The US Securities and Exchange Commission has decided to extend the deadline for deciding on approving options trading for exchange-traded funds directly investing in Bitcoins.

Related: Turns Out Bitcoin ETFs Matter!

All exchanges submitted their applications for listing bitcoin-ETF options on January 25th, and March 10th marked the deadline for the SEC to make its initial decision. According to US securities laws, the SEC has 45 days to make a decision or to postpone it.

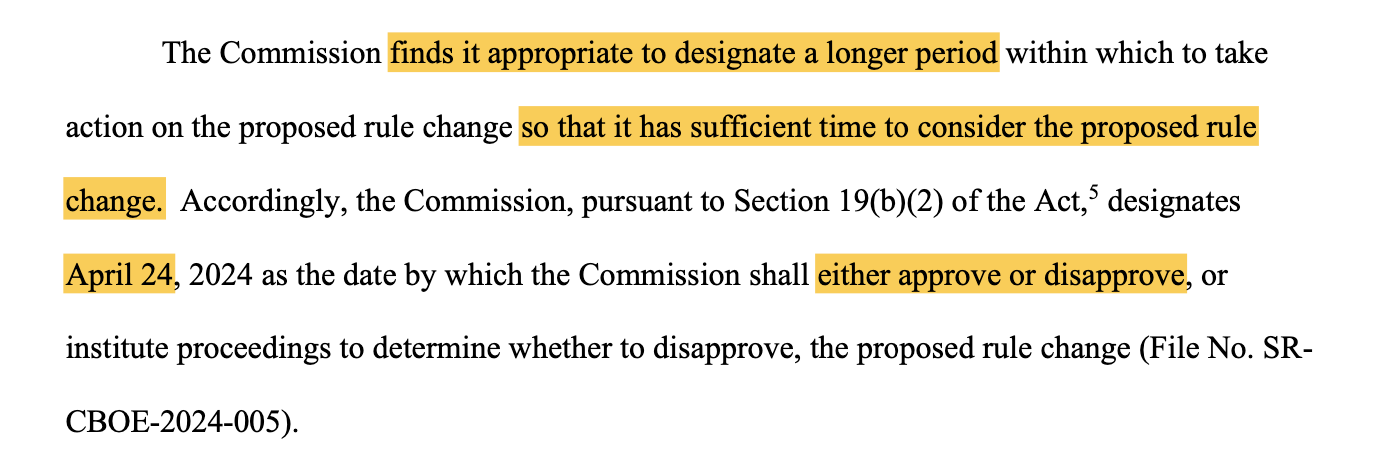

The postponement grants the agency another 45 days – up to a maximum of 90 days by law – to make a final decision, which, as noted by the SEC, will be on April 24th.

In a statement dated March 6th, the SEC decided to give the Cboe Exchange and the Miami International Stock Exchange more time to respond to their applications for proposing options on a bitcoin-ETF.

It also postponed deciding on Nasdaq’s application to offer options on BlackRock’s iShares Bitcoin Trust (IBIT), stating that the delay ensures the company has “enough time to consider” its request.

According to documents published on the agency’s website on Wednesday, the US Securities and Exchange Commission delayed reviewing the application from Cboe Exchange Inc. to offer options linked to ETFs holding bitcoins. The Securities and Exchange Commission (SEC) also delayed deciding on Nasdaq ISE’s application to list and trade options on BlackRock’s iShares Bitcoin Trust.

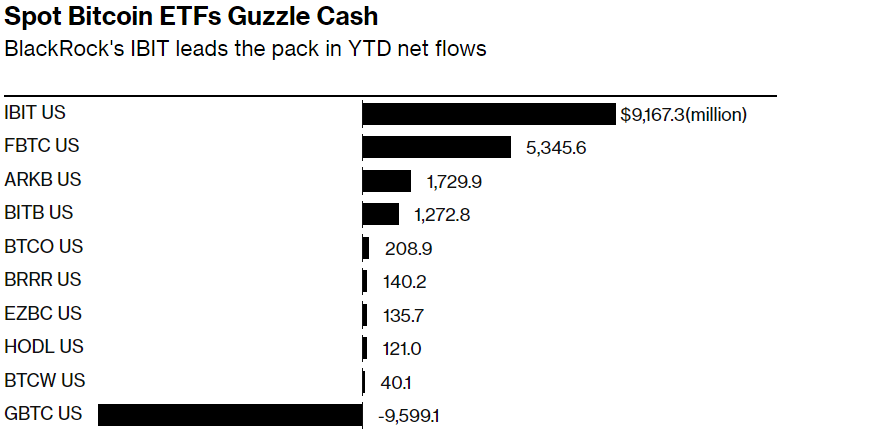

Investors have been pouring money into spot bitcoin funds ever since the SEC gave them the approval back in January. This year, these funds have raked in a whopping $8.9 billion. Excluding the Grayscale spot fund, which has been around in its previous fund structure, recently approved funds collectively hold assets worth around $26 billion.

The Securities and Exchange Commission (SEC) has pulled a classic move by retracting its decision to approve spot bitcoin ETFs just before the deadline for all applications in January expired. On the flip side, there are warnings from certain experts indicating that the regulatory body might also decline the current applications for spot-ether ETFs.

What are the Options?

Options are derivative products that give traders leverage and allow them to make directional bets on the market.

Imagine a trader thinking Bitcoin’s price is going to the moon. They could pay a premium, buy a “call option,” and agree to purchase 1 BTC at today’s price in a month, investing less money than needed to buy 1 BTC outright.

Now, if Bitcoin indeed shoots to the stars within that month, the trader can exercise their option, buy Bitcoin at a lower price, and potentially sell it for a profit. But if Bitcoin falls, well, they’ll probably just let the option contract expire and lose the premium they paid.

Experts Rally for Options Approval

Last month, Grayscale’s CEO, Michael Sonnenshein, took the stage, advocating for the approval of Bitcoin options, stating they’re “essential for a well-balanced and healthy market.”

Meanwhile, Dave Nadig, an analyst at VettaFi, told CNBC in January that once Bitcoin ETF options markets kick-off, “you’re going to start seeing all sorts of hedge fund players in the space.” He added, “speculating on crypto directly in the crypto ecosystem are now going to have some to play with.”

More Info:

- Fake Bitcoin ETF Tweet Triggers SEC and Twitter Investigations

- Bitcoin Has Gained Legality Within Honduras

- Spot Bitcoin ETFs Debut with $4.6 Billion Trading Volume, But Zero Inflows

As investors eagerly await the SEC’s final decision, the market continues to evolve, with experts highlighting the potential for significant growth and innovation once Bitcoin ETF options are approved.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.