According to network data, within the last 24 hours following accusations from the U.S. Department of Justice, KuCoin has seen a net outflow of over $780 million across several chains.

Analytics from the crypto analysis firm Nansen revealed that KuCoin’s total outflow over the past day as of noon Wednesday in Asia across various networks amounted to $882 million, with an inflow of $99 million and a net outflow of $783 million. The dataset encompasses flows on Ethereum, BNB Chain, Avalanche, Fantom, and Polygon.

Related: KuCoin Сlaimed to Have No Problems, But Users Think Differently

“The withdrawal of BTC and ETH has sharply increased, primarily due to retail users, which has had a minor impact on the overall reserve,” stated the Founder & CEO of CryptoQuant in a message on X.

“It seems they’re not mixing up their customers’ funds and have enough reserves to handle user withdrawals,” said Ju, asserting that from an on-chain perspective, the exchange looks “okay.”

Accusations Against KuCoin

On March 26th, the U.S. Department of Justice stated that KuCoin founders Chun Gan and Ke Tang intentionally failed to maintain an anti-money laundering program on the exchange, alleging that the platform is used for “money laundering and terrorism financing.”

On Tuesday, the Department of Justice revealed charges against KuCoin and its two founders, alleging their infringement of anti-money laundering regulations. The Commodity Futures Trading Commission also affirmed KuCoin’s complaint that ether and some other cryptocurrencies are commodities.

Given past incidents, it’s expected that any significant regulatory actions will lead to a sharp outflow of funds, but as long as the exchange keeps clients’ deposits and funds in a 1:1 ratio, it should remain solvent even under such stress.

Martin Lee, Content and Communications Head of Nansen

Reserves Cover Outflows, Analysts Report

Crypto investors typically withdraw their funds from cryptocurrency exchanges when they catch wind of legal troubles or issues with the exchange’s reserve status.

According to CryptoQuant data, as of noon Wednesday in Asia, KuCoin’s Bitcoin reserves stood at around 6,277 bitcoins, while its Ether reserves totaled 99,359 bitcoins.

Per Scopescan, KuCoin’s total portfolio balance across multiple chains amounts to $4.889 billion. According to Nansen, the exchange holds cryptocurrency assets worth $5.1 billion.

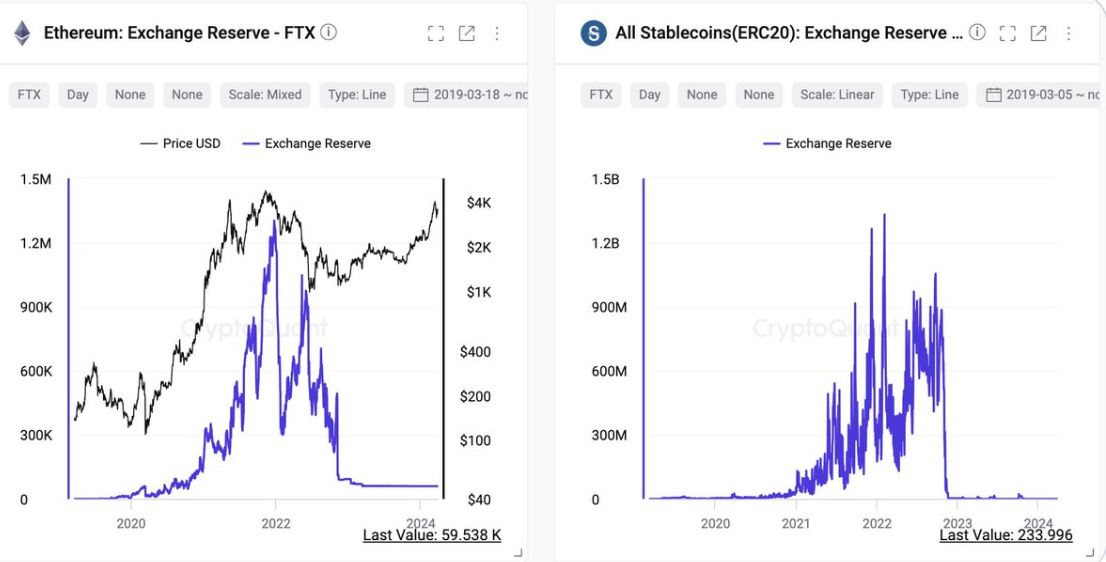

Ju likened KuCoin’s reserves to those of the now-defunct cryptocurrency exchange FTX, noting that KuCoin seems to have kept its clients’ funds separate from its own reserves.

Concerns about KuCoin’s reserves or any major exchange aren’t just confined to its users, as these worries can often lead to a mass exodus from the market. Users rushed to withdraw billions of dollars from FTX when former Binance CEO Changpeng “CZ” Zhao tweeted that Binance would divest all its assets of FTX’s native token FTT. When news of FTX’s collapse broke, the price of Bitcoin plummeted by over 20% in a week

However, despite the lawsuit against KuCoin’s founders, the market doesn’t seem overly bothered by the news: the cryptocurrency fear and greed index still indicate an extreme level of greed, currently sitting at 83 points. Although the allegations and legal challenges, analysts suggest that KuCoin’s reserves appear sufficient to handle the increased withdrawal activity, offering some reassurance to investors.

More Interesting Info:

- Historical Peaks and Downs of Bitcoin’s 15 Years of Existence

- Bitcoin Fear & Greed Index to Highest in 3 Years at 90

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.