Bitcoin investors are extremely greedy these days, as the cryptocurrency is inches away from updating the record high. As of this writing, Bitcoin is hovering above $67,000, gaining 19% during the last week.

Related: What Determines the Price of Bitcoin?

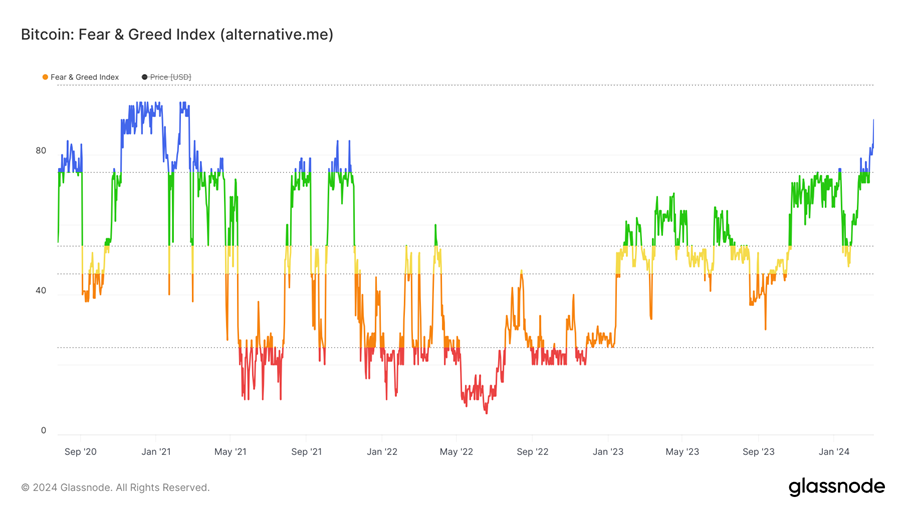

The Fear and Greed index increased to 90, which is the highest level since 2021 when the cryptocurrency established its all-time high (ATH).

Interestingly, when Bitcoin hit its ATH in November 2021, the Fear and Greed index was below the 80 mark.

Glassnode data shows that the indicator has shown wild fluctuations since BTC’s record peak, as the crypto market had to bleed during the crypto winter, when high-profile companies collapsed one after another, including Luna, Three Arrows Capital, and the infamous FTX.

Eventually, the index started to gain traction as Bitcoin entered a recovery phase, and today, it hit the 90 mark for the first time since February 2021.

Related: Bitcoin Continues to Surge, but Analysts Warn of Major Correction

What Is the Fear & Greed Index?

The Fear and Greed index is a gauge provided by alternative.me. It measures market sentiment for crypto assets, including Bitcoin.

Each day, the data provider assesses emotions and sentiments from various sources, synthesizing them to offer a single number.

When the indicator enters the greed zone, it means investors are hoarding Bitcoin driven by the fear of missing out (FOMO). When the market is bearish for extended periods, the indicator approaches its 0 mark, suggesting that investors are in a panic mode.

You can use this indicator considering two basic assumptions:

- Extreme greed, like the one we have today, suggests that the market is due for a correction. We reported on Monday that more analysts expected a correction, although BTC is still unstoppable for now.

- When the indicator turns red, it means investors are too worried and it’s time to buy.

Bitcoin Price Driven by ETF Performance

While many analysts have warned of a correction, Bitcoin continues to get ready to break above its ATH, which has stood for more than two years.

One of the main drivers is the newly launched Bitcoin spot exchange-traded fund (ETF) products, which were approved by the US Securities and Exchange Commission in mid-January 2024. On Monday, the ETFs saw net inflows of over $560 million, which is the third-largest day of inflows to these funds.

Nexo co-founder Antoni Trenchev told CNBC:

With the birth of these nine new ETFs the big moves now tend to take place during the normal trading week rather than the weekends.

He added that what we’re experiencing today might be a rerun of early last week, when BTC jumped $10k in a couple of days.

We’re in that sort of environment when a day or two of sideways consolidation can precede explosive price action thanks to the voracious demand of these new spot ETFs.

More Info:

- Turns Out Bitcoin ETFs Matter!

- What Does Spot Bitcoin ETF Mean for Investors?

- Bitcoin’s Bullish Mood Drives Altcoins Forward

Meanwhile, Bitcoin investors’ greed mood is also explained by the upcoming halving event, which will reduce the pace of coin generation and support prices in the long term.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.