Everyone is talking about Bitcoin ETFs, which recently got the green light from the US Securities and Exchange Commission (SEC), but what about Ethereum ETFs?

At the beginning of January, the SEC finally gave its nod to the first group of BTC ETF products.

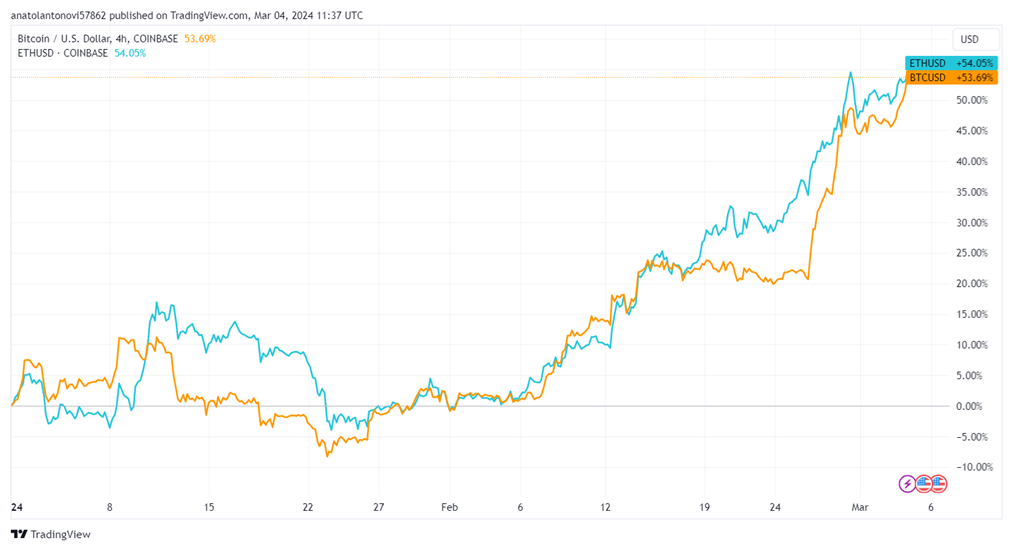

The move has fueled a major rally, with Bitcoin’s market cap showing a record monthly increase in February in USD terms.

Ethereum seems to be catching up, so far showing a similar performance since the beginning of the year.

But general inertia is not the only driver of Ethereum. The second-largest cryptocurrency by market cap is waiting for its own moment of glory, as Grayscale, BlackRock, and VanEck have filed with the SEC to launch the first Ethereum ETFs.

SEC May Remain Adamant till Year End

Crypto enthusiasts believe that the current success of Bitcoin ETFs, whose cumulative volume exceeded the $70 billion mark in less than two months, would attract other similar products, with Ethereum ETFs being next in line.

However, top crypto lawyer Jake Chervinsky took to X to share his pessimistic views.

According to him, the SEC may reject the applications for an Ethereum due to intensifying political pressure. The SEC has already dealt with “a ton of political blowback” for giving the nod to the Bitcoin ETFs despite being forced by the court to do so.

Now the markets are driven by “animal spirits,” and Ethereum ETFs would add more gas to the fire. Bitcoin is getting closer to updating the record high, and the recent ETF approval has played the most important role in this bull run.

The US government would prefer a more controllable market that doesn’t fall victim to emotions, and the SEC may consider political agendas no matter what.

Chervinsky explained:

The SEC has a legal argument that, even if wrong, likely passes the laugh test by enough to justify denial if it wants. And we know the SEC is willing to take wrong legal positions in court to satisfy political priorities.

The next deadlines for an Ethereum ETF approval are in March (BlackRock), April (Grayscale), and May (VanEck). Chervinsky believes that ultimately, the SEC would convince issuers to withdraw their applications.

BlackRock CEO Larry Fink Backs Ethereum ETF

BlackRock’s Ethereum ETF has the backing of the boss himself. Larry Fink, the CEO of the world’s largest asset manager with $10 trillion AUM, told CNBC:

I see value in having an Ethereum ETF.

However, he couldn’t provide more details because of the pending application with the SEC.

Still, Fink shared his vision in which tokenization becomes the next major trend in the coming years.

According to him, having tokenized securities and tokenized identities on a decentralized ledger eliminates all corruption.

Fink said

These are just stepping stones towards tokenization and I really do believe this is where we’re going to be going

Let’s see what the SEC decides on March 10, when it will give its final verdict on BlackRock’s Ethereum ETF application.