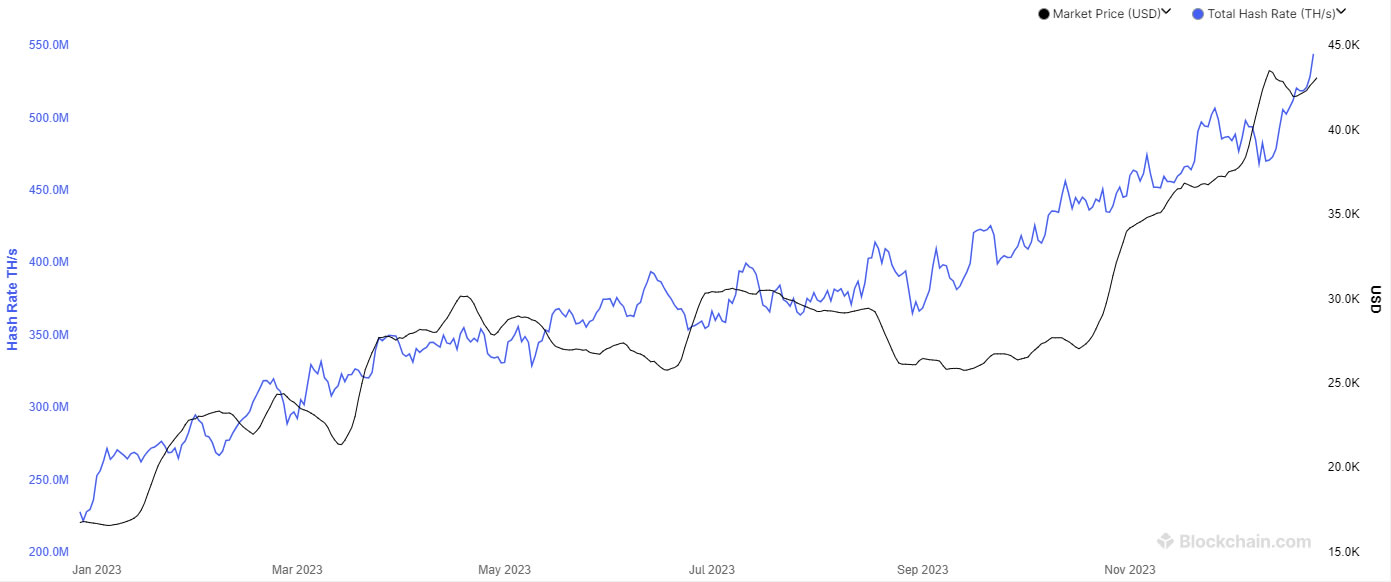

According to Blockchain.com, on December 25th, Bitcoin’s hashing speed hit a record high of 544 exahashes per second (EH/s).

This surge is because the network’s hash rate has more than doubled this year, skyrocketing by 130% since January. Looks like Bitcoin’s flexing its hashing muscles this holiday season.

Interestingly, during the same period when BTC hashing speed soared, the asset’s price pretty much mirrored the trend, surging by over 150% since January 1st, 2023. Coincidence or conspiracy?

What Big Minds Thinks

A high hashing speed might be great for theoretical price models, like the implied price adjusted for hash. But this is not good news for miners, who now have to hustle harder to secure that next block.

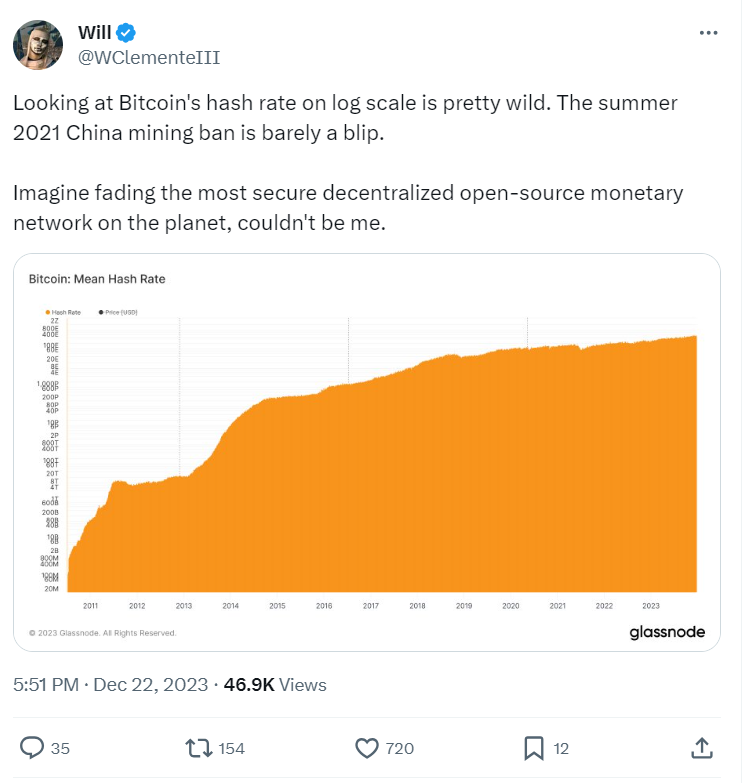

Will Clemente, co-founder of Reflexivity Research, delved into the logarithmic scale of hashing speed, joking, “The China mining ban in summer 2021 was just a blip.” He added, “Imagine fading the most secure decentralized open-source monetary network on the planet, couldn’t be me“

Source: X

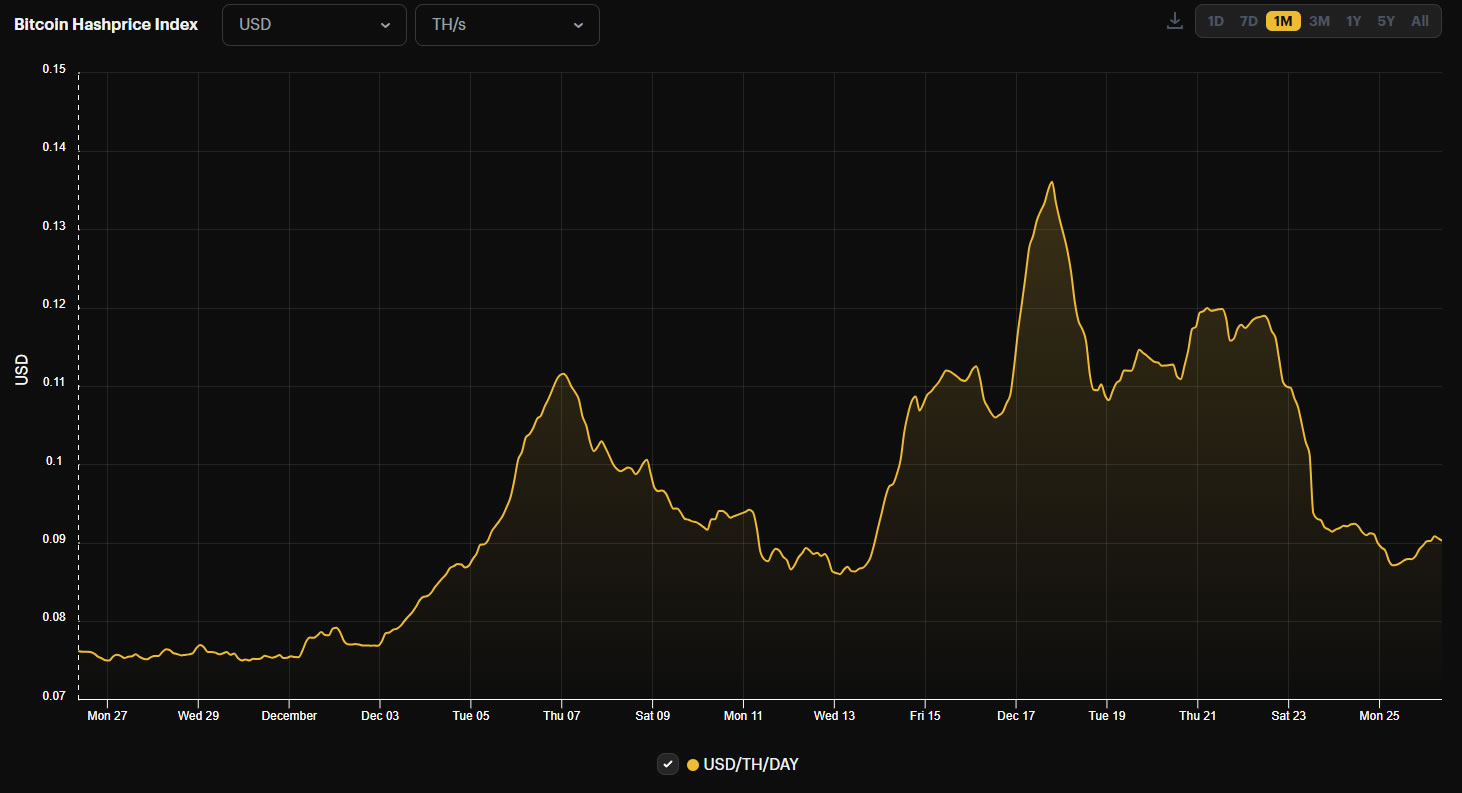

The price of a hash, a measure of profitability, took a tumble over the past week as the enthusiasm for BRC-20 serial numbers cooled off. According to HashrateIndex, the current hash price sits at 0.09 US dollars per terahash per second per day.

Profits took a nosedive, down by 34% compared to the 2023 peak of $0.136 per TH/s per day on December 17th. The hash price often skyrockets during high demand, leading to hefty transaction fees, like during the recent registration madness.

“We’re nearing almost a year without a full Bitcoin mempool cleanse, as since February, we’ve been feeling the pressure of soaring fees,” noted Glassnode analyst “Checkmatey.” Looks like we’re swimming in fee pressure for a while longer!

According to Cointelegraph, the network’s hash rate hit the milestone of over 500 EH/s for the first time at the end of November. That’s one giant leap for hashing-kind!

While high hashing speed might please theoretical price models, miners face the brunt, hustling harder to secure blocks. Profits plunged by 34% from their 2023 peak, exacerbating the pressure on miners due to increased transaction fees.

More on Bitcoin:

Analysts: Bitcoin’s Price Might Rocket to $160K in 2024!

Bitcoin Blitz: Unexpected Rise of 5%, Surges Up x2 Predictions, and SEC Standoffs!

The enigma persists: the network’s security strengthens, yet miners face a profitability puzzle. The Bitcoin saga continues to balance the yin and yang of hashing speed and profits, leaving the industry contemplating its next move.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.