Howdy, HODLers! Welcome back to the Crypto Coinundrums Weekly Digest, where we break down the latest happenings in the crypto frontier. This week, we’re serving up some juicy stories about Ether’s price, a new AI tool created by JPMorgan, musician Grimes joining forces with AI-generated music, and the CFTC winning a record penalty payment in a Bitcoin fraud case. So, strap on your digital spurs and let’s dive into the wild west of cryptocurrency and AI technology!

Ether Price: Holding Steady, but Skepticism Lingers

Ethereum remains above $1,800 for almost a month now, despite a 13.7% dip between April 18-21. If we compare Eth at the start of this year at around $1,200 to $1,900 with the S&P 500, which went from $3,820 to $4,170, we are talking about a whopping 58% gain vs a meager 9%. That’s impressive, although pro investors aren’t sharing the bullish vibe.

Ethereum is drawn to the ongoing banking crisis and worsening macroeconomic conditions in 2023. The US economy’s lackluster 1.1% annualized growth and a 4.2% rise in the personal consumption expenditures price index fuel bearish sentiment.

Whales and market makers are sulking due to the shrinking total value locked (TVL) in Ethereum decentralized applications and sky-high transaction fees. DefiLlama shows a 19% drop in Ethereum’s TVL as it dropped from 18.87 million ETH at the start of 2023 to 15.2 million ETH.

Ether’s struggle to break $2,000 might be because traders fear the Fed raising interest rates again on May 3. Higher rates make fixed-income investments more appealing, while businesses and families face higher debt refinancing costs, dampening enthusiasm for risk assets like ETH.

Ether futures, popular among whales and arbitrage desks, currently show little buying appetite. The Ether futures premium has shrunk from 4.7% on April 1 to 1.8%, indicating buyers are avoiding leveraged longs and opting for short (bear) positions instead.

The neutral 25% delta skew in Ether options says traders are cautiously optimistic. However, between April 24-26, the indicator spiked above 7%, revealing brief trader anxiety. This suggests subtle confidence, but the past four weeks have been marked by moderate fear.

In summary, Ether options and futures markets show pro traders playing it cool. If Ether’s price cracks $2,000, jaws will drop, but for now, the indicators show no signs of panic.

Ethereum’s inflation

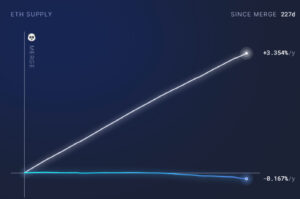

Let’s also take a quick look at the inflation of the total $ETH supply, as some of us may remember, ETH was in fact inflationary. ETH 2.0’s game plan was to make ETH deflationary when traffic on the chain increases, no we are over 200 days down the line and can see the numbers.

If the ETH 2.0 merge never happened, we would see an inflation of 3.3% in Ethereum. However, thanks to the upgrade we are looking at a 0.16% deflation now, which will slightly reduce the total supply of ETH tokens flying around.

And as we well know, by the laws of supply and demand, a decrease in supply may result in upwards price movements. Although there’s never a guarantee that the deflation rate will continue to increase because it also depends on the volume throughput on the Ethereum chain itself.

JPMorgan’s AI Binge-Watches Fed Speeches for Trading clues

JPMorgan, the investment banking behemoth, has cooked up an AI tool to spy on Federal Reserve statements and speeches to uncover trading signals. It’s like a high-tech Sherlock Holmes for finance!

This ChatGPT-based language model munches on comments from US central bankers, rating Fed policy signals on a scale from easy to restrictive – cue the “Hawk-Dove Score.”

For the uninitiated, “Hawkish” refers to monetary policies that raise interest rates to keep inflation in check, while “Dovish” policies favor expansionary measures and lower rates. It’s like a financial yin and yang, with the AI tool straddling the fence.

JPMorgan economist Joseph Lupton said, “Preliminary applications are encouraging.” The AI crystal ball helps analysts detect policy shifts, providing a heads-up on trading signals – like having a digital monetary savant on the team.

The tool can even predict central bank tightening changes. For instance, hawkish statements could lead to rising yields on one-year government bonds. Plus, the JPMorgan model can analyze statements from the past 25 years, revealing that Fed sentiment has been on a rollercoaster ride but remains mostly hawkish.

Bloomberg anticipates that the Federal Reserve will raise its benchmark interest rate by another 25 basis points to 5.25% next week. A 10-point pump in the Hawk-Dove Score suggests a ten percent chance of a rate hike at the next policy meeting, and vice versa.

Ironically, JPMorgan is all-in on AI applications for its own gain but doesn’t trust its employees with the same tools. In February, the company barred staff from using ChatGPT. Although no specific incident triggered the AI chatbot ban, other firms have made similar moves.

In a letter to shareholders earlier this month, JPMorgan CEO Jamie Dimon revealed that the bank has over 300 AI use cases in production. These guys are serious about AI use in finance!

JPMorgan’s new AI tool highlights the growing importance of artificial intelligence in the world of finance. As the Fed’s decisions have a significant impact on global markets, having access to advanced tools like JPMorgan’s can give traders a competitive edge in anticipating market shifts. This development could pave the way for even more sophisticated AI-driven trading strategies in the future.

Grimes Embraces AI-Generated Music, Offers 50% Royalties

Canadian musician Grimes, who is known for her complicated relationship with Elon Musk, is taking a stand for AI-generated music, embracing the technology and offering to split royalties 50/50 with AI creators who use her voice. Grimes’ willingness to be a “guinea pig” for AI-generated music defies the status quo, as many in the creative community express concerns over copyright infringement and intellectual property.

Grimes tweeted her support for AI-generated music, saying she would treat AI creators the same as human collaborators. With no label, Grimes is free from the constraints of the music industry, which might otherwise restrict her from taking such a bold stance. The artist believes in open-sourcing art and “killing copyright”, expressing her curiosity about what creators can achieve with AI.

In the same tweet, Grimes mentioned a recent controversy involving AI-generated tracks of Drake and The Weeknd. On April 13, Universal Music Group sent an email to major streaming services, requesting they block AI from accessing their catalogs for learning purposes, vowing to protect their artists’ rights.

Grimes also revealed plans to create a voice simulation program with a team of developers, making it publicly available. She envisions the program simulating her voice effectively and offering stems and samples for people to train their own AI.

However, AI-generated “deep fakes” that use images and voices of individuals have stirred up ethical concerns. A German tabloid recently used AI to create a fake interview with former Formula One driver Michael Schumacher. Even Google employees are reportedly worried about the company’s upcoming AI-chatbot.

Although in the face of adversity, Grimes’ trailblazing approach to AI-generated music illuminates a thrilling future where AI and human artists join forces in a harmonious symphony of creativity. Her willingness to embrace this technological revolution has the potential to set an inspiring precedent for the entire music industry, opening doors to a realm of unimaginable artistic potential that transcends all previous boundaries. Let the age of AI-human artistic collaboration commence!

CFTC Crushes Crypto Crook with Record-Breaking $3.4B Penalty

In a stunning climax to this week’s Crypto Coinundrums Weekly Digest, we bring you the tale of a modern-day financial villain whose Bitcoin-related shenanigans led to a record-breaking penalty. Buckle up, dear readers, for the astonishing downfall of Cornelius Johannes Steynberg.

The Commodity Futures Trading Commission (CFTC) emerged victorious in a lawsuit involving a fraudulent Bitcoin scheme, resulting in Texas District Court Judge Lee Yeakel ordering the dastardly Steynberg to pay a whopping $3.4 billion. This eye-watering sum includes $1.73 billion in restitution to defrauded victims and an additional $1.73 billion civil monetary penalty. Talk about biting off more than you can chew!

Steynberg, the South African CEO of Mirror Trading International Proprietary Limited (MTI), a so-called “trading and networking company,” led an international fraudulent multilevel marketing scheme. He swindled over 23,000 innocent souls in the U.S. and beyond, amassing more than 29,421 BTC. But alas, karma caught up with the crypto crook.

The CFTC’s victory marks the “highest civil monetary penalty ordered in any CFTC case” and “the largest fraudulent scheme involving Bitcoin charged in any CFTC case.” Steynberg’s rap sheet now includes fraud, registration violations, and failure to comply with Commodity Pool Operator (CPO) regulations. As the cherry on top, Steynberg is permanently prohibited from engaging in conduct that violates the Commodity Exchange Act (CEA) and trading in any CFTC-regulated markets.

Steynberg’s hubris led him to flee South African law enforcement, earning the title of “fugitive.” But his luck ran out in December 2021, when he was detained in Brazil on an INTERPOL arrest warrant. His escape plan? Foiled!

And so concludes this exhilarating chapter in the book of crypto-crime. Steynberg’s tale serves as a cautionary reminder to those who might be tempted by the allure of fraudulent fortune. Stay tuned for more thrilling crypto-adventures in next week’s Crypto Coinundrums Weekly Digest!