Yet another day, another wild trip for Bitcoins to liven up the relatively sluggish Monday on Wall Street. This time, the digital asset surged by 7%, reclaiming the $70,000 mark, marking the latest sign that Bitcoin’s movement during U.S. hours is increasingly becoming the norm.

Related: What Determines the Price of Bitcoin?

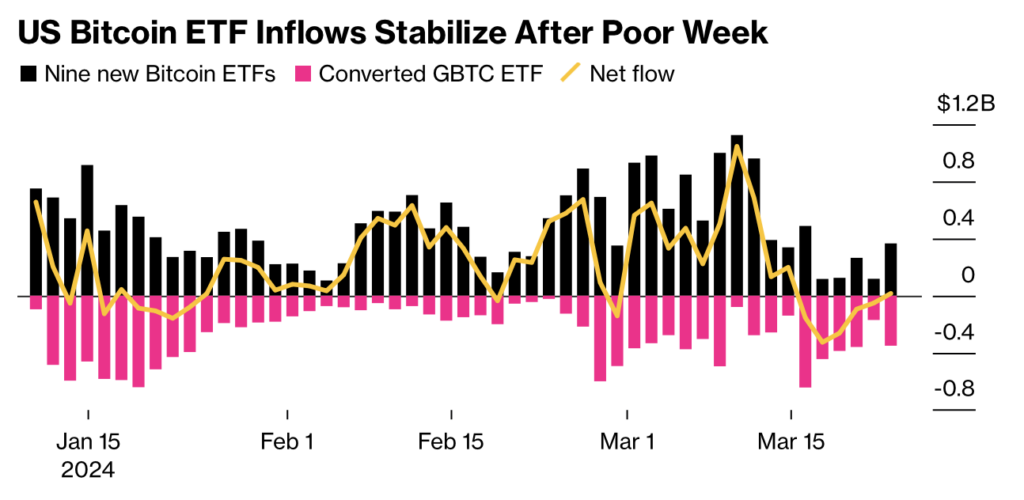

This trend was also evident in February after the token hit $60,000 for the first time since 2021, and in March reached an all-time high. Trading focus shifted to the U.S. with the launch of Bitcoin exchange-traded funds, which have attracted over $11 billion in net inflows since their debut on January 11th.

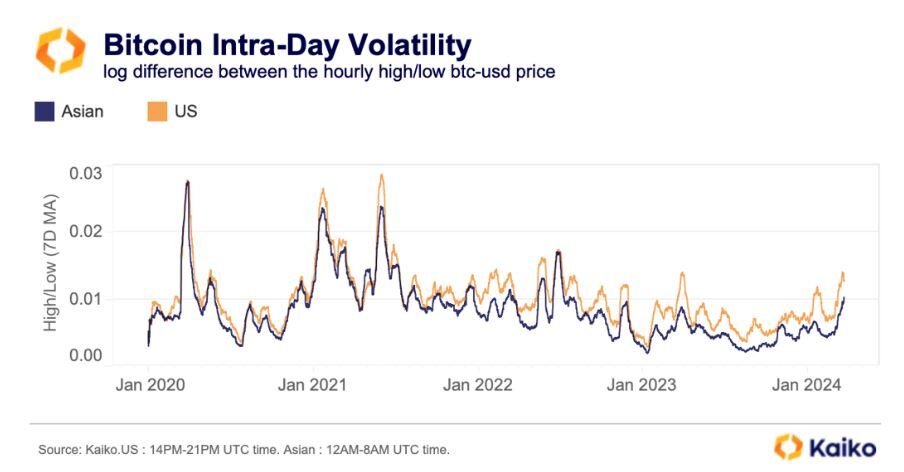

According to research firm Kaiko, a metric tracking the difference between high and low Bitcoin prices, every hour shows a greater disparity in the U.S. and Asia. Thus, the report suggests that volatility tends to be heightened during U.S. trading hours.

Why is Bitcoin price up?

ETFs open doors for the influx of big institutional investors. Bitcoin spot market ETFs led to an outflow from GBTC of $2 billion. Despite this outflow, the week starting March 25 saw an inflow of new Bitcoin spot ETFs totaling $1.1 billion. This marked the first time in 7 weeks that outflows exceeded inflows.

According to CoinShares data, institutional investors poured $12.3 billion into cryptocurrency since the beginning of 2024. Crypto products set a record in 2021 with an annual inflow of $10.6 billion.

Of the $12.3 billion invested in crypto assets in 2024, over $11.9 billion went specifically into Bitcoin. The total assets under management (AUM) of Bitcoin overshadow other digital assets: currently standing at $68.8 billion.

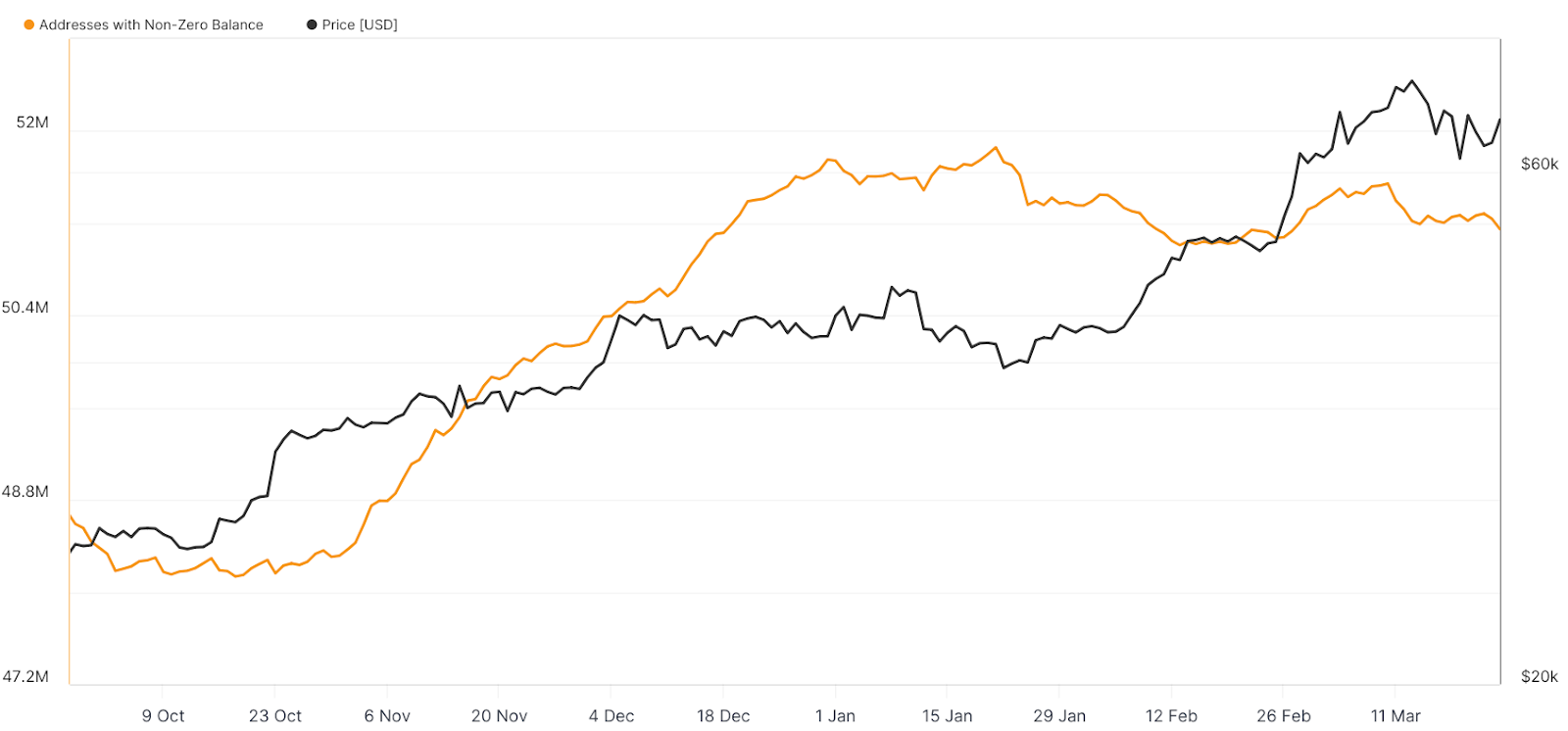

Furthermore, institutional investors aren’t the only group showing heightened interest in Bitcoin. The number of Bitcoin wallets holding a non-zero balance has remained above 51 million throughout 2024.

There have been more Bitcoin wallets than ever before, but due to the consistent price growth month after month, as of March 24, only 3% of wallets were in the red. The sharp increase in non-zero wallets, Bitcoin fleeing from exchanges, and ongoing institutional interest suggest a strong bullish optimism regarding BTC price.

Bitcoin Volatility in US Tops Asia

American Bitcoin funds from companies like BlackRock Inc. and Fidelity Investments are considered some of the most successful ETF launches, reshaping the cryptocurrency market. Changes include improving Bitcoin market liquidity and a sharp rise in spot volumes around the time ETFs calculate their net asset value towards the end of the U.S. trading day.

In contrast, in 2023, amidst U.S. crackdowns on cryptocurrencies, Asia emerged as a new hub for digital asset markets. Bitcoin trading activity became more intense during Asian hours.

As of 8:08 am Tuesday in London, Bitcoin remained virtually unchanged at $70,665. On Monday, the oldest cryptocurrency briefly surpassed $71,000, before its growth tapered slightly to around a 7% increase for the session. Over the past 12 months, the token has surged by 154%, closing near its mid-March peak of almost $73,798.

More Info:

- Turns Out Bitcoin ETFs Matter!

- What Does Spot Bitcoin ETF Mean for Investors?

- Bitcoin’s Bullish Mood Drives Altcoins Forward

Despite regulatory challenges and market fluctuations, Bitcoin’s resilience remains evident. The influx of institutional capital, coupled with sustained interest from individual investors, has propelled Bitcoin to new heights.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.